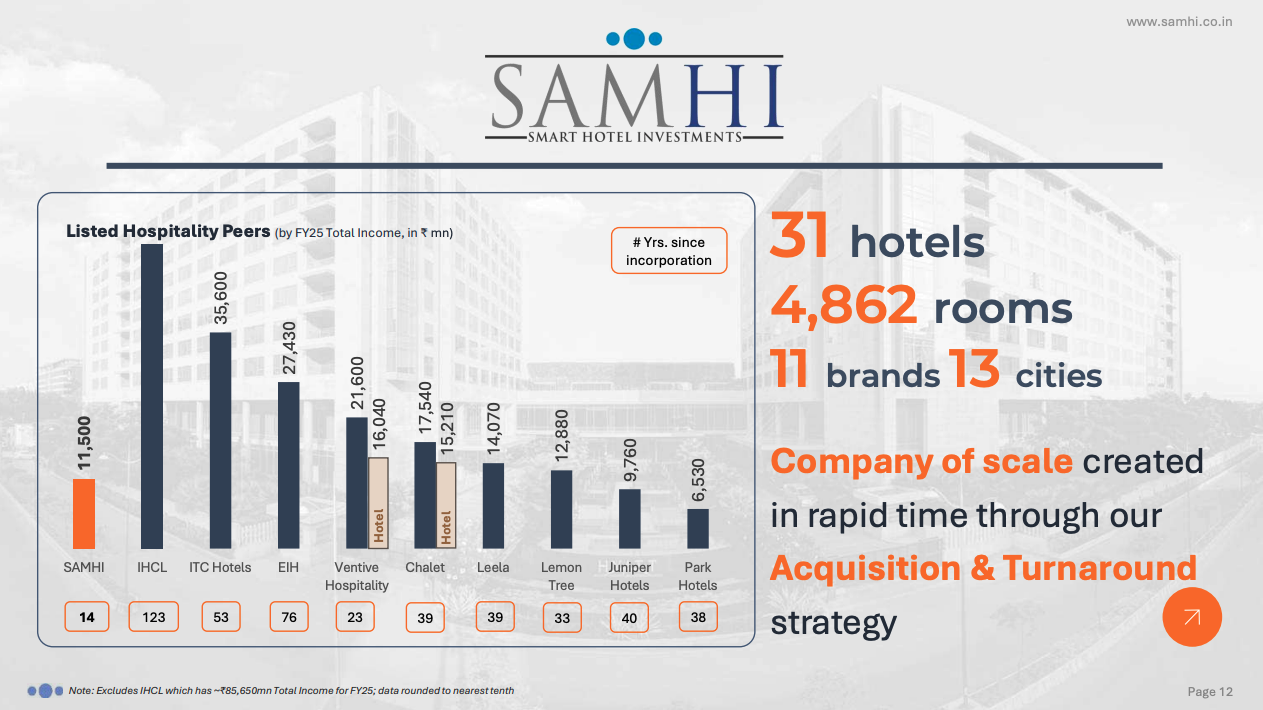

Samhi Hotels operates 31 hotels with 4,862 rooms across 13 cities in India. The company partners with Marriott, Hyatt, and IHG under long-term management agreements. Unlike most hotel companies that build from scratch, Samhi buys existing properties, renovates them, and hands them to global brands for operations.

This approach has made Samhi one of the fastest-growing hotel owners in India by rooms added per year.

Business Model

Samhi acquires underperforming properties in high-demand locations, spends capital on renovation and rebranding, then contracts Marriott, Hyatt, or IHG to run day-to-day operations.

The model works like this: Samhi identifies a hotel trading below replacement cost in a strong commercial corridor. It buys the asset, invests in upgrades, and attaches a global brand. The brand brings distribution reach, loyalty programs, and operating expertise. Samhi collects the property-level profits minus management fees.

Marriott operates 66% of Samhi’s rooms. Hyatt operates 17%. IHG operates 15%. The remaining 2% is unbranded.

Building a hotel from the ground up in India takes five to seven years. The process involves land acquisition, zoning approvals, construction, brand affiliation, staffing, and ramp-up. Capital remains tied up for years before generating returns. Buying an existing property compresses this timeline. Samhi can acquire, renovate, and rebrand a hotel in 18 to 24 months. Cash flows begin sooner. Risk decreases because the asset already exists and demand in the micro-market is observable.

Sheraton Hyderabad shows how this works. Samhi acquired the property in 2015 when it yielded roughly 2% on invested capital. The hotel had 158 rooms at acquisition. Samhi invested in renovation and expansion. By FY19, RevPAR had grown to INR 4,100. By FY23, it reached INR 6,050. By FY25, with 272 rooms, RevPAR hit INR 9,140. The property now targets 25%+ return on capital employed with 326 rooms upon full expansion.

Portfolio Segments

Samhi divides its hotels into three categories based on brand positioning and pricing.

Upper-Upscale and Upscale includes properties like Hyatt Regency Pune, Renaissance Ahmedabad, Sheraton Hyderabad, Courtyard Bangalore, and Hyatt Place Gurugram. These hotels target corporate travelers, conferences, and events. They command higher room rates and generate stronger margins. This segment currently holds 1,074 rooms across five properties but contributes 43% of room revenue despite holding only 22% of inventory.

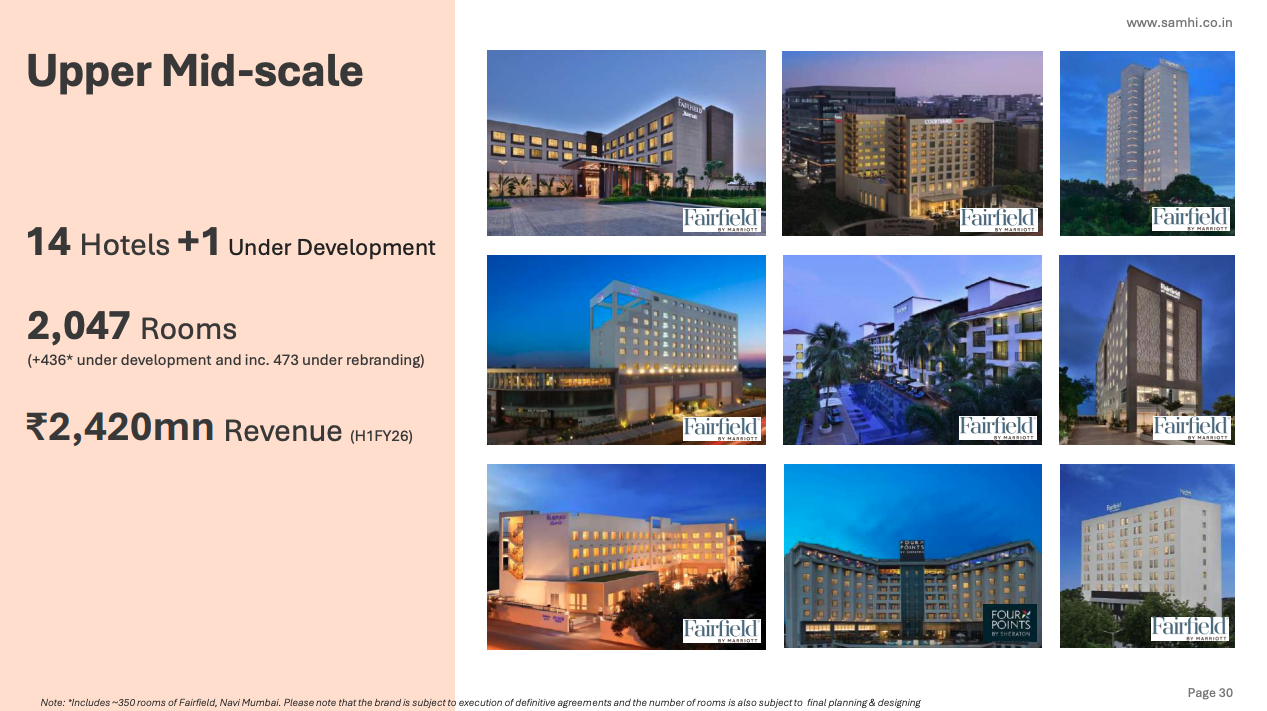

Upper Mid-scale covers Fairfield by Marriott and Four Points by Sheraton properties. These hotels sit below the upscale tier but above budget options. They attract business travelers seeking reliable service at moderate prices. Samhi operates 2,189 rooms in this segment across multiple cities including Bangalore, Pune, Hyderabad, Chennai, and Goa.

Mid-scale consists primarily of Holiday Inn Express hotels. These properties focus on value-conscious travelers and serve markets like Ahmedabad, Bangalore, Pune, Gurugram, Hyderabad, Nashik, and Chennai. The segment holds 1,560 rooms but contributes only 15% of revenue while holding 34% of inventory.

The gap between room inventory share and revenue share reflects the pricing power of premium hotels. Upper-upscale properties command rates roughly 60% above the portfolio average. Mid-scale runs about 40% below average.

Geographic Footprint

Samhi’s hotels cluster around India’s major business centers.

Bangalore holds 22% of the portfolio. Hyderabad follows at 17%. Pune accounts for 18%. Delhi-NCR represents 11%. Chennai contributes 9%. The remaining inventory spreads across Ahmedabad (9%), Goa (3%), Coimbatore (3%), Visakhapatnam (2%), Nashik (2%), Jaipur (2%), and Kolkata (2%).

The location strategy targets high-density micro-markets near airports, tech parks, and commercial districts. These areas face barriers to new entry due to land scarcity, long approval timelines, and fragmented ownership. Hotels already operating in these corridors hold structural advantages.

Tier-1 cities generated 13% ROCE in FY25 compared to just 6% from Tier-2 markets. This gap explains why all future expansion targets Tier-1 and metro markets. Office space absorption drives hotel demand in these markets. Bangalore absorbed 13.1 million square feet of office space in FY25. Hyderabad absorbed 8.4 million. Pune absorbed 5.8 million. Delhi-NCR absorbed 8.7 million. When companies lease offices, they also need hotel rooms for visiting employees, clients, and event attendees.

Growth Pipeline

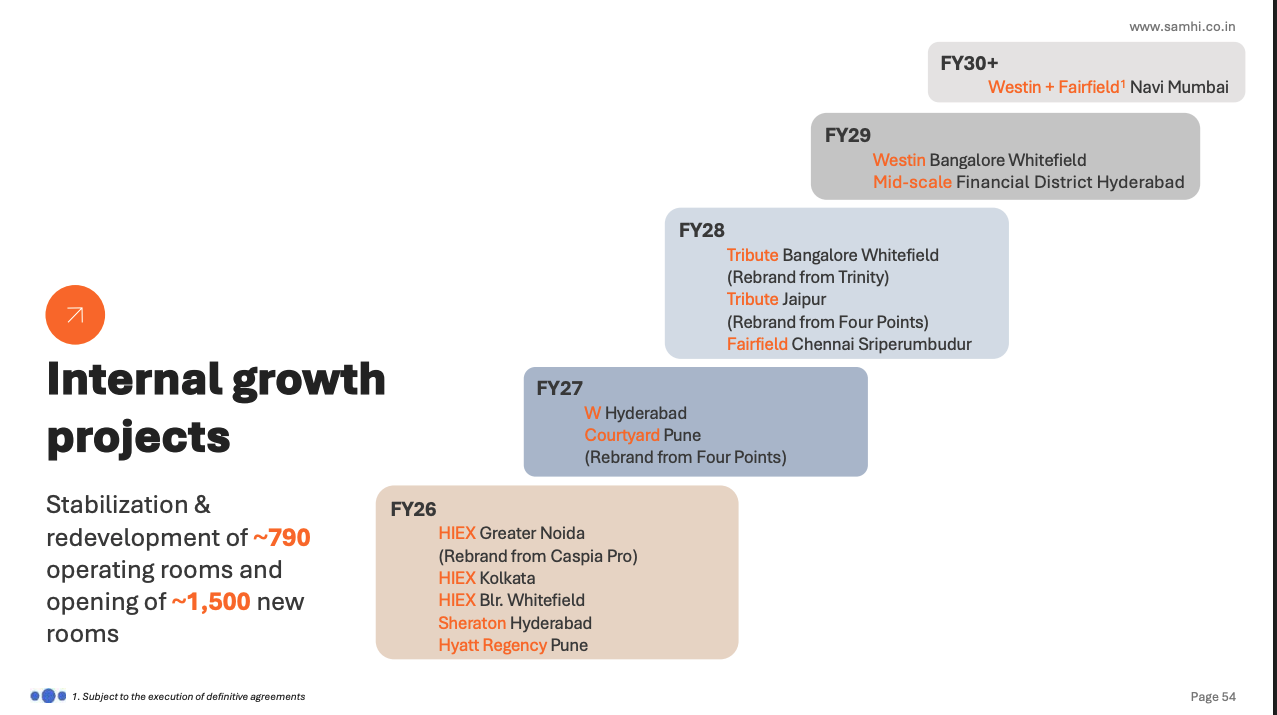

Samhi plans to add roughly 1,500 rooms through FY30, representing a 30% increase in operational inventory over 4-5 years.

Completed projects include Holiday Inn Express Greater Noida (133 rooms), Holiday Inn Express Kolkata (113 rooms), Sheraton Hyderabad expansion (12 rooms), and Holiday Inn Express Whitefield Bangalore expansion (56 rooms).

Fit-out stage projects include 42 additional rooms at Sheraton Hyderabad and 22 rooms at Hyatt Regency Pune.

Design stage projects include:

- W Hotel Hyderabad: 170 rooms, greenfield expansion

- Courtyard by Marriott Pune: 217 rooms, rebranding from Four Points by Sheraton

- Tribute Portfolio Bangalore: 142 rooms, rebranding from Trinity

- Tribute Portfolio Jaipur: 114 rooms, rebranding from Four Points by Sheraton

- Fairfield Sriperumbudur expansion: 86 rooms

- Westin Whitefield Bangalore: 220 rooms, greenfield expansion

- Mid-scale asset in Hyderabad Financial District: 260 rooms, cold-shell fit-out under variable lease

The largest project is a dual-branded Westin and Fairfield development in Navi Mumbai. Phase 1 adds approximately 400 rooms. Full build-out reaches 700 rooms. This marks Samhi’s entry into the Mumbai Metropolitan Region.

The Navi Mumbai project sits near the upcoming Navi Mumbai International Airport and DY Patil Stadium. The Atal Setu bridge improves connectivity. Total investment runs approximately INR 10 billion. Cost per key falls below typical Mumbai replacement rates. At full capacity, the property targets INR 1.80 to 1.85 billion in annual EBITDA.

The Hyderabad Financial District project follows a different structure. Samhi takes a long-term variable lease rather than owning the land and building. The lessor constructs the building shell. SAMHI funds only interior fit-out. This keeps cost per key at INR 45 to 50 lakh, well below typical levels.

City-wise, the planned inventory addition breaks down as: Navi Mumbai (47%), Hyderabad (31%), Bangalore (15%), Chennai (6%), and Pune (1%).

Premiumization Strategy

SAMHI is shifting its portfolio toward higher-priced segments. The upper-upscale and upscale segment currently contributes 43% of room revenue from 22% of inventory. By FY30, room contribution from this segment is expected to reach 43% of total keys as well, up from current levels. This shift happens through rebranding existing properties and adding new upscale inventory.

The Four Points by Sheraton in Pune Viman Nagar will convert to a Courtyard by Marriott. The Four Points in Jaipur will rebrand to Tribute Portfolio. The Trinity property in Bangalore Whitefield will become Tribute Portfolio. Each conversion moves the hotel up the brand ladder.

New builds like Westin Whitefield, W Hotel Hyderabad, and the Westin portion of Navi Mumbai add fresh upscale inventory. The Financial District Hyderabad project adds mid-scale rooms but does so in a micro-market where Samhi already operates Sheraton and Fairfield properties, creating full price-segment coverage.

Upper-upscale hotels generate higher revenue per room. They also produce stronger margins due to better pricing power and event revenue. The upscale and above segment for SAMHI has higher non-room revenue contribution (56% of room revenue) compared to other segments. ARR is expected to register approximately 10% CAGR over FY25-28E. F&B revenues are expected to deliver 8% CAGR over the same period.

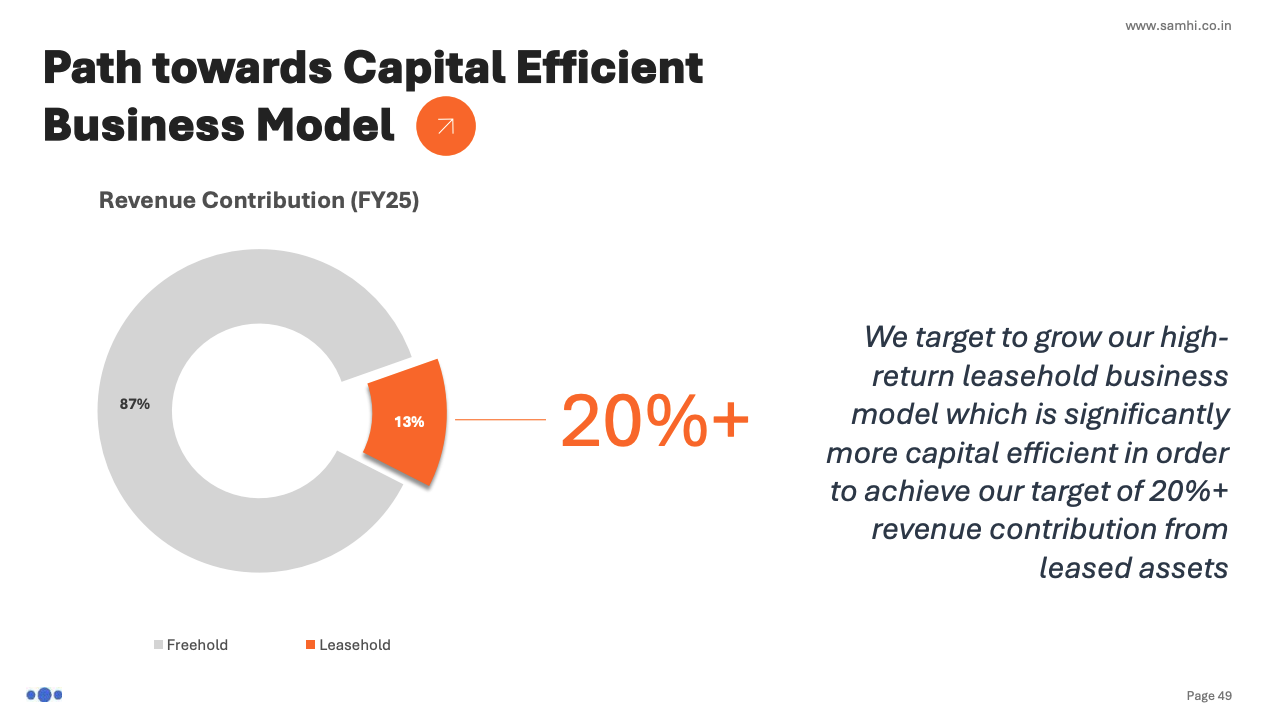

Leasehold vs Freehold Assets

Samhi’s portfolio consists of both freehold (owned) and leasehold (rented) assets. The distinction matters for capital efficiency. Leasehold assets generated 18% ROCE in FY25 compared to 11% for freehold properties. The lower capital investment required for leaseholds improves returns even if absolute profits are smaller.

Currently, leasehold assets contribute 13% of revenue. Samhi targets increasing this to 20% over time. The Hyderabad Financial District project under variable lease follows this strategy.

GIC Partnership

In 2024, GIC, Singapore’s sovereign wealth fund, invested approximately INR 7,500 million in SAMHI. Of this amount, INR 6,000 million went toward debt reduction. The remainder provides growth capital. GIC took a 35% stake in five upscale hotel properties that form a joint venture platform.

The partnership delivers three benefits:

- First, it reduced leverage. Net debt to EBITDA dropped from 7.2x in FY24 to 5.1x in FY25 and stood at 2.9x as of September 2025.

- Second, it provides growth capital without diluting Samhi’s equity stake in the broader business. The GIC structure funded approximately INR 1.5 billion in early acquisitions.

- Third, it creates a vehicle for future upscale acquisitions where Samhi can source deals and contribute them to the JV platform, sharing ownership with GIC while maintaining operational control.

Operating Metrics

Occupancy ran at 75% in the September 2025 quarter, up from 72% in the same period of 2024.

Average room rate reached INR 6,997, up 6% year over year. RevPAR (revenue per available room) hit INR 5,026 in the September 2025 quarter, up from INR 4,529 a year earlier.

Portfolio-wide ARR increased from INR 5,316 in FY23 to INR 6,285 in FY25. RevPAR rose from INR 3,803 in FY23 to INR 4,670 in FY25. Occupancy improved from 72% in FY23 to 74% in FY25.

These metrics reflect both industry tailwinds and portfolio improvement. Demand for Indian hotel rooms continues to outpace supply growth. Domestic leisure travel, corporate events, and conference activity remain strong. Foreign tourist arrivals have recovered but remain below pre-pandemic levels, providing further upside as international travel normalizes.

H1 FY26 Performance and H2 Outlook

SAMHI posted 11% revenue growth in H1 FY26. This was impacted by geopolitical tensions and heavy monsoons.

Growth is expected to pick up in H2 due to several factors:

- New inventory absorption: Holiday Inn Express Kolkata (113 rooms), Holiday Inn Express Bangalore expansion (56 rooms), and Trinity Bangalore (142 rooms) are now operational and ramping up.

- Planned room additions: Sheraton Hyderabad adds 42 rooms. Hyatt Regency Pune adds 22 rooms.

- Seasonal strength: Q3 and Q4 typically see strong MICE (meetings, incentives, conferences, exhibitions) demand in Bangalore and Hyderabad, SAMHI’s core markets.

- Renovation impact: Planned renovation and rebranding of Trinity Bangalore, Four Points Pune, and Four Points Jaipur should drive ARR growth in FY27 and FY28.

Balance Sheet and Debt Reduction

SAMHI has seen consistent net debt reduction over the past year.

- Gross debt declined from INR 26.9 billion in FY23 to INR 21.3 billion in FY25. It is expected to reach INR 15.3 billion by FY28.

- Cash and equivalents stood at INR 700 million in FY25 and are expected to reach INR 7.6 billion by FY28.

- Net debt to EBITDA ratio fell from 10.8x in FY23 to 5.1x in FY25. It is expected to decline to 1.2x by FY28.

- Interest rates on borrowings have declined from 13% to 8.5% currently. Annualized interest costs dropped from INR 3,940 million in Q1 FY24 to INR 1,250 million in Q2 FY26.

The interest rate reduction was supported by:

- GIC investment and subsequent deleveraging

- Asset recycling initiatives

- Strong operating cash flow

- Credit rating improvements

Capital Expenditure and Free Cash Flow

Despite planned expansion, capex is expected to remain contained at INR 2.0-2.2 billion per year over FY25-28E. This is because cost per key for Samhi is significantly lower than industry average across most projects due to:

- Acquiring assets below replacement cost

- Variable lease structures that reduce upfront capital

- Brownfield expansions within existing properties

- Efficient renovation approaches

Industry Context

Branded hotel room supply in India grows slower than demand. Adding branded hotel rooms takes years. Land acquisition, permitting, construction, and brand affiliation stretch timelines beyond what demand cycles allow. Meanwhile, air passenger traffic grows at 7-10% annually. Office space absorption in major cities exceeds 50 million square feet per year. Corporate India expands its footprint continuously.

Air traffic reached 173 million passengers in 2024, up from 152 million in 2023. Indian carriers added over 150 aircraft in 2024 alone. The government plans to double operational airports to 300 by 2047.

The MICE segment (meetings, incentives, conferences, exhibitions) grows at roughly 18% annually. Corporate offsites, industry conferences, and large-scale events drive demand for full-service hotels with banquet facilities.

This demand-supply imbalance supports pricing power across the industry. Hotels can raise rates without losing occupancy. Operating leverage improves as fixed costs spread across higher revenues.

Competitive Position

Samhi competes with Indian Hotels (IHCL), Chalet Hotels, Lemon Tree, EIH, and several smaller players. Samhi trades at lower multiples than peers. The stock sits at approximately 10-11x forward EV/EBITDA compared to higher multiples for peers. Part of this discount reflects Samhi’s higher leverage (though declining) and shorter public market track record. Part reflects the market’s tendency to assign premium multiples to well-known legacy brands.

Samhi’s acquisition model creates a different risk profile than competitors focused on new builds or management contracts. The company takes property-level risk but captures full upside from successful turnarounds. It moves faster than new-build competitors but depends on deal flow to maintain growth.

The portfolio’s age presents both opportunity and risk. Older properties require ongoing capital expenditure. Renovation cycles recur every seven to ten years. Samhi must reinvest continuously to maintain competitive positioning.

Key Risks

Execution risk on pipeline projects. The Navi Mumbai development represents Samhi’s largest-ever project. Construction delays, cost overruns, or softer-than-expected demand could impair returns.

Cyclicality. Hotel demand correlates with economic activity. A slowdown in corporate travel, reduced conference spending, or broader economic weakness would pressure occupancy and rates.

Interest rate sensitivity. Samhi carries significant debt. Rising interest rates increase financing costs and reduce free cash flow available for reinvestment or debt reduction. The reduction from 13% to 8.5% has helped profitability; any reversal would hurt.

Concentration risk. Bangalore and Hyderabad together hold roughly 40% of the portfolio. A regional economic shock or tech sector contraction would disproportionately affect Samhi’s performance.

Brand partner dependency. Marriott, Hyatt, and IHG control distribution, loyalty programs, and operating standards. Changes in these relationships could affect hotel performance.

Currency and macro factors. Foreign tourist arrivals depend partly on exchange rates and global economic conditions beyond Samhi’s control.

Renovation execution. Multiple rebranding projects are underway simultaneously. Poor execution on any major renovation could delay expected ARR improvements.

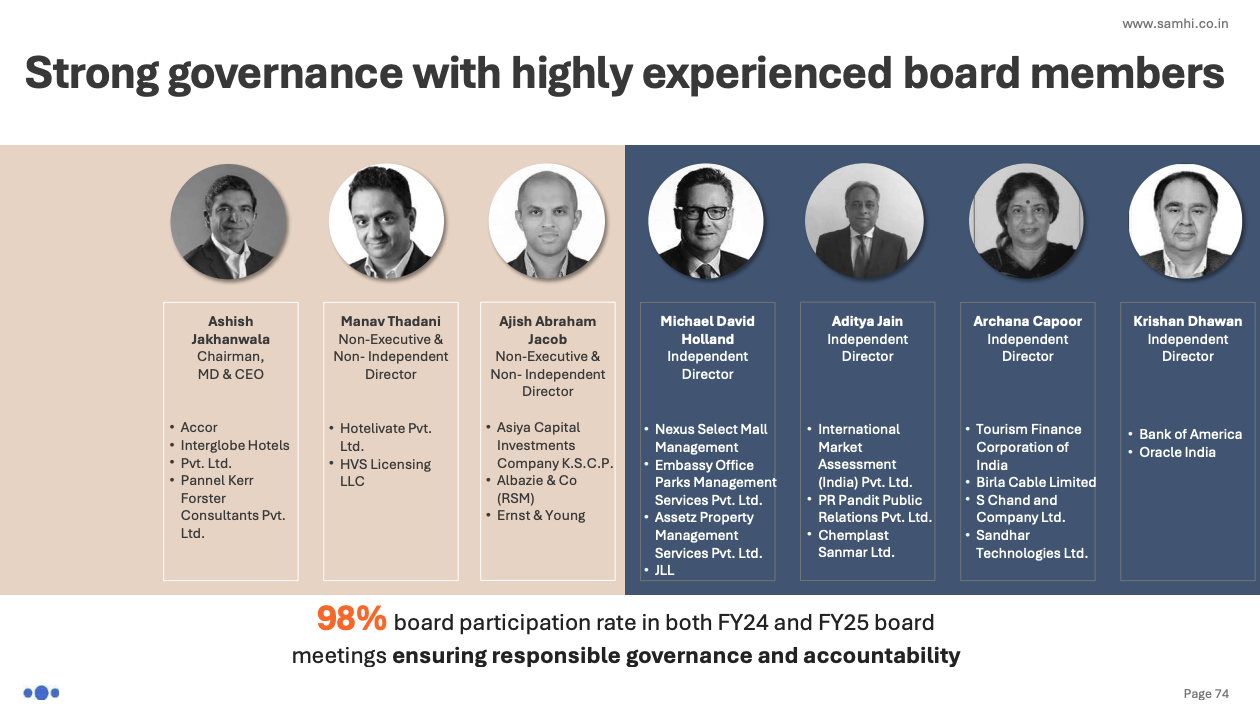

Management Team

Ashish Jakhanwala serves as Chairman, Managing Director, and CEO. He has background in hotel operations, design, consulting, and investment. Before founding Samhi, he worked as Regional Director of Development at InterGlobe Hotels (the Accor franchise partner in India) and as a consultant at Pannell Kerr Forster. He holds qualifications in commerce, hotel management, and a PGDM from the International Management Institute.

Rajat Mehra serves as CFO. He joined Samhi in 2012 after working in finance and change management at Religare Corporate Services. He is a chartered accountant.

Gyana Das heads Investments and has been with Samhi since 2011. He previously worked at InterGlobe Hotels. He holds degrees in architecture and city planning from VNIT Nagpur and IIT Kharagpur.

Summary

Samhi Hotels owns and upgrades branded hotels in India’s major commercial markets. The company buys underperforming properties, invests in renovation, and partners with global brands for operations. The portfolio holds 4,862 rooms across 31 hotels. Upper-upscale properties generate disproportionate revenue. The company plans to add 1,500 rooms by FY30, including a 700-room project in Navi Mumbai.

The GIC partnership reduced leverage and provides growth capital. Net debt to EBITDA fell from over 7x to under 3x and is expected to reach 1.2x by FY28. The portfolio mix is shifting toward premium segments through rebranding and new upscale additions. This should drive ARR growth and margin improvement.

H1 FY26 growth was impacted by external factors. H2 should see improvement from new inventory absorption, seasonal strength in core markets, and completed renovations. Risks include execution on large projects, cyclical demand, interest rate exposure, and geographic concentration.

Further Reading

Explore more deep dives on Finance Pulse: