Acutaas Chemicals (formerly Ami Organics) is a manufacturer of pharmaceutical intermediates and specialty chemicals. The company is experiencing rapid growth driven primarily by its pharma CDMO business, as well as the ramp up of its specialty chemicals segment, which includes electrolyte additives and semiconductor chemicals.

Acutaas’s business can be categorized into two broad categories: Pharma Intermediates (85% of FY25 revenues) and Specialty Chemicals (15%). The portfolio comprises 610+ products with a customer base of about 600 customers across 55 countries.

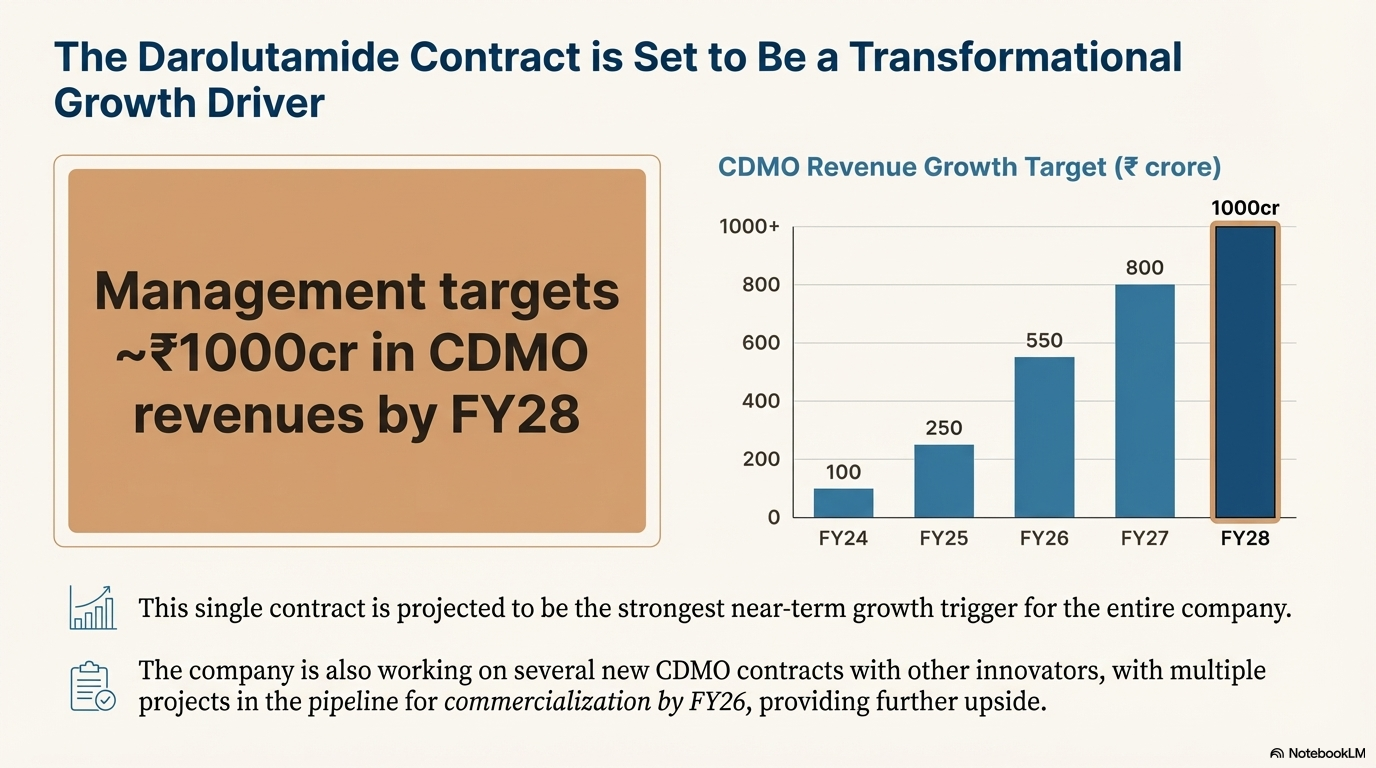

Management aims for 25% annual sales growth and targets revenues of ~Rs 1000 crore by FY28 in its pharma CDMO division. The strongest near term growth trigger will be its pharma CDMO contract with Fermion to supply intermediates for darolutamide, a fast growing blockbuster patented drug for prostate cancer.

Business Segments

Revenue Mix by Segment (FY25)

| Segment | Revenue Contribution |

|---|---|

| Advanced Pharma Intermediates | 85% |

| Specialty Chemicals | 15% |

Advanced pharma intermediates accounted for 85% of company’s overall revenues in FY25. The company develops, manufactures and commercialises intermediates used for manufacturing API and NCE in India and overseas markets in therapeutic areas such as anti-retroviral, anti-inflammatory, anti-psychotic, anti-cancer. Since inception, it has created over 550 pharmaceutical intermediates in 17 different therapeutic areas, which are supplied to over 160 customers.

Acutaas has positioned itself as a supplier capable of handling multiple chemistries such as nitration, diazotization, oxidation, esterification, ammoxidation, and is highly backward integrated for most of its intermediates. As a result company has gained dominant market share in many of its products.

As of FY24 the pharma intermediate business consists of 10% from CDMO, 40% from innovator and 50% from generic pharma intermediates. About 95% of the portfolio targets fast growing chronic therapy (anticancer, antiviral, CNS and cardiovascular segments). Company is usually first to market with different routes of synthesis and capabilities to supply intermediates from n-1 to n-12 stages. Once an intermediate supplier becomes a registered source in customer’s DMF, there is an entry barrier against new entrants. This becomes a source of moat and leads to limited competition and high market share in chosen molecules.

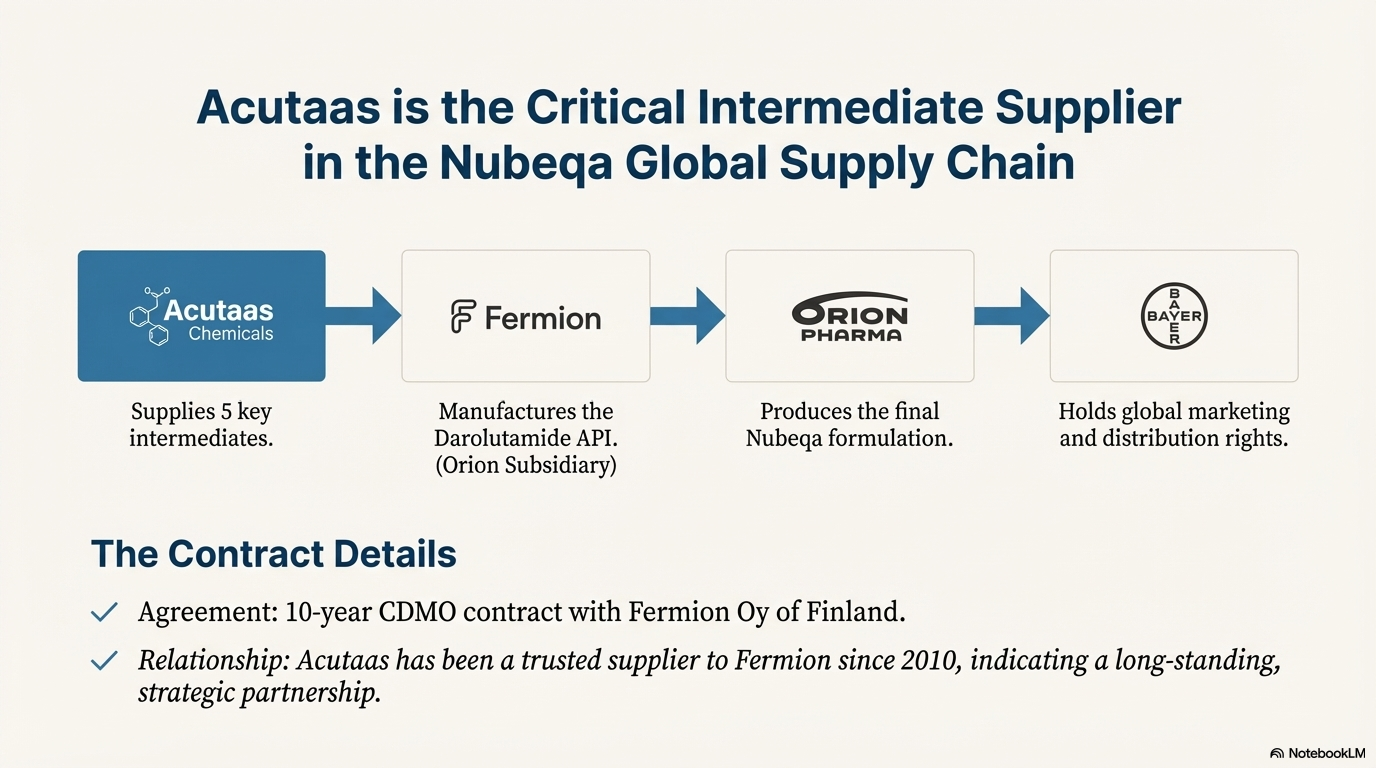

Acutaas has built strong relationships with customers like Fermion for which it started supplying intermediates since 2010. Company holds 15 process patents and has adopted newer technologies such as flow chemistry and distributed control systems to make production processes more efficient.

Key Growth Drivers in Non-CDMO Business

Apixaban: Apixaban (innovator brand name Eliquis) is an anticoagulant medication used to treat and prevent blood clots and to prevent stroke in people with non-valvular atrial fibrillation. The global market size of the drug is close to US$20 billion, although this will decrease after its patent expires in 2026. There are more than 70 manufacturers of the API. Acutaas has a sizeable market share for two intermediates used to produce the API: 1(4-aminophenyl)-3-morpholin-4-yl-5,6-dihydropyridine-2(1H)-one and ethylchloro acetate. Acutaas has already established a pipeline of 25-30 customers for the post-patent era.

Lumateperone tosylate: Lumateperone (innovator brand name Caplyta) is a medication used to manage and treat schizophrenia and other neuropsychiatric disorders. Its patent expiry is 2029. Acutaas holds a process patent for one of its intermediates: benzyl,3-methyl-2-oxo-2,3,9,10-tetrahydro-1H-pyrido[3’,4’:4,5]pyrrolo[1,2,3-de]-quinoxaline-8(7H)-carboxylate.

Rivaroxaban: Rivaroxaban (innovator brand name Xarelto) is an anticoagulant medication used to treat and prevent blood clots. The drug was initially developed by Bayer and marketed by Johnson & Johnson. Its patents are expiring by 2026, and Acutaas will supply four intermediates to generics suppliers.

Trazodone: Trazodone is the largest API in terms of revenues for the company and has been contributing Rs 100 crore+ of revenues for the past 2-3 years. Acutaas offers three intermediates used to make this API and claims to hold a dominant market share (80-90% in FY21) in these.

CDMO Business: Key Growth Driver

In its CDMO business Acutaas undertakes contract manufacturing for pharma companies under long term supply contracts. Company has commenced a 10 year contract with Fermion Oy of Finland to supply intermediates for darolutamide (brand name Nubeqa which has become a blockbuster for Bayer). This contract will be a major growth driver in coming years. Acutaas is currently supplying 5 intermediates for the molecule darolutamide. Bayer is selling Nubeqa as the end product. Acutaas is also working on several new CDMO contracts with other pharma innovators with multiple projects in pipeline to be commercialized by FY26.

Prostate Cancer Treatment Market

Prostate cancer is a condition in which abnormal cells grow and invade in uncontrolled manner in the prostate. Prostate cancer inhibits production of male sex hormones (androgens) and ultimately blocks the action of androgen.

Antiandrogen drugs are medications that block androgens from binding with the androgen receptors that exist in prostate cancer cells. In its early stages, prostate cancer cells rely on androgens to feed their growth. By blocking the coupling of androgens with cancer cells, antiandrogens starve the cancer cells of the androgens they need to grow.

First-generation ARIs, like Bicalutamide, are the original, weaker drugs that partially block the androgen receptor. Second-generation ARIs (Nubeqa, Xtandi) are the modern standard, providing a much more potent and complete blockade of the receptor. Across the prostate cancer space, older androgen receptor inhibitors command the highest share. With newer ARi assets Erleada and Nubeqa, despite being third to market, Nubeqa now leads Erleada in every setting. This suggests physician preference for Nubeqa which could be due to the benign safety profile of the drug with similar or better efficacy.

About Darolutamide

Darolutamide (marketed by Bayer under the brand name Nubeqa) is a drug to combat prostate cancer. It was initially approved in 2019 to treat non-metastatic castration-resistant prostate cancer (nmCRPC), but subsequently in August 2022 also approved by the USFDA in fighting metastatic castration-sensitive prostate cancer (mCSPC) in combination with docetaxel.

Darolutamide was developed jointly by Bayer and Orion Pharma. Fermion (a fully-owned subsidiary of Orion) manufactures the darolutamide API, while Orion manufactures the formulations and Bayer holds the marketing and distribution rights.

Fermion manufactures the darolutamide API, upon which Orion manufactures the formulations and sells to Bayer at COGS; in exchange, Fermion/Orion receive a combination of royalties and milestone payments. The average annual royalty rate is currently above 20% including product sales to Bayer. As global sales increase, annual royalty rates will increase. If annual sales for darolutamide hits EUR 3 billion, Orion’s royalty rate will increase above 25%.

Efficacy of Darolutamide Versus Peer Drugs

Studies have shown that darolutamide offers certain advantages over other prostate cancer treatments, particularly in terms of efficacy and safety.

Minimal Blood-Brain Barrier Penetration: Its low penetration of the blood-brain barrier reduces central nervous system-related adverse events such as seizures, fatigue, dizziness, and mental impairment, making it better tolerated compared to other androgen receptor inhibitors.

Efficacy in Prolonging Metastasis-Free Survival: Clinical trials such as ARAMIS demonstrated that darolutamide significantly prolongs metastasis-free survival in men with nonmetastatic castration-resistant prostate cancer, with a median metastasis-free survival of 40.4 months compared to 18.4 months with placebo.

Overall Survival Benefit: Darolutamide significantly reduces the risk of death by approximately 31% compared to placebo.

Favorable Safety Profile: Darolutamide is associated with a low incidence of adverse events, with rates similar to placebo for many side effects including fatigue, falls, fractures, seizures, cognitive disorders, and hypertension.

Better Tolerability: Indirect comparisons suggest darolutamide has a more favorable tolerability profile than apalutamide and enzalutamide, with fewer treatment-emergent adverse events like falls, fractures, rash, fatigue, and mental impairment.

Upcoming Clinical Trials

Orion is conducting two significant clinical trials for darolutamide:

ARASTEP (phase III, PSMA-positive biochemical recurrence): Evaluates darolutamide + ADT in men whose PSA is rising after local therapy but before overt metastasis. Success could shift Nubeqa into the early-recurrence setting and extend therapy duration per patient.

DASL-HiCaP (phase III, adjuvant high-risk localized PCa): Tests darolutamide as part of adjuvant ADT after surgery or radiotherapy in very-high-risk local disease. A positive read-out would move the drug even earlier in the treatment cascade, opening an entirely new adjuvant market.

Specialty Chemicals

Acutaas began to strategically diversify beyond advanced pharma intermediates in 2021, when it acquired two manufacturing sites (Ankleshwar and Jhagadia) from Gujarat Organics. In 2023, company acquired a 51% stake in Baba Fine Chemicals entering the niche of high-purity semiconductor chemicals. Company also has forayed into electrolyte additives where it will initially start with manufacturing Vinylene Carbonate and Fluoroethylene Carbonate.

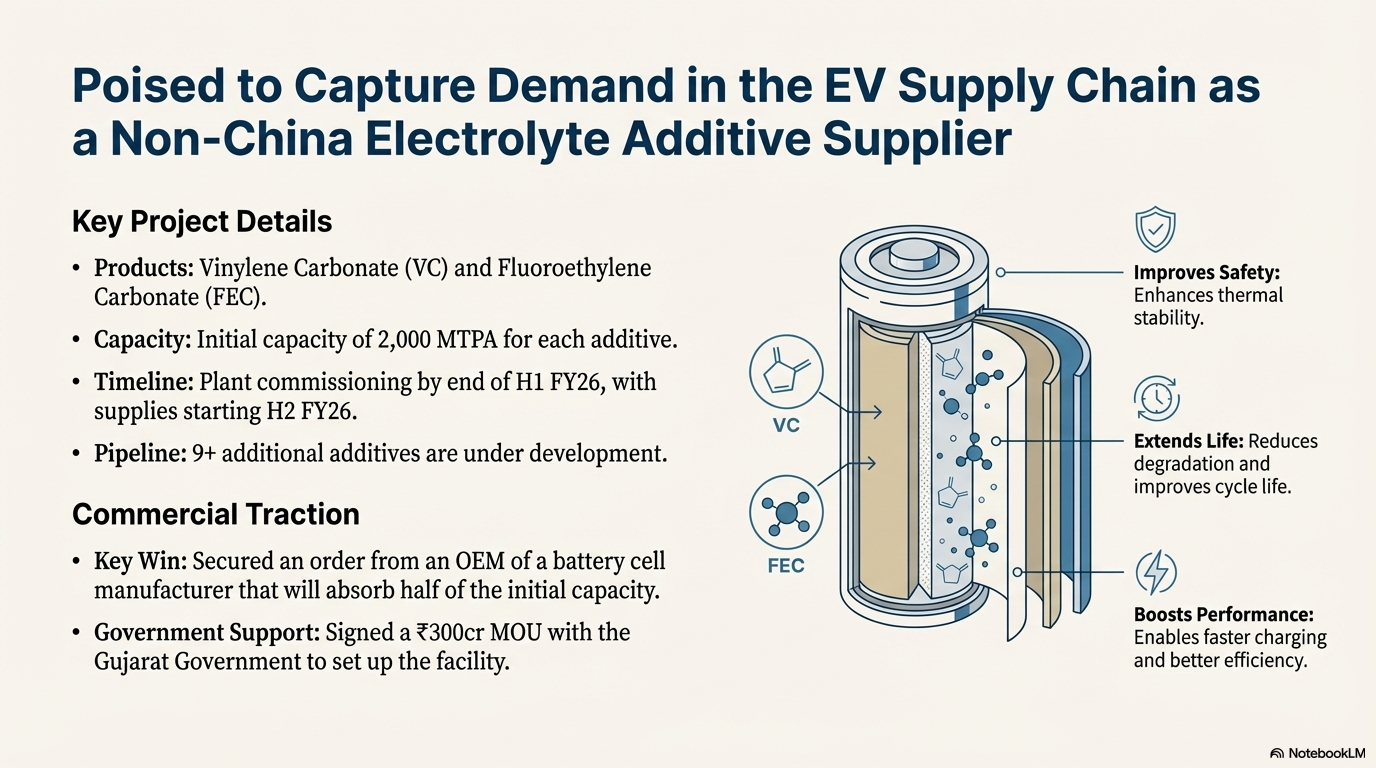

Electrolyte Additives Business

Acutaas has forayed into battery chemicals by setting up production capacities for electrolyte additives under a wholly owned subsidiary named Ami Organics Electronics Private Limited. Company will have 2000 KTPA capacity each for Vinylene Carbonate and Fluoroethylene Carbonate and expects commissioning of plant by end of H1 FY26 and supplies starting from H2 of FY26. Acutaas has obtained an order from an OEM of a battery cell manufacturer which will take half of the capacity. These additives are used in small doses within Li-ion battery electrolyte formulations to improve cell life, safety, and performance.

Acutaas will be the first global manufacturer outside China to develop electrolyte additives for lithium-ion batteries. Initial capacity is 2,000 MT each and a pipeline of 9+ additives is under development. Company has also signed an MOU with the Gujarat Government for about Rs 300 crore investment to set up an electrolytes facility.

Gujarat Organics Business

Acutaas acquired 2 sites at Ankleshwar and Jhagadia from Gujarat Organics in 2021. Under this business Acutaas manufactures and supplies specialty chemicals and preservatives including paraben and paraben formulations, methyl salicylate and range of other specialty chemicals used in personal care, pharmaceuticals and agrochemical industries. However, this line of business is largely commoditized with modest margins. Rationale for this acquisition per management was to bag the manufacturing sites. Company does not have any major capex plans in this business and the unutilized land has been converted into a pharma CDMO unit.

Semiconductor Chemicals via Baba Fine Chemicals

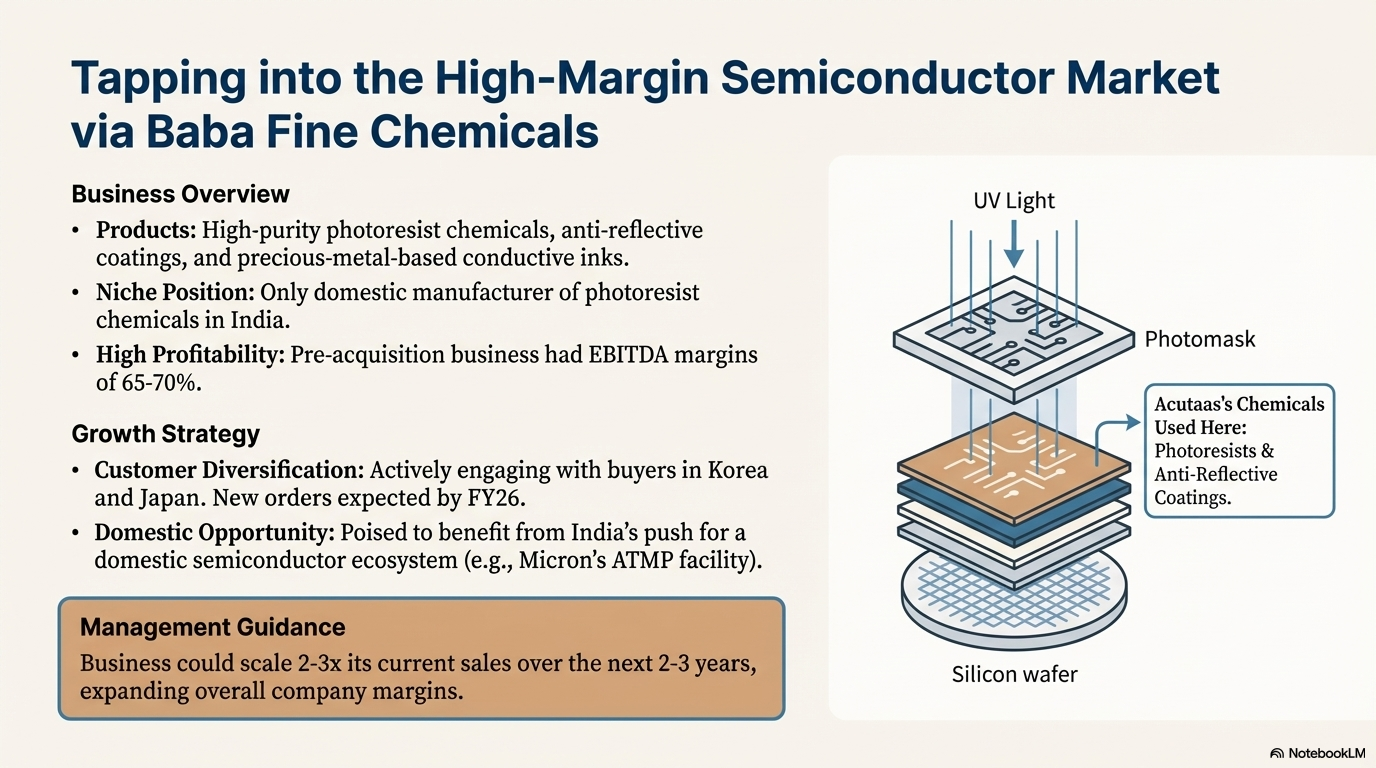

This segment includes high-purity semiconductor chemicals via the Baba Fine Chemicals unit. Acutaas is the only manufacturer in India producing photoresist chemicals domestically. These chemicals are used in semiconductor fabrication in materials for photolithography such as photoresists, anti-reflective coatings, and photo acid generators, as well as precious-metal-based conductive inks (silver, copper, gold, platinum inks) for chip and PCB manufacturing.

Company acquired a majority stake in Baba Fine Chemicals in 2023. BFC was founded by three scientists in 2002. Before the acquisition by Acutaas, BFC was focused only on 1 single customer - Heraeus Epurio, a German company with operations worldwide. Volumes supplied had been very small and so business was very small at time of acquisition with revenues at Rs 40 crore in FY23 with EBITDA margins of 65-70%. Post acquisition, BFC revenues declined in FY24 and FY25 due to supply disruptions with demand weakness in semiconductor industry. Acutaas is actively in discussions with prominent semiconductor materials buyers in Korea and Japan and expects new orders to materialize by FY26 from these engagements, alongside a potential rebound from the original customer as the chip cycle improves.

India’s push to establish a domestic semiconductor ecosystem (new ATMP/OSAT facilities by Micron, government incentives for chip fabs) could create local demand for photoresist and ancillary chemicals in the coming years. Management guides that the semiconductor chemicals business could scale 2-3x its current sales over the next 2-3 years. It is a higher margin business, so margins for the company will expand as this line of business expands.

Manufacturing Facilities

Acutaas operates four manufacturing units in India, each supporting different segments of its business.

Unit I - Sachin (Surat, Gujarat): The flagship plant for advanced pharmaceutical intermediates. This facility has an installed reactor capacity of ~144 KL (with 13 production lines and 40 reactors) and is fully cGMP-compliant. Unit I also houses the main R&D center for the company, and it currently operates at around 70-80% capacity utilization.

Unit II - Ankleshwar (Gujarat): Inaugurated in December 2023. The company had acquired an older Ankleshwar facility in 2021 as part of the Gujarat Organics acquisition, but that aging unit was demolished and replaced with this state-of-the-art brownfield plant. The new Ankleshwar unit is spread over ~10,375 sq m and is equipped with ~90 reactors (~436-442 KL total capacity) along with modern automation (DCS and powder transfer systems). It is designed to cater pharma intermediates and CDMO contracts.

Unit III - Jhagadia (Gujarat): Focused on specialty chemicals production. This facility (acquired from Gujarat Organics in 2021) is much larger in land area (~56,998 sq m) with an installed capacity of about 512 KL. It manufactures products like preservatives and personal care specialty chemicals such as parabens, methyl salicylate and other specialty chemicals. This unit currently runs at roughly 60% utilization and a new electrolyte additives plant is under construction here as a brownfield expansion. Company has ample land here for further brownfield expansion.

Unit IV - Greater Noida (Uttar Pradesh): A small-scale facility operated via Acutaas’s subsidiary Baba Fine Chemicals (BFC) with installed capacity of ~1.8 KL of glass-lined reactor capacity geared towards semiconductor chemicals.

| Facility | Location | Capacity | Utilization | Focus |

|---|---|---|---|---|

| Unit I | Sachin, Surat | 144 KL | 70-80% | Pharma Intermediates, R&D |

| Unit II | Ankleshwar | 436-442 KL | Ramping up | CDMO, Pharma Intermediates |

| Unit III | Jhagadia | 512 KL | 60% | Specialty Chemicals, Electrolyte Additives |

| Unit IV | Greater Noida | 1.8 KL | Low | Semiconductor Chemicals |

Key Growth Triggers

CDMO Ramp-up

Management targets Rs 1000 crore revenues from CDMO by FY28 as it ramps up production of intermediates for darolutamide. Company has a strong pipeline of molecules with many molecules in verification phase, which can be optionality.

Patent Expiry Wins

Several core pharmaceutical intermediates are expected to see volume uptick as major drug patents expire in 2025-2026, driving higher demand from generic manufacturers.

Ramp up of Specialty Chemicals

Semiconductor chemicals which are currently going through a down cycle - as demand comes back along with the company’s initiatives to expand customer base to Taiwan, Korea, Japan, can bring new orders as customer qualifications conclude. Battery electrolyte additives are a new growth driver. A dedicated plant (Jhagadia) will be operational by H2 FY26 to start contributing to revenues. Company is positioned as a non-China supplier for electrolyte additives. As specialty chemicals segment scales up, margins will expand owing to better mix.

Capacity and Efficiency

Major capacity expansion at Ankleshwar (4x reactor increase) completed, ensuring ample headroom for growth. A new pilot plant is being set up to accelerate scale-up of high-potency chemicals and CRAMS projects, enabling faster commercialization of new products. In-house solar power (10.8 MW commissioned) will reduce operating costs and support margin improvement as volumes grow.

Key Risks

Semiconductor Demand Slump

Prolonged weakness in legacy semiconductor markets could delay the recovery and scale-up of Acutaas’s photoresist chemicals business (Baba Fine Chemicals), keeping the specialty segment growth muted.

Regulatory Compliance

As a chemicals supplier to regulated pharma markets, any lapse in GMP quality standards or environmental/pollution norms could lead to production halts or export restrictions. The business environment is highly regulated, and non-compliance can severely disrupt operations.

Tariffs if Levied by the US on Pharma Imports

The US government has launched an investigation into pharma imports, which will likely culminate in tariffs within the next 6-12 months. This could impact demand for some of Acutaas’s customers, particularly those supplying generics to the US. It could also impact margins, as it may not be possible to fully pass on heavy tariffs to end-consumers.

Inability to Secure Customer Approvals for New Products

Regulatory approval processes can be lengthy and uncertain, potentially delaying revenue recognition from new product launches.

Seasonality and Lumpiness in Business

CDMO businesses are generally lumpy and cyclical in nature. For Acutaas H1 accounts for 40% of the topline and H2 with 60%. The nature of business is such where nothing happens for decades while months where decades happens. Company has been supplying intermediates to Fermion since 2010. Building relationships is a moat in this business. However if company fails to win new orders, sales might get impacted.

Nubeqa’s Growth Slowing Down

Any deceleration in Nubeqa’s market penetration or competitive pressure from other ARIs could impact Acutaas’s key CDMO revenues from darolutamide intermediates.

Further Reading

Explore more deep dives on Finance Pulse: