Intellect Design Arena makes the software that runs banks. Core banking systems. Transaction platforms. Cash management. Trade finance. Insurance underwriting. The infrastructure that processes deposits, moves money between countries, and decides whether to approve a loan.

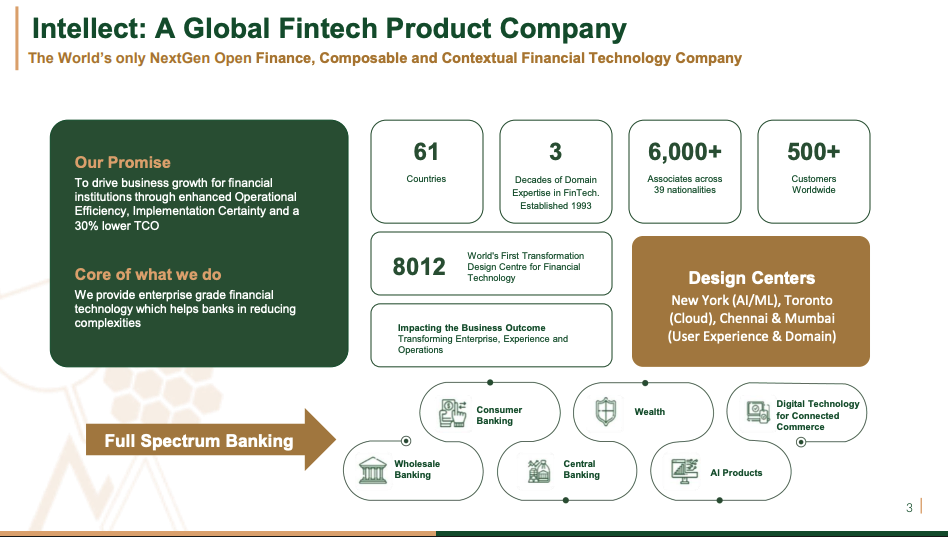

Arun Jain founded the company in 2011. He had built Polaris Software Lab from scratch starting in 1993, grew it into a major banking IT firm, then sold it to Virtusa. Intellect was his third venture in financial technology. The company listed on the BSE and NSE in 2014 after a demerger from Polaris. Today Intellect operates in 57 countries and serves more than 500 financial institutions. In India, 14 of the top 15 banks run Intellect products. Globally, 88 large transaction banks use its Digital Transaction Banking platform.

The business splits into four verticals:

| Segment | Revenue Contribution | What It Does | Where It Sells |

|---|---|---|---|

| Global Transaction Banking | ~40% | Payments, cash management, liquidity, trade finance | US, UK, Europe |

| Global Consumer Banking | ~40% | Core banking, lending, cards, deposits, treasury | Middle East, APAC, Europe |

| Wealth, Insurance & Capital Markets | ~15% | Wealth management, brokerage, underwriting | Global |

| Digital Technology for Commerce | ~5% | Government procurement, retail systems | India |

Geography splits 45% North America and Europe, 35% Middle East and Africa, 20% India.

Revenue comes from two buckets. Implementation work (installing and customizing the software) makes up 50% of revenues. License-linked revenues (license fees, annual maintenance contracts, subscriptions) make up the other 50%. The company handles implementations itself rather than handing them to system integrators.

When a bank buys core banking software, it stays for a decade or more. Implementations take 12 to 24 months at most vendors. Ripping out a core system and starting fresh is expensive and risky. In March 2023, the company launched eMACH.ai, a platform built on microservices, APIs, and cloud infrastructure. The architecture allows banks to replace individual modules instead of doing full system overhauls. Implementation timelines dropped to 4-6 months. Deal sizes expanded from USD 3 million to USD 7-8 million.

In August 2024, Intellect launched Purple Fabric, an enterprise AI platform. More than 45 global banks and insurers have adopted it. The platform launched in the US in August 2025. A London brokerage signed a INR 200 crore multi year deal to use Purple Fabric for underwriting transformation. The company targets INR 10 billion in Purple Fabric revenues within 3-5 years.

In December 2025, Intellect won 35 credit unions across 8 Canadian provinces for digital banking transformation. These credit unions manage over $13 billion in assets. This followed an earlier deal to acquire Central 1’s digital banking operations, giving access to about 190 credit unions.

| Milestone | Year | Event |

|---|---|---|

| Foundation | 1986 | Arun Jain founds Nucleus Software Workshop |

| Polaris Birth | 1993 | Polaris Software Lab incorporated |

| IPO | 1999 | Polaris IPO oversubscribed 21 times |

| Citigroup DNA | 2003 | Polaris-Orbitech merger brings 57 product IPRs |

| Demerger | 2014 | Intellect Design Arena listed on BSE and NSE |

| Revenue Mark | 2018 | Crosses INR 10 billion revenue |

| Platform Launch | 2023 | eMACH.ai platform goes live |

| AI Platform | 2024 | Purple Fabric launched |

The Problem Intellect Solves

Most large banks in developed markets still run on core banking systems deployed in the 1980s and 1990s. COBOL. Mainframes. Batch processing. Built for an era when banking meant walking into a branch. These legacy systems are monolithic. A single bundled software application handles the database, user interface, and server operations in one place. Everything is vertically integrated. Everything is proprietary. Everything is locked in.

This worked when change was slow. It does not work when customers expect real-time everything. It does not work when regulators demand new reporting formats every quarter. It does not work when fintechs can launch a competing product in weeks. The cost of maintaining this infrastructure compounds every year. Banks spend 70-80% of their IT budgets just keeping the lights on. New features get bolted onto old systems. Technical debt accumulates.

Banks know they need to modernize. Traditional core banking transformations are multi-year projects with massive cost overruns and high failure rates. Many banks have tried and failed. The ones that succeeded often spent five years and hundreds of millions of dollars.

The eMACH.ai Architecture

Intellect launched eMACH.ai in March 2023. The name is an acronym: Event-driven, Microservices, API-first, Cloud-native, Headless.

Event-driven means the system responds to things happening in real-time. A payment arrives. An account balance changes. The system reacts immediately rather than waiting for a batch job to run at midnight.

Microservices means the system is built from small, independent components rather than one giant block of code. Each microservice handles one thing. If the payments service needs an update, you update just that piece. You do not risk breaking everything else.

API-first means every capability is exposed as a programmable interface. Other systems can connect. Fintechs can integrate. The bank becomes a platform rather than a closed box.

Cloud-native means the system was designed from the ground up to run on cloud infrastructure. It scales automatically. It handles failures gracefully. It costs less to operate.

Headless means the user interface is decoupled from the business logic. Banks can change how things look to customers without touching the core processing. They can offer the same capabilities through mobile apps, web portals, voice assistants, or embedded banking.

The platform runs on 386 microservices, 650 events, and more than 2,015 APIs.

| Dimension | Before eMACH.ai | After eMACH.ai |

|---|---|---|

| Architecture | Product-specific, siloed | Unified, microservices-based, API-first, cloud-native |

| Composability | Fixed functionality bundles | Modular capability blocks across all banking domains |

| Deployment Speed | Months to years | 4-6 months for full modules |

| Ecosystem Integration | Limited third-party marketplace | Pre-integrated fintech, merchant, and partner marketplace |

| AI Layer | Feature-level intelligence within products | Embedded AI and analytics across all modules |

| Business Model | Individual product licenses | Platform access, capacity-based, or journey-based pricing |

Implementation Speed

The Union Bank of India cash management implementation went live in 5 months. That is one of the fastest implementations in the industry.

Compare this to the alternatives:

| Platform / Vendor | Typical Implementation Timeline | Implementation Approach |

|---|---|---|

| Intellect (eMACH.ai) | 4-6 months (even for full modules) | Composable, microservices-based, rapid deployments |

| Finastra (Fusion Essence) | 12-15 months (with migration) | Tiered, waterfall approach |

| Temenos (T24/Transact) | 18-24 months | Process-driven, DevOps-enabled but structured |

| Oracle Financial Services | 12-30 months (3-5 years for large banks) | Incremental/staged modernization |

| FIS / Traditional | 2-5 years | Incremental/staged modernization |

Intellect takes direct ownership of implementations rather than handing them off to system integrators. Most vendors rely on partners like Accenture, Deloitte, or TCS to do the actual deployment work. The trade-off: implementation revenues represent 50% of Intellect’s total revenues. That is higher than typical software product companies. But it also means Intellect controls the customer experience end-to-end. When something goes wrong, there is no finger-pointing between vendor and integrator.

Deal Metrics

The eMACH.ai launch changed Intellect’s commercial trajectory. Deal wins increased. Deal sizes expanded. The proportion of large transformation contracts grew.

| Period | Deal Wins | YoY Change | Destiny Deals as % of Total |

|---|---|---|---|

| FY22 | 35 | 9.4% | 51% |

| FY23 | 42 | 20.0% | 60% |

| FY24 | 52 | 23.8% | 58% |

| FY25 | 43 | -17.3% | 65% |

| H1FY26 | 35 | 52.2% | - |

Destiny deals are contracts worth more than INR 200 million. These are the transformation projects that reshape a bank’s technology foundation. They take longer to close but generate revenue over many years. The number of deals fell in FY25. But deal quality improved. Destiny deals now represent 65% of total wins, up from 51% in FY22.

Deal Pipeline

Pipeline growth has accelerated sharply in recent quarters.

| Quarter | Pipeline (INR Bn) | YoY Growth | Destiny Deals in Pipeline |

|---|---|---|---|

| Q1FY24 | 72.4 | 16% | 68% |

| Q2FY24 | 75.2 | 15% | 62% |

| Q3FY24 | 80.2 | 14% | 62% |

| Q4FY24 | 81.4 | 16% | 67% |

| Q1FY25 | 85.3 | 18% | 67% |

| Q2FY25 | 88.9 | 18% | 64% |

| Q3FY25 | 100.0 | 25% | 65% |

| Q4FY25 | 102.3 | 26% | 68% |

| Q1FY26 | 113.0 | 33% | 70% |

| Q2FY26 | 120.0 | 35% | 75% |

Pipeline growth jumped from 14-18% in FY24 to 25-35% in recent quarters. Destiny deals now form 75% of the pipeline.

The pipeline by deal size shows concentration in larger contracts:

| Deal Size Bucket | Q2FY23 | Q4FY23 | Q1FY24 | Q4FY24 | Q1FY25 | Q4FY25 | Q2FY26 |

|---|---|---|---|---|---|---|---|

| >INR 500 Mn | 15 | 17 | 18 | 19 | 23 | 25 | 27 |

| INR 300-500 Mn | 23 | 24 | 25 | 25 | 27 | 31 | 32 |

| INR 200-300 Mn | 28 | 29 | 30 | 35 | 34 | 37 | 38 |

| Total Destiny Deals | 66 | 70 | 73 | 79 | 84 | 93 | 97 |

Recent Destiny Deal Wins

| Customer | Platform/Domain | Deal Details |

|---|---|---|

| London Market Brokerage | Purple Fabric (Underwriting & Insurance) | Multi-year deal worth ~INR 200 crore. Underwriting ecosystem deployed across places to streamline insurance policy placement. |

| UK-based Global Bank | eMACH.ai Wholesale Banking | Digital transformation to expand wholesale banking footprint into India, Hong Kong, Singapore. |

| Bank Albilad (KSA) | Cash Management | Cash management transformation in Saudi Arabia. |

| Tier-1 Canadian Bank | eMACH.ai Core Banking | Entry into US core banking market. Initially covers US operations, plans to expand to Europe and Asia. |

| Tier-1 Canadian Bank | Payments & Cash Management | Real-time transaction modernization of US operations. |

System Integrator Partnerships

After developing eMACH.ai, Intellect entered partnerships with major system integrators. The company still handles most implementations directly but now collaborates with SIs to expand reach.

| Partner | Partnership Type | Focus Areas |

|---|---|---|

| Wipro | Global Strategic Partner | eMACH.ai solutions globally |

| HCLTech | Global Strategic Partner | eMACH.ai and Purple Fabric platforms |

| LTIMindtree | Global Strategic Partner | eMACH.ai + iTurmeric in MEA and APAC |

| Coforge | Global Strategic Partner | eMACH.ai + iTurmeric in APAC, North America, Europe, UK |

| AWS | Technology Partner | Cloud infrastructure support |

| Big Four Consultants | Advisory Partners | Consulting and reach expansion |

| Confianza | P&C Insurance Partner | Risk evaluation and submission workflows |

Purple Fabric: The AI Platform

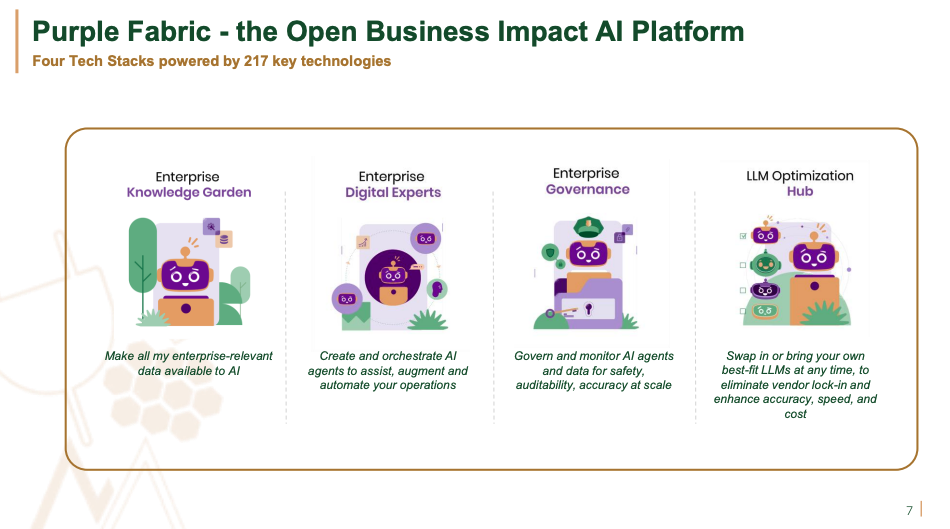

Intellect launched Purple Fabric in Q4FY25. This is an enterprise AI platform that transforms enterprise data into actionable insights.

The platform is built on four foundational technologies:

| Component | Function |

|---|---|

| Enterprise Knowledge Garden | Makes all enterprise-relevant data available to AI |

| Enterprise Digital Experts | Creates and orchestrates AI agents to assist, augment, and automate operations |

| LLM Optimization Hub | Swaps in or brings best-fit LLMs to eliminate vendor lock-in |

| Enterprise Governance | Governs and monitors AI agents and data for safety, auditability, accuracy at scale |

Monetization Models

| Model | Description | Revenue Approach | Target Scale |

|---|---|---|---|

| Platform Subscription | Enterprise AI platform like Palantir | ~USD 1 million per client annually | 50-100 clients in 4 years |

| Domain-Specific AI Apps | Apps built on Purple Fabric | Usage-based: basis points on premiums, per transaction/file | INR 1 Bn revenue per use case in 3-5 years |

| AI Embedded in Products | AI integrated into existing Intellect products | Premium pricing (20% higher than peers) | Full product suite |

Intellect charges about USD 1 million per client per year for the platform. Palantir charges about USD 3 million. This pricing differential gives Intellect a competitive wedge.

Four to five use cases are already live:

| Product | Application |

|---|---|

| Purple Fabric APX | Invoice processing automation |

| Purple Fabric Magic Submission | Insurance submission intake and triage |

| Purple Fabric Magic Placement | Policy quote comparison and matching |

| Purple Fabric ESG Edge | Real-time ESG and GRC insights |

The Purple Fabric pipeline has reached INR 8 billion and represents 8% of the Q1FY26 deal pipeline. The company has generated 500-600 leads since launch.

Product Portfolio

Wholesale Banking Products (iGTB)

| Product | Description |

|---|---|

| Contextual Banking Exchange (CBX) | Digital banking platform for cash management. Uses AI, ML, and predictive analytics to provide actionable insights to corporate treasurers and CFOs. |

| Digital Transaction Banking (DTB) | Integrated platform covering payments, liquidity, collections, virtual accounts, trade finance, and supply chain finance. |

| Payments Services Hub (PSH) | Channel aggregation and orchestration for end-to-end payment processing. Routes payments through optimal rails based on customer preferences. |

| Liquidity Management Solution (LMS) | Physical cash concentration, notional pooling, inter-company loans, investment sweeps. Market leader in corporate liquidity. |

| Trade and Supply Chain Finance (TSC) | Integrated platform for trade and supply chain operations with unified limit management. |

Consumer Banking Products (iGCB)

| Product | Description |

|---|---|

| Intellect Digital Core (IDC) | Fully integrated core banking across deposits, lending, treasury, trade finance, and cards. Supports digital challenger banks and legacy modernization. |

| Digital Lending | End-to-end loan lifecycle management. In-principle approval in 2 minutes. Over 99% straight-through processing. |

| Digital Cards | Comprehensive payment solution from origination to collections. Manages 100+ million cards. Multiple lines of credit on single account. |

| Wealth Qube | Relationship-centric wealth management. Supports private banks, retail banks, asset managers, broker-dealers. API-based, omnichannel. |

| Quantum (Central Banking) | Platform for central banks covering currency management, public debt, depository management, enterprise general ledger. |

Risk, Treasury & Capital Markets Products (iRTM)

| Product | Description |

|---|---|

| Capital Cube | Integrated treasury and asset-liability management. Real-time information on liquidity, funding, exposures. |

| Capital Alpha | Multi-asset, multi-exchange, multi-currency brokerage solution. Front-to-back for retail and enterprise brokers. |

| Capital Sigma | Asset servicing suite for custody, fund services, investor services. 95%+ straight-through processing. |

Insurance Products (Intellect SEEC)

| Product | Description |

|---|---|

| Intellect Xponent | Cloud-native underwriting workstation for commercial specialty risks. Big data and risk analysis frameworks. 250+ integrations. |

iTurmeric: The Integration Platform

Before eMACH.ai, Intellect built iTurmeric. This is a cloud transformation accelerator that helps banks modernize progressively without ripping and replacing their entire infrastructure. The platform enables composable banking. Instead of locked functionality bundles, banks can assemble capabilities from modular components. New systems can be tested and run in parallel with legacy systems.

Key capabilities:

- Enterprise integration with API-first architecture

- Cloud-native, microservices-based

- Progressive modernization without business disruption

- Co-existence with legacy infrastructure during transition

Revenue Mix Evolution

The company expects a shift in revenue composition over the next 2-3 years.

| Revenue Type | Current Mix | Expected Mix (2-3 Years) |

|---|---|---|

| Implementation Revenues | 50% | 40% |

| License-Linked Revenues | 50% | 60% |

Within license-linked revenues, the composition shows subscription growth:

| Quarter | License Revenues | AMC Revenues | Subscription Revenues |

|---|---|---|---|

| Q3FY24 | 36% | 32% | 32% |

| Q4FY24 | 44% | 38% | 18% |

| Q1FY25 | 40% | 39% | 21% |

| Q2FY25 | 34% | 48% | 18% |

| Q3FY25 | 40% | 42% | 17% |

| Q4FY25 | 44% | 35% | 20% |

| Q1FY26 | 33% | 34% | 32% |

| Q2FY26 | 34% | 34% | 32% |

Subscription revenues jumped from 17-21% in FY25 to 32% in H1FY26. This reflects Purple Fabric traction.

Annual Recurring Revenue Trajectory

| Quarter | ARR (INR Mn) | QoQ Change |

|---|---|---|

| Q4FY24 | 6,950 | - |

| Q1FY25 | 7,500 | 7.9% |

| Q2FY25 | 6,620 | -11.7% |

| Q3FY25 | 6,950 | 5.0% |

| Q4FY25 | 8,700 | 25.2% |

| Q1FY26 | 10,410 | 19.7% |

| Q2FY26 | 10,800 | 3.7% |

ARR expanded from INR 6,950 million in Q4FY24 to INR 10,800 million in Q2FY26. That is 55% growth in 8 quarters.

Global Expansion: The Central 1 Acquisition

Intellect signed an agreement to acquire the digital banking operations of Central 1 Credit Union in Canada. This deal gives access to about 190 credit unions currently on Central 1’s platform. Intellect will operate and support Central 1’s digital banking software during the transition to its own eMACH.ai platform. The acquisition is only marginally profitable but creates cross-selling opportunities for Intellect’s broader core banking solutions.

The company targets India, UK, and Canada as USD 100 million markets each in the long term.

Market Opportunity

The Americas and Europe banking software markets are each expected to grow at roughly 14% CAGR from FY25 to FY29.

| Market | FY25 Size | FY29E Size | CAGR |

|---|---|---|---|

| Americas Banking Software | INR 6 Bn | INR 10 Bn | ~14% |

| Europe Banking Software | INR 6 Bn | INR 10 Bn | ~14% |

Many large banks in developed markets still run on legacy core banking systems built on COBOL, mainframes, or monolithic architectures. Rising regulatory demands, customer expectations for digital channels, and competitive pressure create urgency for modernization.

Business Model Economics

Intellect operates a high gestation, high upfront cost business. Investments in R&D and sales and marketing are front-loaded. But these costs do not remain elevated forever. They come down as the company transitions from investment phase to monetization phase.

Revenue Streams

| Stream | Description | Characteristics |

|---|---|---|

| License Fee | Upfront payment for software use in on-premise model | Higher in advanced markets; increases with product maturity |

| Implementation Fee | Customization and roll-out of software | Ongoing customization, change requests, production support |

| Annual Maintenance (AMC) | Software maintenance and upgrades | Percentage of license component; grows with implementation footprint |

| Subscription (SaaS) | Cloud deployment on recurring basis | Potential upside linked to transaction volumes, accounts, or revenue |

Cost Drivers

| Category | Description |

|---|---|

| Product Manufacturing | Development of products, new versions, user journeys, technology re-platforming |

| Research & Engineering | Core technology components, frameworks, architectures, tools |

| Service Delivery | Implementation costs, production support, maintenance |

| Sales & Marketing | Business development, branding, market development, pre-sales |

| General Administration | Infrastructure, shared services, corporate management |

Software has near-zero marginal costs once developed. Creating another copy costs virtually nothing. This scalability combined with subscription-based pricing results in high gross margins and predictable revenue.

Customer Stickiness

Repeat business forms 85-90% of total revenues. Net Promoter Score stands at 60 versus industry average of 43. High NPS with existing customers increases reference ability and reduces customer acquisition costs.

When a bank installs a core banking system, the switching costs are enormous:

- Implementation takes 12-24 months

- Staff training on new systems

- Data migration risks

- Integration with existing systems

- Regulatory approval processes

- Business continuity concerns

Management Team

| Name | Role | Background |

|---|---|---|

| Arun Jain | Chairman & Managing Director | 30+ years in fintech. Founded Nucleus Software, built Polaris, created Intellect. Deep domain expertise in banking technology. |

| Manish Maakan | CEO, Intellect Wholesale Banking | 30 years in technology, consulting, and financial services. Built Digital Transaction Banking into globally rated platform. Former roles at GE Money, IBM, E&Y, Whirlpool. |

| Rajesh Saxena | CEO, Intellect Consumer Banking | Former CEO of American Express India. 19 years at Citibank managing product and country P&L roles. XLRI MBA, BITS Pilani gold medalist. |

| Banesh Prabhu | CEO, IntellectAI | 38+ years including 23 years at Citibank managing technology across 55+ markets. Former head of Technology & Operations at Siam Commercial Bank. |

| Vasudha Subramaniam | Chief Financial Officer | 20+ years in finance. Chartered Accountant and Cost Accountant. Led business finance, FP&A, cost management, taxation. |

| Krishna Rajaraman | Chief Technology Officer | 20+ years across corporate, retail, treasury, and investment banking platforms. Pioneer of omnichannel and low-code platform solutions. |

| Kannan Ramasamy | Chief Partner Officer | 30+ years in tech industry. Former MD for India & South Asia at Logica. Senior roles at Misys, HCL, NIIT. |

Guidance

Management has provided specific targets:

| Metric | Target | Timeline |

|---|---|---|

| Quarterly Revenue Run-rate | INR 8 Bn | End FY26 |

| Quarterly Revenue Run-rate | INR 10 Bn | FY28 |

| Annual Revenue | INR 40 Bn | FY28 |

| Annual PAT | INR 10 Bn | FY28 |

| EBITDA Margin (incl. other income) | 27-30% | FY28-29 |

| Purple Fabric Revenue | INR 2 Bn | FY26 |

| Purple Fabric Revenue | INR 10 Bn | FY28 |

| Purple Fabric Customers | 5,000 | 2-3 years |

| Platform Revenue | INR 10 Bn (25% of total) | FY28 |

Growth Triggers

- Purple Fabric AI platform targeting ₹1,000-5,000 Cr revenue potential over next 3 years

- ₹200 Cr Purple Fabric revenue guidance for FY26 with 70% of pipeline now AI-integrated

- eMACH.ai platform driving 20% YoY growth design target with 30% EBITDA margin ambition

- Central1 acquisition adding 170 Canadian credit unions and ₹200 Cr ARR base

- Strong US market entry with 3 major deals won in Q1 across core banking, payments and liquidity

- License-linked revenue now 50%+ of total and targeting 60% by FY27

- Global deal funnel crossed ₹12,000 Cr with 11 multi-million dollar destiny deals in Q2

- Purple Fabric embedded across all products creating AI-native banking solutions

- Enterprise Knowledge Garden and Digital Experts differentiating against Palantir/C3.ai

- 9,000+ AI agents deployed internally driving productivity gains without headcount increase

- Consulting business launched to drive business impact transformation deals

- Americas revenue growth accelerating faster than other regions

- 22 digital transformations executed in Q2 alone across 5 continents

- ARR base crossed ₹1,080 Cr establishing predictable revenue foundation

- New 7.25 lakh sq ft Siruseri facility housing Purple Fabric AI Labs and Design Centers

Risks

- Slowdown in bank IT spending could delay core transformation deals. Banks often cut discretionary technology spending during economic uncertainty.

- Intense competition from global software vendors (FIS, Temenos, Oracle Financial Services), domestic product players, and large Indian IT service firms in core digital transformation deals.

- Regulatory and compliance requirements across 57 countries. Each jurisdiction has different rules for banking technology.

- Purple Fabric scaling slower than expected. The AI platform is new and unproven at scale. Slower adoption could impact growth and margin trajectory.

- Large deal conversion challenge. Destiny deals take longer to close and have more complex decision processes. Conversion rates can be unpredictable.

- Implementation execution. Since Intellect handles most implementations directly, any quality issues impact both revenue and reputation.

- Key person risk. Arun Jain has been central to the company’s evolution from Polaris to Intellect. Leadership continuity matters.

Valuations

| FY25 | FY26E | FY27E | FY28E | |

|---|---|---|---|---|

| Revenue | 2500 | 2950 | 3481 | 4003 |

| Revenue Growth % | 18 | 18 | 15 | |

| EBITDA Margin % | 21 | 22 | 24 | 26 |

| EBITDA | 531 | 649 | 835 | 1041 |

| Depreciation | 156 | 180 | 200 | 220 |

| Finance Cost | 8 | 10 | 10 | 10 |

| Other Income | 77 | 90 | 100 | 110 |

| PBT | 444 | 549 | 725 | 921 |

| Tax % | 25 | 25 | 25 | 25 |

| Tax | 111 | 137 | 181 | 230 |

| PAT | 333 | 412 | 544 | 691 |

| PAT Growth % | 23.7 | 32 | 27 |

Further Reading

Explore more deep dives on Finance Pulse: