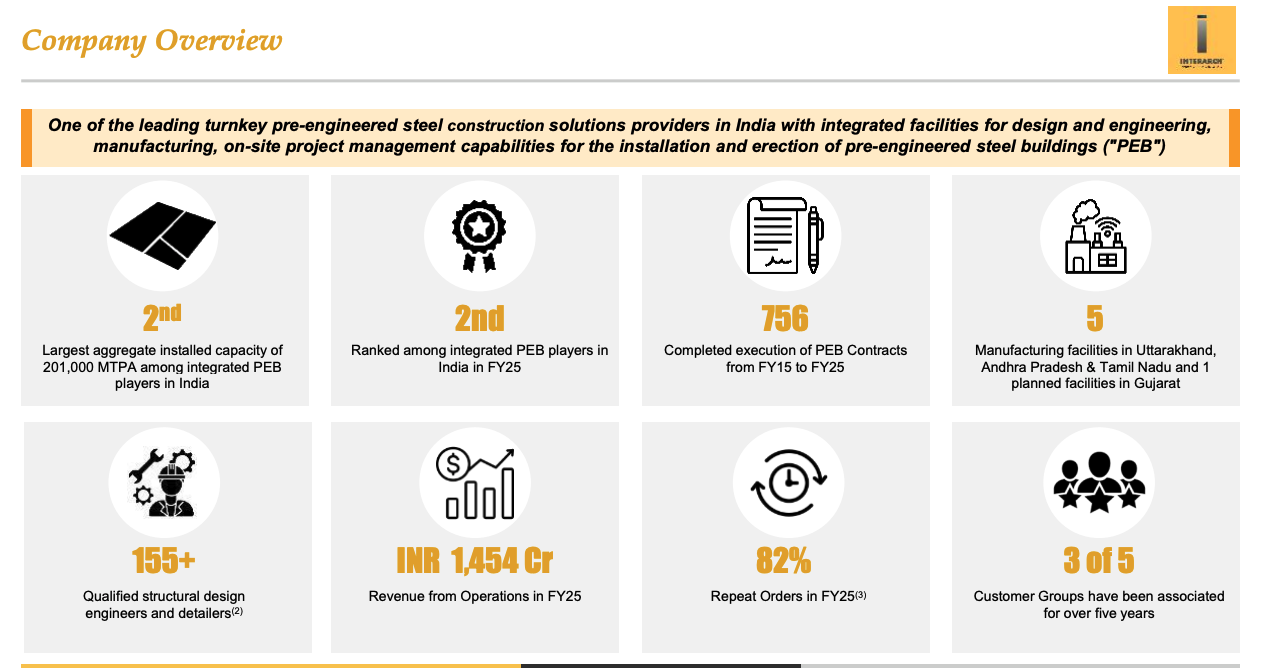

Interarch Building Solutions is the second largest pre-engineered building (PEB) company in India. Founded in 1983, the company designs, manufactures, and installs steel structures for factories, warehouses, and infrastructure projects. Current installed capacity stands at 161,000 metric tons per annum across five manufacturing facilities in Uttarakhand, Tamil Nadu, and Andhra Pradesh.

The company holds roughly 7% of India’s PEB market, which is worth approximately ₹200 billion annually.

What Interarch Does

Pre-engineered steel buildings (PEB) are structures constructed using fabricated steel components. These buildings are designed and manufactured off-site and then assembled on-site. This method reduces construction time, minimizes waste, and ensures consistent quality, making it an attractive option for industries such as manufacturing, logistics, retail, aviation and warehousing. Everything from design, engineering, production, making the items, delivering it to site and erecting it at site will be all done in one lump sum price.

Interarch operates as a turnkey solutions provider. The process starts with understanding customer requirements through technical sales, moves to in-house design and engineering, then to manufacturing at their facilities, and finally to on-site installation. The company employs over 125 structural design engineers and detailers.

Key components of pre-engineered buildings

Main frame or primary structure: This frame is the main load-carrying and support structure of a pre-engineered building made of rigid steel frames. The primary structure consists of columns, rafters, and other supporting structures. The shape and size of these structures differ based on their application and requirements. The frame is constructed by bolting the end plates of connecting sections together.

Secondary structure: It consists of purlins, grita, and eave struts used to support the wall and roof panels. Purlins are employed on the roof, grits on walls, and eave struts at the intersection of the sidewall and roof.

Roof, wall panels, and insulation: These components are used for sheeting and generally made of ribbed steel sheets. They are used as roof and wall sheeting, roof and wall liners, partition, and soft sheeting. Steel sheets are generally produced from steel coils.

Benefits of PEB

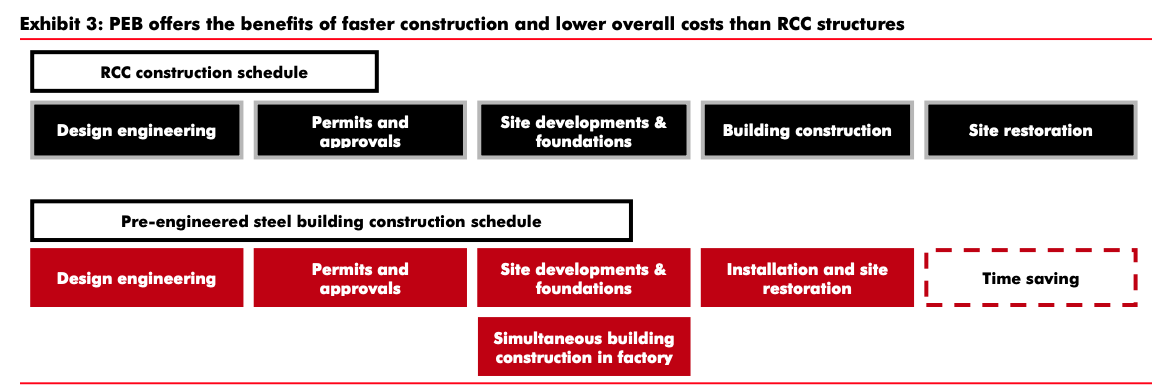

Faster construction: As pre-engineered construction involves components being manufactured at the factory first, it allows for the simultaneous preparation of the foundation at the construction site. This helps accelerate project timelines and decreases overhead site costs, including labour costs. Additionally, as these structures are manufactured at the factory, they also prevent project delays caused by external factors, such as adverse weather.

Flexible offerings: PEBs offer design flexibility and quick installation, making it suitable for a wide range of applications, including industrial buildings and warehouses.

Cost-effective: PEBs are cost-effective due to their reduced construction time (~50% lower) and lower labour costs. Overall cost savings could be 20-40%, apart from the opportunity cost saved in starting the plant early.

Sustainable: PEBs are also sustainable, given steel can be recycled. Further, in- house manufacturing process minimises waste. Further, these require low maintenance as they are resistant to pests, rot, and other issues.

Manufacturing Process

The pre-engineered building construction plan is structured into three primary phases - design, fabrication, and installation. The initial design phase encompasses critical tasks such as site preparation, finalising the design specifications, and obtaining the requisite approvals. The design phase is the first phase of overall PEB construction and is extremely critical to the overall outcome of the PEB building. It is followed by the fabrication phase, which focuses on manufacturing of pre-engineered structures as well as construction of substructures that not only enhance cost efficiency but also accelerate project timelines significantly. Hence, this simultaneous approach contributes to substantial savings in terms of both time and resources.

Finally, the concluding phase of pre-engineered building construction involves the transport of individual building components to the designated construction site, where the final structure is installed with precision.

Manufacturing Footprint

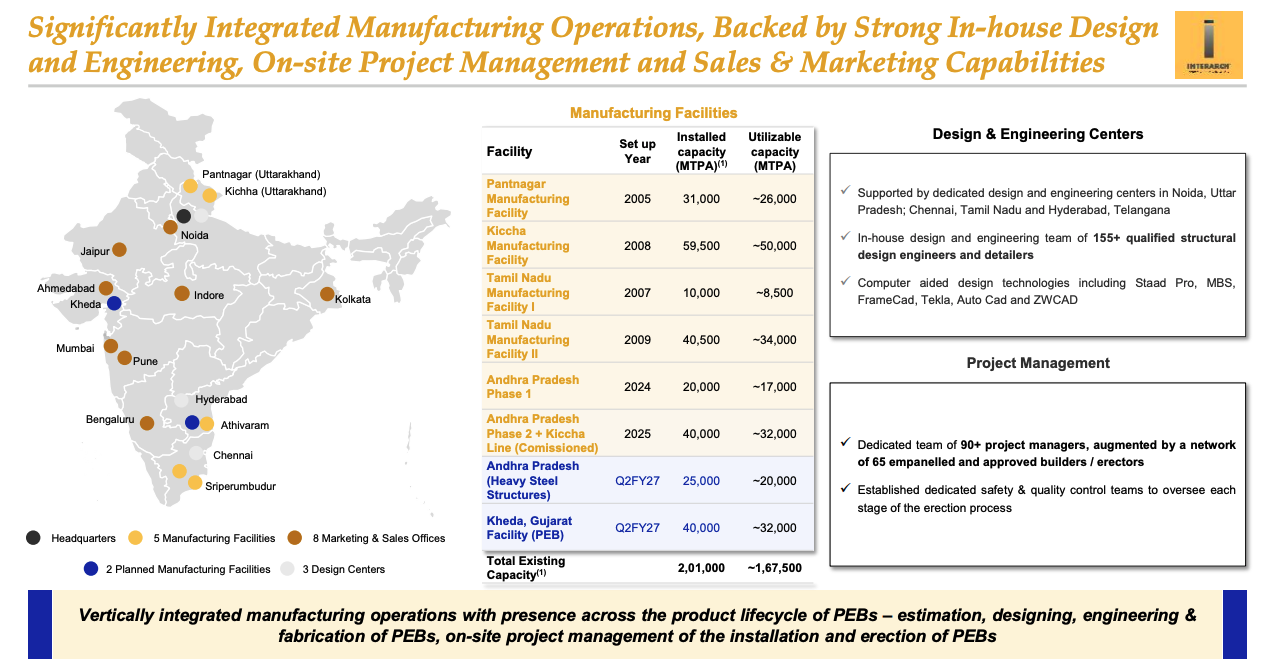

Interarch operates five facilities:

- The Kichha plant in Uttarakhand is the largest at 59,500 MTPA. It produces complete PEB steel structures, primary and secondary framing systems, metal ceilings, corrugated roofing, and light gauge framing systems.

- The Pantnagar facility, also in Uttarakhand, has capacity of 31,000 MTPA for PEB steel structures.

- Tamil Nadu hosts two facilities in Sriperumbudur. One produces metal ceilings and corrugated roofing at 10,000 MTPA. The other manufactures PEB steel structures at 40,500 MTPA.

- The newest facility at Attivaram in Andhra Pradesh has 20,000 MTPA capacity, commissioned in 2024.

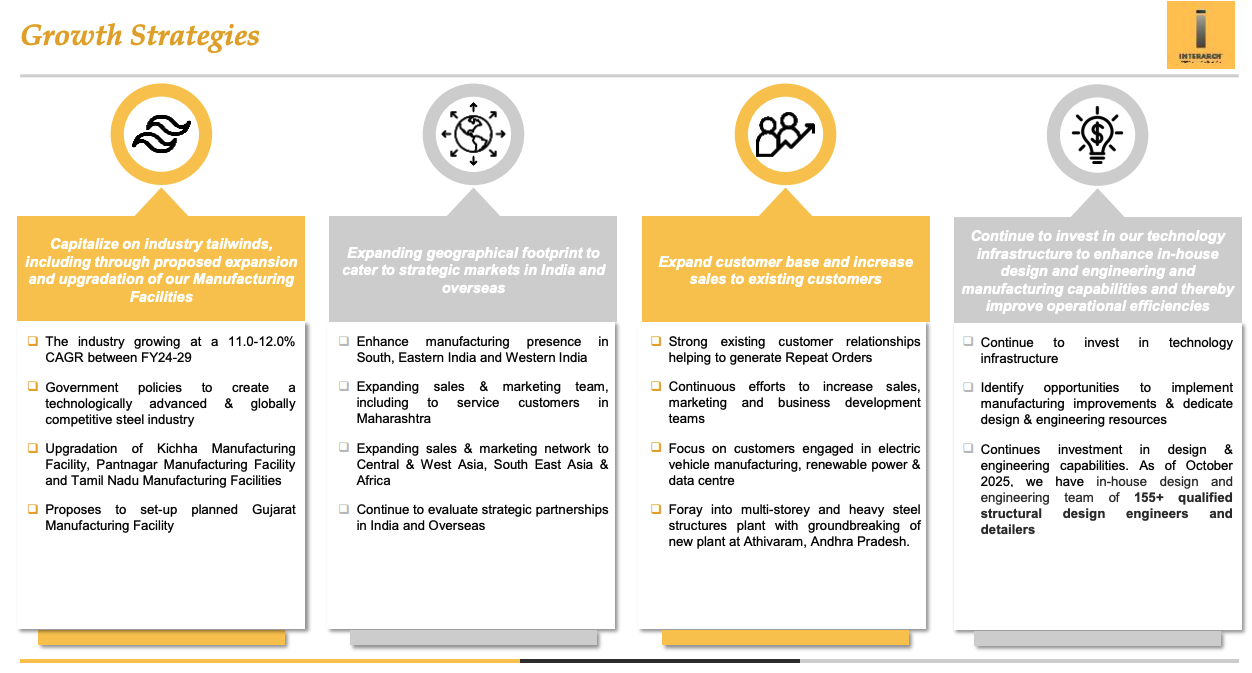

Total installed capacity reached 161,000 MTPA by FY25-end. The company plans to expand to over 200,000 MTPA by the first quarter of FY26, adding 40,000 MTPA through brownfield expansion at existing locations. Further expansion is planned for Andhra Pradesh and a new greenfield facility in Gujarat.

Recent Project Wins

The company has won several large orders in emerging sectors. In semiconductors and battery manufacturing, Interarch received two projects worth ₹2.2 billion from Tata Projects. One is for Tata’s semiconductor manufacturing facility in Jagiroad, Assam. The other is for a lithium-ion battery manufacturing unit in Sanand, Gujarat for Agratas Energy Storage Solutions.

In renewable energy, the company secured a project for India’s largest solar photovoltaic module manufacturing unit from Tata Projects for First Solar Power India. Other wins include a greenfield turbine blades manufacturing unit for LM Wind Power Blades in Gujarat and a solar cells and modules manufacturing unit for Renew Photovoltaics. In warehousing and logistics, clients include Indospace, ESR, Logos India, Amazon, Flipkart, Mahindra Logistics, and Concor.

Industry Structure

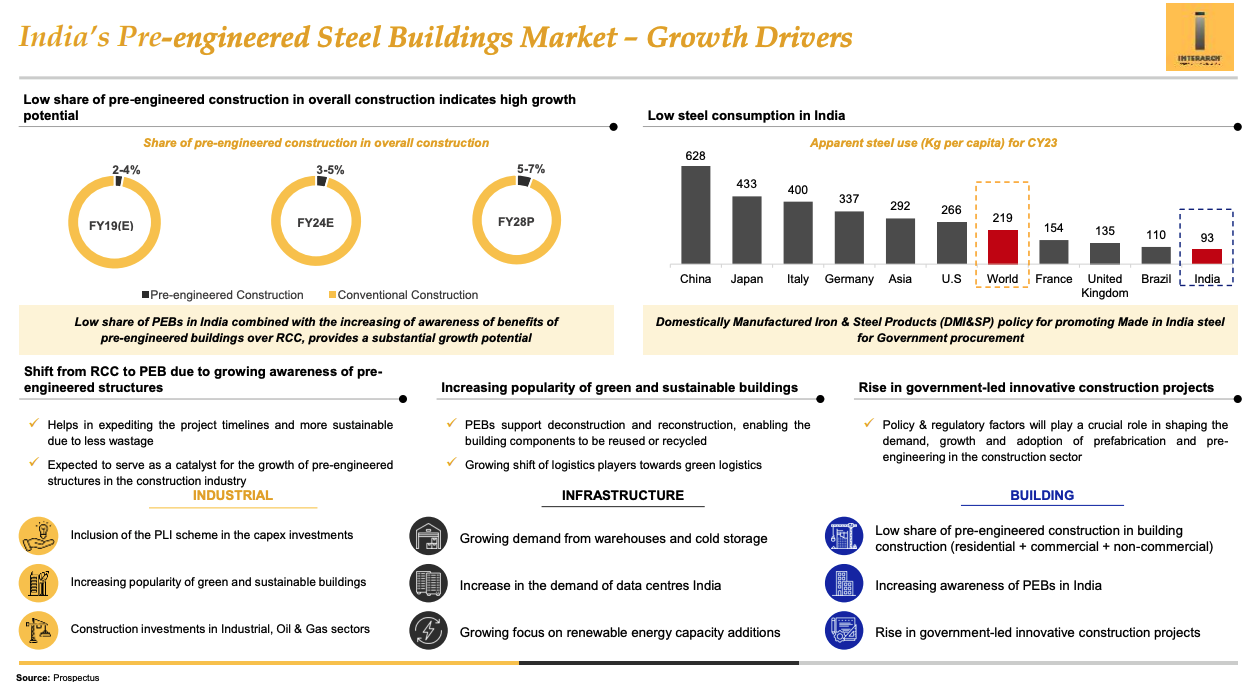

The Indian PEB industry remains fragmented. Organized players control 40-45% of the market. Unorganized players, enabled by low capital intensity and low technical barriers, hold 55-60%.

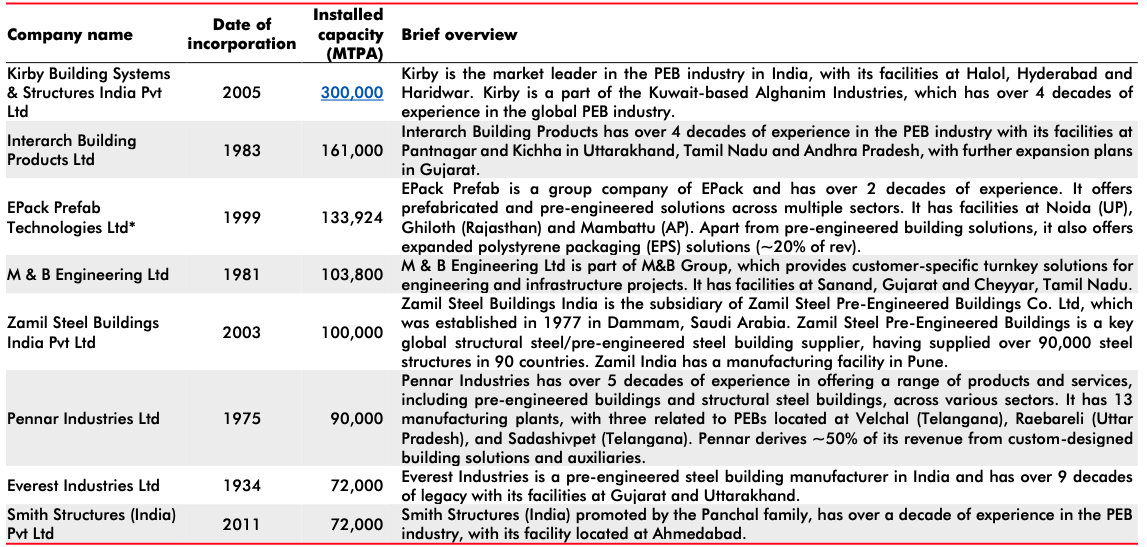

Within the organized segment, the top seven players command 80-85% share. These include Kirby Building Systems (market leader at 300,000 MTPA capacity), Interarch (second at 161,000 MTPA), EPack Prefab (134,000 MTPA), M&B Engineering (104,000 MTPA), Zamil Steel (100,000 MTPA), Pennar Industries (90,000 MTPA), and Everest Industries (72,000 MTPA).

Kirby is part of Kuwait-based Alghanim Industries. Zamil Steel is a subsidiary of Saudi Arabia-based Zamil Pre-Engineered Buildings. The rest are Indian companies. Organized players have been gaining share from unorganized players. In FY18, organized players held 32% of the market. By FY24, this rose to 44%. Better execution track record, quality engineering services, and reliability drive this shift. Large industrial clients prefer established players who can deliver complex projects on time.

Growth Triggers

1. Private Sector Capex Cycle Remains Strong

Industry capacity utilization in India stands above 75%, higher than the long-term average of 73.4%. When utilization crosses 75%, companies typically announce expansion plans. The RBI data shows utilization has been trending upward since the Covid lows.

The MoSPI private sector capex survey covering 588 enterprises projects manufacturing capex to increase further in FY26. Manufacturing capex grew from approximately ₹1.4 trillion in FY22 to over ₹2 trillion in FY25. FY26 projections show continued growth. Every new factory, every capacity expansion, every greenfield project needs a building. PEB is the preferred choice for industrial buildings given 40-50% faster construction and 20-40% lower overall costs.

2. Warehousing Expansion at the Top End

India’s warehousing stock is expected to grow from approximately 1 billion square feet in CY24 to 1.3 billion square feet by CY27. That’s an 8% CAGR for the overall market.

The more relevant number is Grade A warehousing growth at 17% CAGR over the same period. Grade A stock was 248 million square feet in CY24 and is projected to reach 398 million square feet by CY27. Grade A warehouses are built by organized developers like Indospace, ESR, Logos India, and Mahindra Logistics. These developers work exclusively with top-tier PEB suppliers who can deliver quality structures on schedule.

Interarch counts all the major warehousing players among its clients: Indospace, ESR, Logos India, Amazon, Flipkart, Mahindra Logistics, Ascendas FirstSpace, Concor, and Seabird Marine. The e-commerce and third-party logistics expansion continues to drive demand. Amazon and Flipkart alone are adding millions of square feet annually.

3. Renewable Energy Manufacturing Buildout

India’s push for domestic solar module manufacturing has created a wave of factory construction. The Production Linked Incentive scheme for solar modules has attracted investments from Tata Power Solar, First Solar, Reliance, Adani, Waaree, and others.

Interarch has already captured significant orders here. The company won the project for India’s largest solar photovoltaic module manufacturing unit from Tata Projects for First Solar Power India. Other wins include a greenfield turbine blades manufacturing unit for LM Wind Power Blades in Gujarat and a solar cells and modules manufacturing unit for Renew Photovoltaics.

The client list in renewable energy includes Avaada, Ampin, Reliance New Energy, Tata Power Solar, ReNew Power, Siemens Gamesa, Voith, First Solar, Exide, Amara Raja, GMR, LM Wind Power, Abellon CleanEnergy, Flovel, Green Global Solutions, and Emmvee.

Solar module manufacturing capacity in India is expected to expand from approximately 20 GW in 2023 to over 100 GW by 2030. Each GW of module manufacturing capacity requires factory space. Wind turbine blade manufacturing is similarly expanding as India targets 140 GW of wind capacity by 2030. Battery cell manufacturing is the next wave. The ACC PLI scheme has allocated ₹181 billion for domestic battery manufacturing. Reliance, Ola Electric, Rajesh Exports, and others have announced plans totaling over 100 GWh of capacity.

4. Semiconductor and Electronics Manufacturing

India’s semiconductor mission has triggered factory construction across the country. Interarch has won two projects worth ₹2.2 billion from Tata Projects in this space.

The first is for Tata Electronics’ semiconductor fabrication facility in Jagiroad, Assam. This is India’s first commercial semiconductor fab, a joint venture with Taiwan’s Powerchip Semiconductor Manufacturing Corporation. The facility will manufacture chips for automotive, computing, and communications applications. The second is for a lithium-ion battery cell manufacturing unit in Sanand, Gujarat for Agratas Energy Storage Solutions, a Tata Group company. This is a 40 GWh capacity facility.

The semiconductor client list shows Micron and Tata Electronics. Micron is building a ₹22,500 crore assembly and test facility in Gujarat. More fabs are expected as the government has approved proposals from multiple consortiums.

Electronics manufacturing more broadly continues to expand under the PLI schemes for mobile phones, IT hardware, and components. Foxconn, Pegatron, Wistron, and others are building and expanding facilities in India.

5. Data Center Construction Boom

Data center capacity in India is expanding rapidly. Current capacity stands at approximately 900 MW across major cities. This is expected to grow to over 2,000 MW by 2027.

Each MW of data center capacity requires approximately 10,000-12,000 square feet of built-up area. A 50 MW data center needs around 500,000 square feet of building space. The shell and structure for data centers increasingly use PEB given speed of construction and ability to accommodate the high floor loads and ceiling heights these facilities require.

Interarch has supplied PEB solutions for data center buildings, including a project in Navi Mumbai. The company’s experience with complex industrial structures translates well to data center requirements. Major data center operators like NTT, Equinix, STT GDC, CtrlS, Yotta, and Adani are all expanding capacity. Hyperscalers like AWS, Google Cloud, and Microsoft Azure are investing in India regions.

6. Rising PEB Penetration Across Segments

Current PEB penetration in India stands at 14% for industrial/manufacturing applications, 6% for infrastructure, and just 0.5% for buildings. Industry projections show penetration rising to 20% for industrial, 9% for infrastructure, and 1% for buildings by FY29. The penetration increase alone represents significant demand growth even without underlying sector expansion. If the industrial construction market remains flat but penetration rises from 14% to 20%, that’s a 43% increase in PEB demand from industrial alone.

PEB structures cost 20-40% less than RCC when accounting for faster construction time, lower labor costs, and reduced foundation requirements. The opportunity cost of delayed plant startup increasingly matters to manufacturers racing to capture market share. Infrastructure penetration is rising as more warehouses, cold storage facilities, and logistics parks choose PEB. Airport hangars, railway yards, and metro depots are increasingly using PEB.

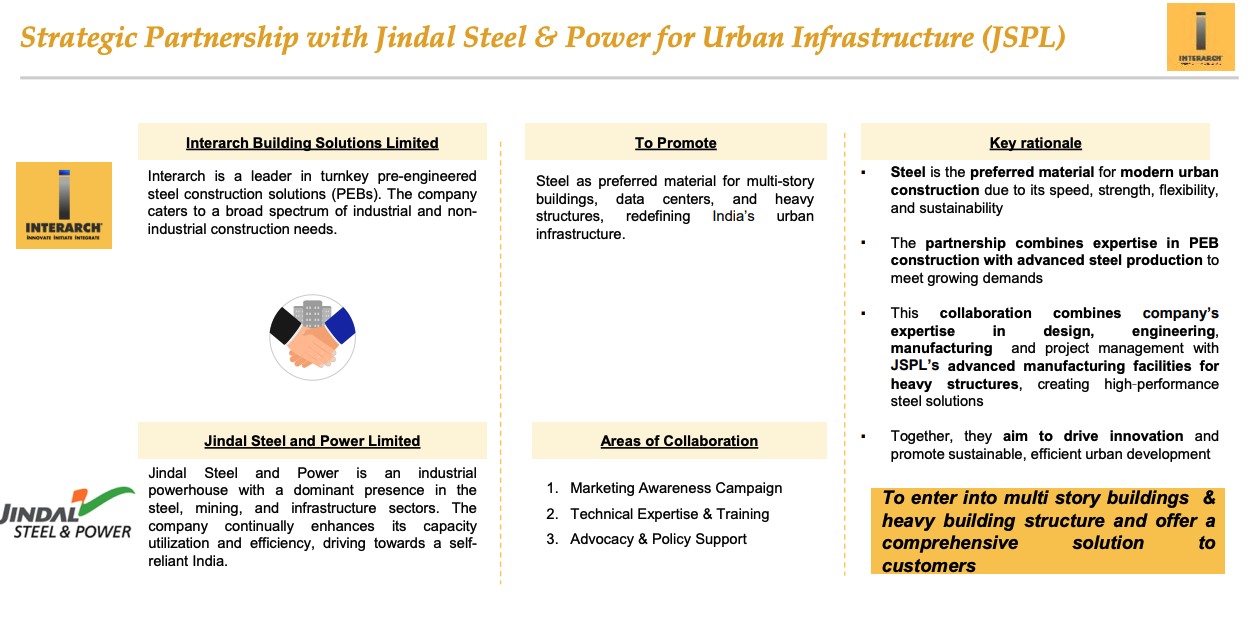

Building segment penetration remains low but is growing from a tiny base. Multi-story commercial buildings, hospitals, and institutional structures are beginning to adopt steel construction. The JSPL partnership positions Interarch to capture this emerging opportunity.

7. Market Share Shift from Unorganized to Organized

The organized segment’s share of the PEB market has grown from 32% in FY18 to 44% in FY24. Unorganized players lost 12 percentage points of market share in six years. This shift accelerates during periods of high demand. When large industrial clients need reliable execution on tight timelines, they choose established players with proven track records. The cost of a delayed factory startup far exceeds any savings from using a cheaper unorganized supplier.

Quality requirements are also tightening. MNC clients demand certifications, quality management systems, and safety standards that unorganized players cannot provide. Insurance and compliance requirements favor organized players. Among organized players, the top seven have maintained 80-85% share consistently. Within this group, market share has been relatively stable, though Interarch and EPack Prefab have grown faster than Pennar and Everest in recent years.

Interarch’s 15% revenue CAGR from FY20-25 compares to 8% for Pennar and 6% for Everest. Faster growth at similar or better margins suggests Interarch is gaining share within the organized segment as well.

8. JSPL Partnership for Heavy Building Structures

Interarch has partnered with Jindal Steel and Power Limited to offer PEB solutions for multi-story buildings and heavy building structures. This expands capabilities beyond the traditional single-story industrial sheds.

Multi-story buildings require heavier steel sections and different engineering expertise. JSPL brings technical knowhow from its structural steel business and access to specialized steel grades. Interarch brings design engineering, fabrication, and project execution capabilities.

Applications include IT parks, commercial complexes, hospitals, educational institutions, and residential towers. A single multi-story project can be worth ₹500 million to ₹1 billion, significantly larger than typical industrial shed orders.

Key Risks

Steel price volatility: The company enters into fixed price contracts and holds inventory of ~2 months of raw material (steel). sharp volatility in prices of raw material can affect the financials of the company.

Slowdown in Capex Cycle: interarch’s order inflow is dependent on the private capex cycle. If there is a slowdown in the capex cycle it will result in a slowdown for the company.

Hiring right talent is the key: company relies on its internal design & engineering team for optimum & efficient designing of its project. Any alteration or loss of this talent may cause the company to lose market share and revenues.

Increased competitive intensity & pricing war: An increase in the competitive intensity by players will lead to a bidding war which will cause prices and in turn revenue and margins to drop. industry has low entry barriers with limited capital requirements which makes the risks to margin for interarch a key risk.

Valuations

| FY25 | FY26E | FY27E | FY28E | |

| sales | 1454 | 1,773.88 | 2,128.66 | 2,511.81 |

| % growth | 22% | 20% | 18% | |

| EBITDA margin | 9.35% | 9.50% | 10.00% | 10.00% |

| EBITDA | 135.949 | 168.52 | 212.87 | 251.18 |

| other income | 21 | 25.00 | 28.00 | 30.00 |

| dep | 12 | 14.5 | 17 | 19 |

| interest | 2.4 | 2.00 | 2.00 | 2.00 |

| PBT | 142.55 | 177.02 | 221.87 | 260.18 |

| tax | 24% | 25% | 25.00% | 25.00% |

| PAT | 108.34 | 132.76 | 166.40 | 195.14 |

| % growth | 22.55% | 25.33% | 17.27% | |

| forward PE | 21.99 | 18.75 |

Further Reading

Explore more deep dives on Finance Pulse: