Business Overview

Jamna Auto Industries makes springs for trucks. It is the largest manufacturer of automotive leaf springs in India. The company ranks among the top three producers globally. It has operated for over 65 years since incorporation in 1965.

The company commands 62 to 65 percent of the commercial vehicle OEM market for leaf springs in India. In the parabolic spring segment, its share reaches 95 percent. This position makes Jamna the default supplier for truck manufacturers.

Jamna operates 10 manufacturing plants across India. These facilities are in Yamunanagar, Malanpur, Chennai, Jamshedpur, Hosur, and Pune. All plants hold ISO certification. The combined annual capacity exceeds 300,000 metric tonnes of springs.

Products and Segments

Jamna produces five main product categories. These are multi-leaf springs, parabolic springs, lift axles, trailer mechanical suspensions, and air suspensions. Each product serves a distinct function in commercial vehicle suspension systems.

Multi-Leaf Springs

Multi-leaf springs are the traditional suspension solution for commercial vehicles. They consist of multiple curved steel plates stacked together. The leaves flex under load to absorb road shocks. This design has served trucks and buses for decades.

These springs suit heavy-duty applications. Mining trucks, tippers, and off-road vehicles use them. The robust design handles rough terrain and extreme loads. Jamna holds 67 percent market share in conventional leaf springs.

Parabolic Springs

Parabolic springs represent the modern evolution of leaf spring technology. The steel thickness tapers from the center toward the ends. This geometry distributes stress evenly across the spring length. The design requires fewer leaves to carry the same load. Parabolic springs weigh 40 percent less than conventional multi-leaf springs. This reduction directly improves fuel efficiency for trucks. It also increases payload capacity. A lighter suspension means more cargo per trip.

Jamna developed this technology through a collaboration with NHK Spring of Japan. The partnership brought advanced manufacturing techniques to India. Jamna now controls 95 percent of the parabolic spring market in the country.

Lift Axles

Lift axles are auxiliary axles that can be raised or lowered. Trucks use them when carrying heavy loads. The axle lowers to distribute weight across more wheels. When the truck runs empty, the axle lifts to reduce tire wear and fuel consumption.

Jamna offers both steerable and non-steerable lift axles. These products improve fuel economy by 3 to 5 percent when running unladen. The reduced tire contact also cuts maintenance costs. Fleet operators see the benefit in total cost of ownership.

Trailer Suspensions

Jamna manufactures mechanical suspensions for trailers. These systems include spring assemblies, hangers, and mounting hardware. The company offers complete suspension solutions rather than individual components.

Trailer air suspensions form a separate product line. These systems use air springs instead of steel. They provide a smoother ride for sensitive cargo. The ride height stays consistent regardless of load. Jamna makes these for mono, twin, and tridem axle configurations.

Air Suspension Systems

Jamna entered the air suspension market through a technology tie-up with Ridewell Corporation of the USA. The partnership provides design and manufacturing expertise for air suspension axles. This product serves the bus and trailer segments.

The company launched air suspension kits for buses in 2025. These kits allow bus operators to upgrade existing vehicles. The aftermarket opportunity extends the addressable market beyond new vehicle sales.

Allied Components

Jamna produces supporting components through its subsidiary Jai Automotive Components. The product range includes U-bolts, center bolts, bushes, hanger brackets, spring pins, and air bellows. These parts complete the suspension system.

A new plant in Pithampur near Indore will manufacture U-bolts and springs. The first phase became operational in April 2025. This facility adds capacity for allied components that accompany the main spring products.

Technology Partnerships

Jamna has built its product portfolio through two key technology partnerships. NHK Spring of Japan provided tapered leaf spring technology. The collaboration transferred manufacturing know-how for parabolic springs. This enabled Jamna to offer weight-saving suspension solutions.

Ridewell Corporation of the USA partnered for air suspension axles. The American company specializes in trailer suspension systems. This tie-up brought air suspension capability to Jamna’s product range. The partnership covers both design and manufacturing.

Customers

Tata Motors and Ashok Leyland are the two largest customers. Together they account for roughly 65 percent of Jamna’s revenue. Both companies are leading truck manufacturers in India. Tata Motors holds 46 percent of the domestic MHCV market. Ashok Leyland holds 31 percent.

The customer list extends to other OEMs. Daimler India, Volvo Eicher, Force Motors, and AMW all source springs from Jamna. The company supplies suspension components across the commercial vehicle industry.

Jamna also serves the replacement market. The aftermarket division offers 800 part numbers. The company recently strengthened distribution in South India. Aftermarket sales provide revenue diversification beyond OEM dependence.

Export markets contribute to the business. Jamna ships to over 15 countries. The company plans to add 40 new export markets within 12 months. International sales reduce reliance on the Indian commercial vehicle cycle.

Industry Context

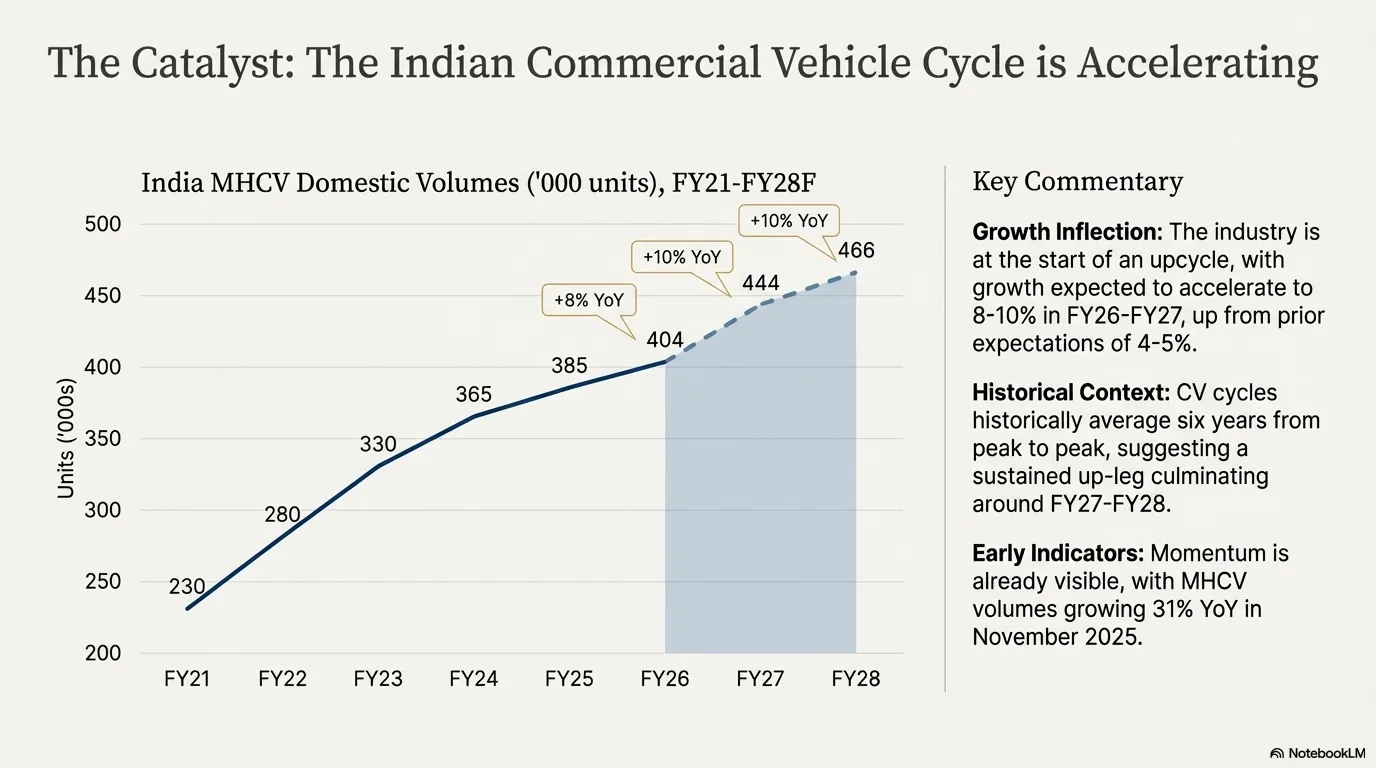

CV Cycle Turning Up

The Indian commercial vehicle industry stands at the early stages of an upcycle. CV cycles from peak to peak have averaged six years historically. The next upcycle is likely to culminate in FY27 to FY28. Initial signs were visible in November 2025 when domestic MHCV volumes grew 31 percent year-on-year. The MHCV industry grew moderately in the past few years. Growth is now expected to accelerate to 8 percent in FY26 and 10 percent in FY27. This compares to earlier expectations of 4 to 5 percent. MHCV volumes are projected at 404,000 units in FY26, 444,000 units in FY27, and 466,000 units in FY28.

Light commercial vehicles show similar momentum. LCV volumes are expected at 646,000 units in FY26, 698,000 units in FY27, and 733,000 units in FY28. The growth rates are 8 percent, 8 percent, and 5 percent respectively. LCV demand picked up well after GST cuts. Exports are also improving.

Structural Drivers

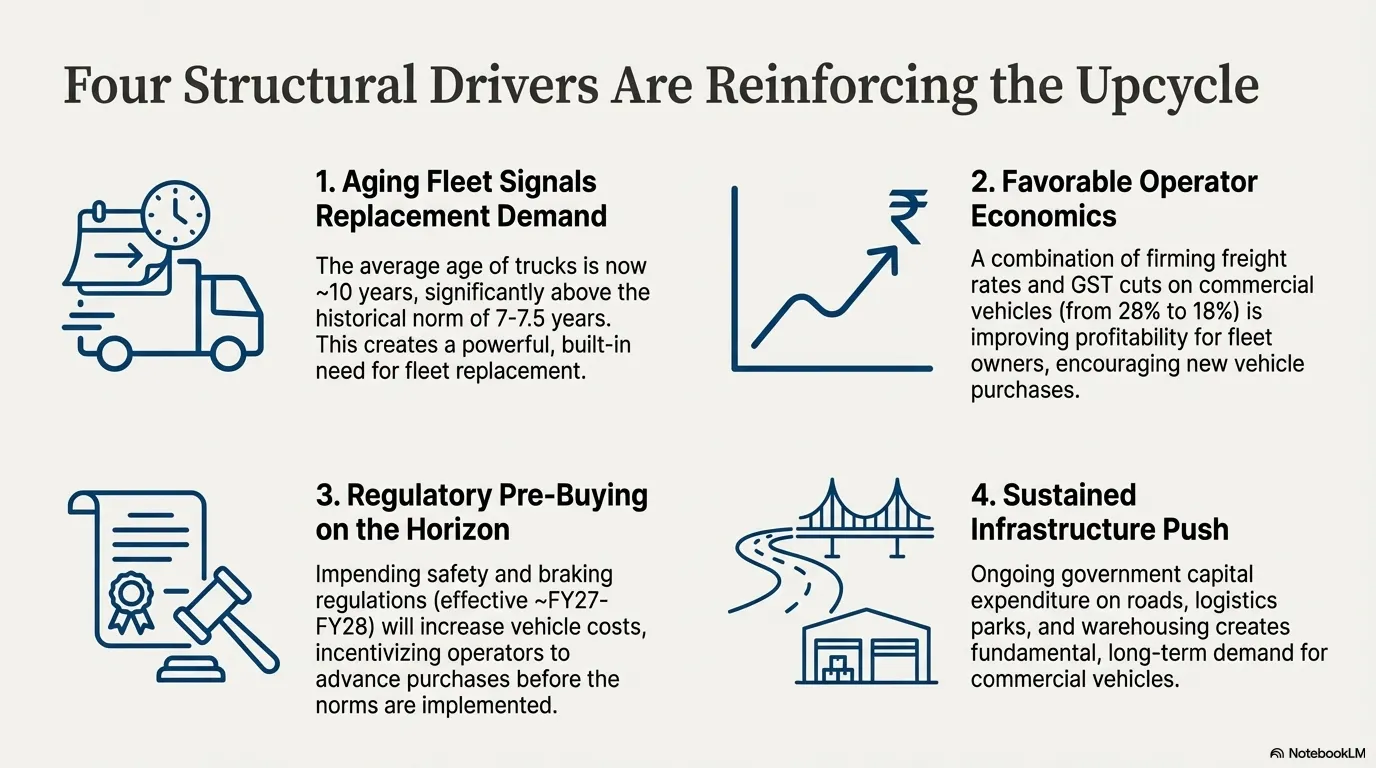

Four structural factors support the upcycle. First, freight rates are firming up. Rising rates improve profitability for fleet operators. Better economics encourage new vehicle purchases and trigger replacement demand.

Second, GST cuts have improved affordability. Lower rates increased operator margins. The September 2025 reform reduced tax on commercial vehicles from 28 to 18 percent. This cut acquisition costs and enabled higher-tonnage truck purchases.

Third, the fleet is aging. The average age of trucks in the system is now close to 10 years. The long-term norm is 7 to 7.5 years. This gap highlights the likelihood of a replacement cycle. Old trucks need to be replaced.

Fourth, regulatory norms will trigger pre-buying. New safety and braking regulations become effective around FY27 to FY28. These norms will increase vehicle costs. Fleet operators will advance purchases to avoid higher prices. This creates a demand surge before implementation.

Tractor-Trailer Mix Shift

Tractor-trailers have gained share in the industry mix. They increased from 9 percent in FY21 to 22 percent in FY25. This shift benefits Jamna’s trailer suspension business. Each tractor-trailer requires suspension systems for both the truck and the trailer.

The Dedicated Freight Corridor is now 96 percent operational across Eastern and Western regions. However, non-bulk cargo at 30 percent of freight continues to rely on road transport. The diversified CV freight base limits the rail impact on truck demand. Tractor-trailers may see some normalization as bulk freight shifts to rail.

Infrastructure Tailwinds

Infrastructure spending supports the outlook. Road construction, logistics parks, and warehousing create demand for trucks. The government’s capital expenditure program continues. These projects need commercial vehicles for execution and subsequent freight movement.

New model launches across powertrains strengthen near-term prospects. OEMs are introducing vehicles that meet upcoming emission and safety norms. Healthier demand indicators across segments point to sustained momentum through FY28.

Competitive Position

Jamna’s dominant market share creates a self-reinforcing position. OEMs prefer a single source for suspension components. This reduces supply chain complexity. Jamna’s 10 plants across India ensure proximity to major truck manufacturing hubs.

The technology partnerships provide product differentiation. NHK Spring’s tapered leaf technology offers weight savings competitors cannot match. The Ridewell tie-up adds air suspension capability. Few Indian players have equivalent technical depth.

Scale economics favor the market leader. Spring manufacturing requires significant capital investment. Jamna’s 300,000 tonne capacity spreads fixed costs. Smaller competitors face higher per-unit costs. The installed base creates a barrier to entry.

Competition comes from Munjal Showa, NHK Automotive Components India, Vikrant Springs, and smaller regional players. None matches Jamna’s scale in the commercial vehicle segment. The competition is fragmented.

Growth Triggers

CV Upcycle Leverage

Jamna’s revenue tracks MHCV volumes closely. The expected 8 to 10 percent volume growth in FY26 and FY27 will flow through to spring demand. With 62 to 65 percent market share, Jamna captures most of the incremental volume. Operating leverage should improve margins as utilization rises.

Parabolic Spring Adoption

Parabolic springs carry higher value than conventional leaf springs. Each conversion from multi-leaf to parabolic increases revenue per vehicle. Fuel efficiency regulations favor lighter components. OEMs are shifting specifications toward parabolic springs.

Jamna controls 95 percent of this segment. Rising adoption directly benefits the company. The 40 percent weight reduction appeals to fleet operators seeking lower operating costs. Payback periods are short given fuel savings.

Trailer Market Growth

The tractor-trailer mix shift from 9 to 22 percent of the industry creates demand for trailer suspensions. Each trailer needs mechanical or air suspension systems. Jamna’s trailer suspension products address this growing segment.

The company launched new trailer mechanical suspensions in 2025. It also introduced air suspension for trailers. These products target the aftermarket and replacement demand. The trailer market could outgrow the truck market.

Export Expansion

Jamna is pursuing European expansion. The company showcased its portfolio at Automechanika Dubai 2025. It plans to add 40 new export markets. International sales provide diversification from domestic cycles.

The aftermarket export segment offers 800 part numbers. These replacement springs serve global truck populations. Export revenue is less volatile than OEM sales. Currency tailwinds can boost margins on foreign sales.

Aftermarket Development

Jamna is building its aftermarket presence. The company strengthened distribution in South India in 2025. It launched new products specifically for replacement demand. The aftermarket offers higher margins than OEM supply.

Allied components like U-bolts and bushes expand the addressable market. The Indore plant adds capacity for these products. Complete suspension kits bundle multiple components per sale.

Risks

Cyclicality

Commercial vehicle sales are cyclical. The peak-to-peak cycle averages six years. While the current position is early in an upcycle, the eventual downturn will affect Jamna. MHCV volumes have historically swung between peaks of 276,000 units in FY07 to 390,000 units in FY19.

Technology Disruption

Electric trucks may change suspension requirements. Battery weight alters load distribution. Air suspensions could gain share from steel springs. Jamna’s product portfolio may need to evolve.

Raw Material Costs

Steel is the primary input. Price volatility affects margins. The ability to pass through cost increases depends on OEM relationships. Long-term contracts may lag spot market movements.

Further Reading

Explore more deep dives on Finance Pulse: