Sansera Engineering makes components that most people never see but every vehicle needs. The company forges and machines critical parts like connecting rods, crankshafts, and rocker arms. These parts translate fuel combustion into wheel motion. Without them, an engine is just an expensive paperweight.

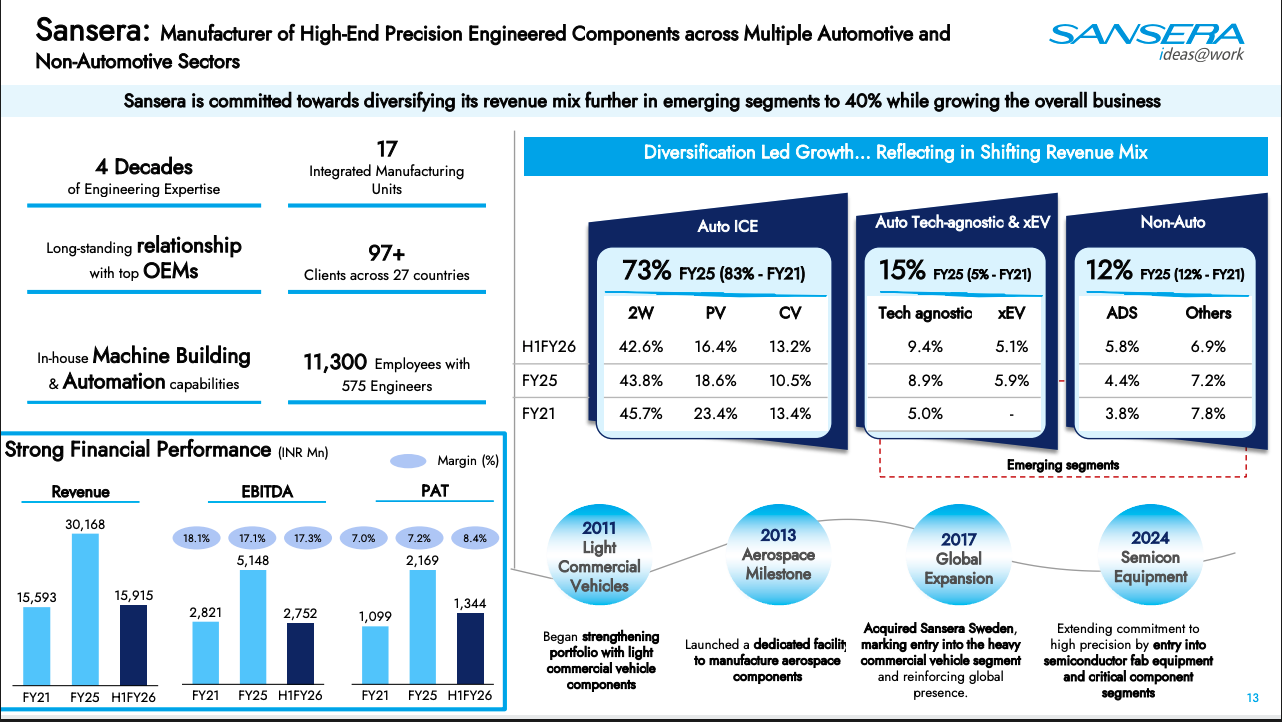

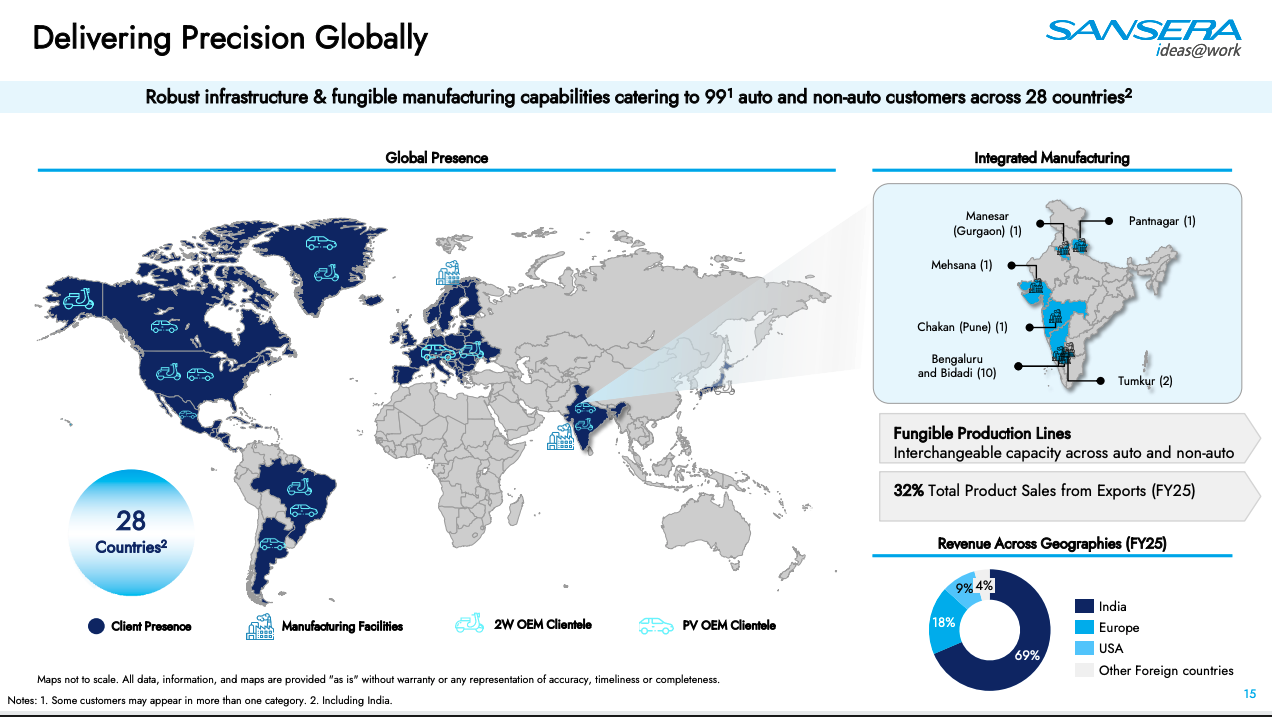

Founded in 1981 in Bangalore, Sansera started with a single order from an Indian auto OEM. Four decades later, it supplies to Bajaj, Honda, TVS, Royal Enfield, Yamaha, Hero, and Maruti Suzuki domestically. It exports to 27 countries. It operates 17 manufacturing facilities across India and one in Sweden.

The company now faces a fundamental question. Its core business depends on internal combustion engines. Electric vehicles need fewer mechanical parts. Sansera’s response has been to diversify into aerospace, defence, semiconductors, and EV components while protecting its profitable ICE franchise.

Business Segments: A Deep Dive

Automotive ICE Business (74% of Revenue)

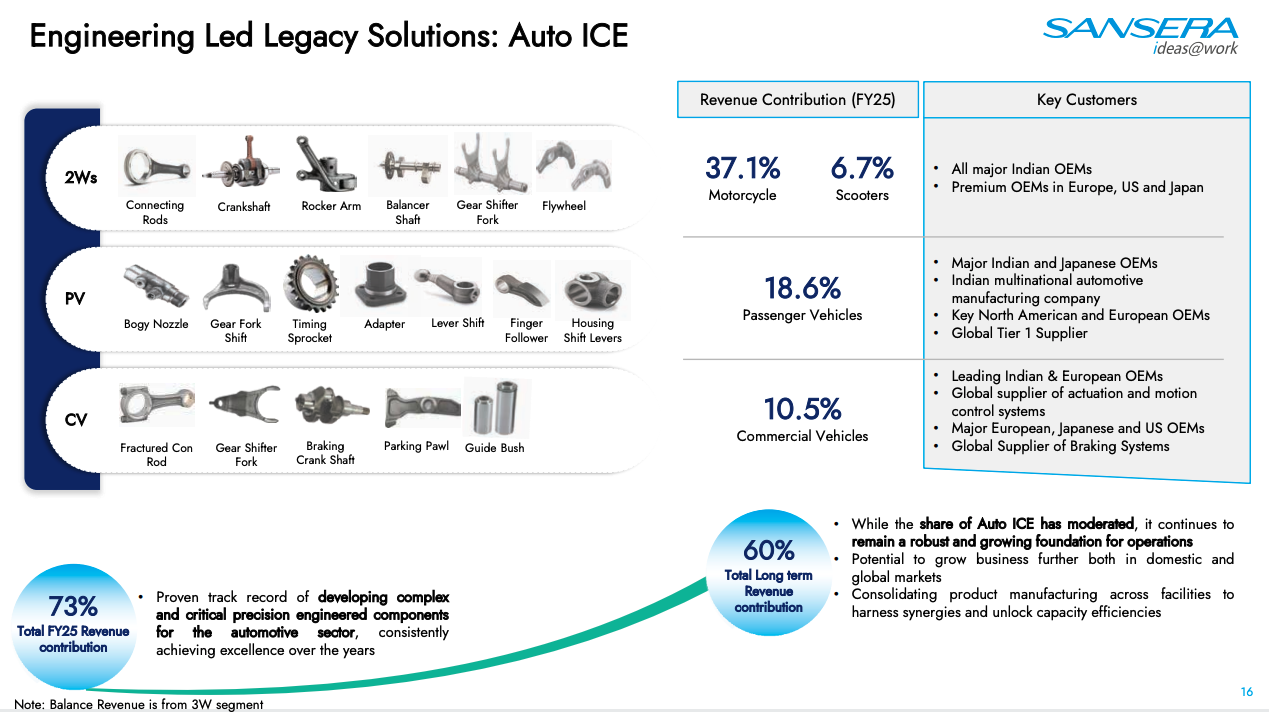

This is Sansera’s bread and butter. The company makes engine and transmission components for vehicles powered by petrol and diesel. The segment breaks down into three sub-categories.

Two-Wheeler Motorcycles (37% of total revenue)

Motorcycles contribute more than a third of Sansera’s revenue. The company supplies connecting rods, crankshafts, and rocker arms to every major Indian two-wheeler manufacturer. Bajaj Auto, Honda, TVS Motor, Royal Enfield, Yamaha, and Hero all buy from Sansera. Some of these partnerships span over 20 years. This stickiness comes from the nature of the product. Engine components require extensive testing and validation before production begins. Once an OEM qualifies a supplier, switching costs are high.

The Indian motorcycle market is the largest in the world. Consumers are buying more expensive motorcycles with larger engines. A 350cc Royal Enfield uses more sophisticated components than a 100cc commuter bike. This premiumisation trend increases the content per vehicle.

For ICE motorcycles, Sansera’s kit value runs around Rs 2,000 per vehicle. For electric motorcycles, this could rise to Rs 10,000 per vehicle. The company can make aluminium forged parts for chassis, suspension, and other structural components that EVs still need.

Two-Wheeler Scooters (7% of total revenue)

Scooters are a smaller but stable segment. Urbanization and last-mile mobility needs drive demand. The market is shifting toward premium models with better features, which suits Sansera’s precision manufacturing capabilities.

The Indian scooter market is transitioning rapidly to electric. Sansera’s participation in EV scooter components remains limited but evolving. The focus remains on high-value drivetrain and precision components for electric two-wheelers in the motorcycle category.

Passenger Vehicles (19% of total revenue)

The PV segment serves both domestic and global OEMs. Products include rocker arms, connecting rods, and shifter forks. Maruti Suzuki is a key customer domestically. Global customers include manufacturers in Europe and North America. FY25 was difficult for this segment. The domestic market slowed. Export markets in Europe and the USA faced their own headwinds. Inventory buildup at customers led to order reductions.

The company sees recovery ahead. New model launches and fresh OEM order wins should support growth. Localisation efforts with global customers are deepening Sansera’s share of business across platforms.

Commercial Vehicles (10% of total revenue)

Sansera serves both medium and heavy commercial vehicles as well as light commercial vehicles. Products span engine parts (connecting rods, brackets, valve bridges), transmission parts (gear shifter forks, intermediate rings), and braking assembly components (crankshafts, guide bushes). The CV industry is cyclical. Domestic and global markets have seen pressure. Sansera has partially offset this through its diversified customer base and increased content per vehicle.

The 2017 acquisition of Mape in Sweden marked Sansera’s entry into heavy commercial vehicles in Europe. Mape specializes in connecting rods for diesel engines used in buses, trucks, boats, and industrial applications like generators and compressors.

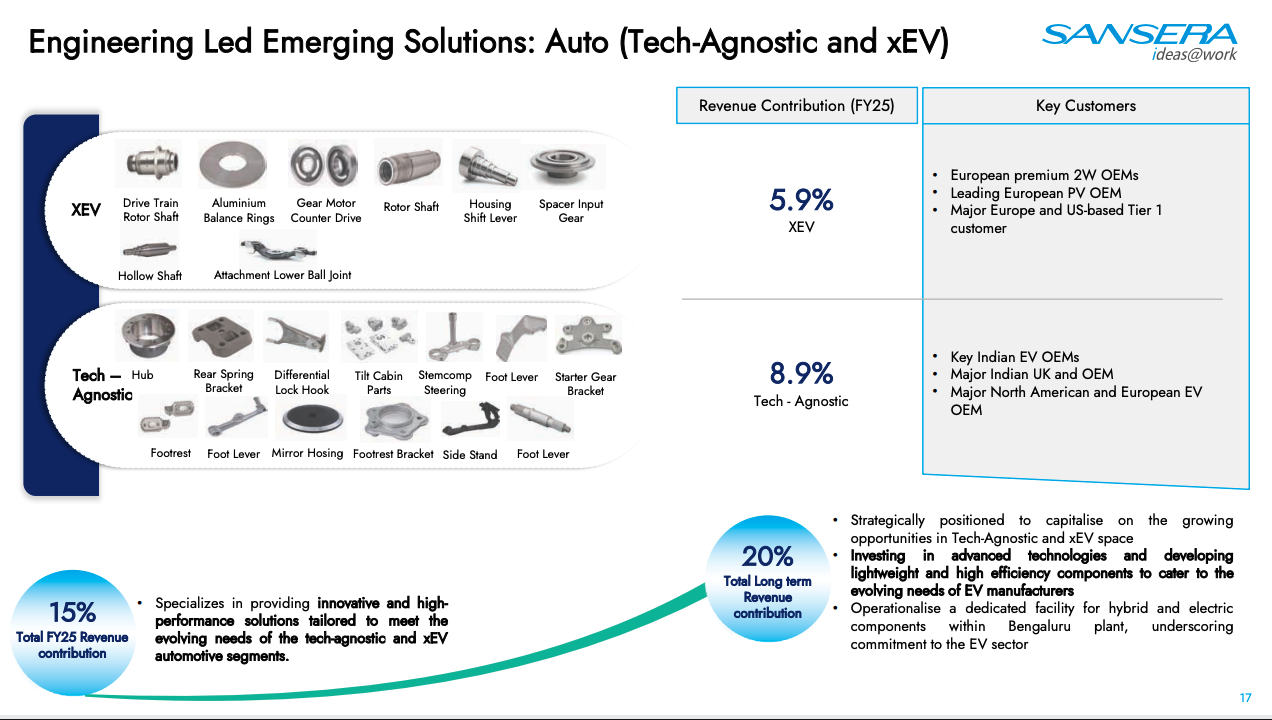

Tech-Agnostic and xEV Business (15% of Revenue)

This is where Sansera is building its future. Tech-agnostic components work across ICE, hybrid, and electric vehicles. Chassis parts, steering components, braking systems, and suspension parts fall into this category. These products do not care what powers the vehicle. The xEV segment focuses specifically on electric and hybrid vehicles. Products include clutch assembly parts for battery EVs, transmission parts for hybrids (pinion differential drives, motor generator shafts, gear components), and drivetrain parts for electric two-wheelers.

Combined revenue from tech-agnostic and xEV grew 30% year-on-year in FY25. The order book for these segments stands at Rs 3.1 bn (17% of total order book) for xEV and Rs 1.5 bn (8% of total order book) for tech-agnostic.

Sansera has expanded its aluminium forging operations to serve this market. Aluminium is lighter than steel. Electric vehicles need lightweighting to maximize range. Global EV manufacturers in the US and Europe are key customers. The company secured orders from a new American xEV OEM that started production in the fourth quarter of FY24. Management targets 20% of revenue from xEV and tech-agnostic segments within three years, up from 15% today.

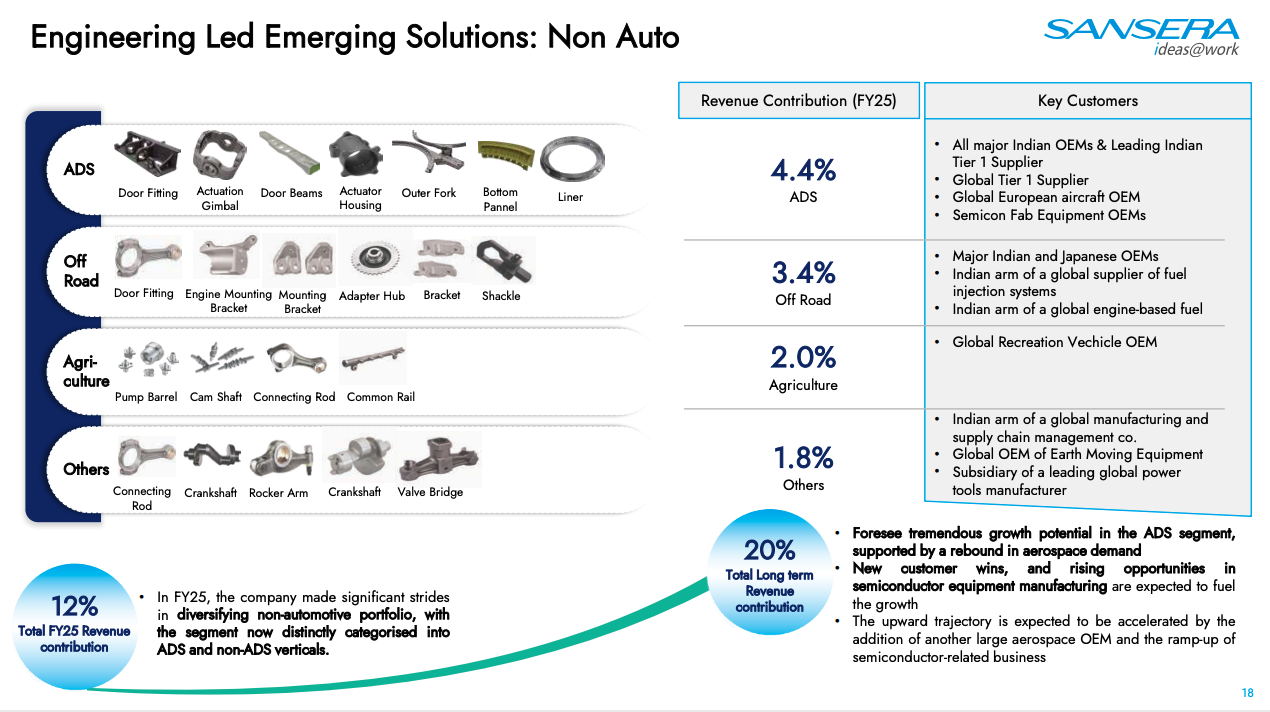

Non-Auto Business (12% of Revenue)

Sansera is building a non automotive business across four verticals.

Aerospace, Defence, and Semiconductor (4.4% of total revenue)

This is the most exciting part of Sansera’s diversification story. The segment has a strong order book of Rs 3.7 bn (20% of total order book). Revenue is expected to double in FY26 from the current Rs 1.3 bn.

In aerospace, Sansera manufactures aerostructure parts, cargo parts, lighting parts, seating parts, engine auxiliaries, and engine casings. The company recently won direct supply contracts from Airbus. This marks a milestone in its aerospace expansion. The company has invested Rs 1.2 bn in aerospace machining infrastructure. The target is Rs 6.0 to 6.5 bn in revenue from a gross block of Rs 3.0 bn, implying asset turns of around 2x.

Semiconductor equipment manufacturing is a newer but high-potential area. Sansera has secured a long-term letter of intent from a global leader in wafer fabrication equipment. The initial annual order is worth US$ 17 mn, expected to scale to US$ 30 mn over three years. To support this business, the company is setting up a Class 1000 Clean Room facility. Semiconductor equipment requires extremely high precision and specialized machining capabilities. This segment should deliver premium pricing and margin accretion.

Off-Road (3.4% of total revenue)

Sansera supplies connecting rods, crankshaft assemblies, balancer shafts, suspension parts, and transmission components for ATVs and off-road vehicles. Key markets include Europe and North America. The segment saw revenue decline in FY25 due to labor issues at a key customer’s facility in Europe. Orders dropped temporarily. Management expects recovery in coming quarters. The company recently added a large European off-road vehicle OEM to its customer base.

Agriculture (2.1% of total revenue)

Products include cam shafts, pump housings, common rail parts, and body flanges for tractors and agricultural machinery. Strong rural demand has supported this segment. Increasing mechanization in farming and expansion of precision agricultural technologies provide a stable revenue base.

Others (1.8% of total revenue)

This includes engineering and capital goods (connecting rods, valve bridges, integral cranks, hubs), power tools (hand tools for residential and industrial applications), and power transmission components (fuse caps).

Investment Thesis

1. Diversification to Non-Auto and EV Segments Reduces ICE Risk

Sansera derives 74% of revenue from ICE components. This creates vulnerability if electric vehicle adoption accelerates faster than expected. The company is addressing this head-on. The plan is to increase the combined share of xEV, tech-agnostic, and non-auto segments from 26% to 40% within three years. This would reduce ICE auto contribution from 74% to 60%.

Of the Rs 18.5 bn order book, 50% comes from ICE auto, 17% from xEV, 8% from tech-agnostic, and 20% from aerospace, defence, and semiconductor. New businesses are growing faster than the legacy business.

2. Two-Wheeler Premiumisation Drives Content Growth

India is the world’s largest two-wheeler market. Sansera has deep relationships with all major OEMs. The premiumisation trend benefits the company directly. Consumers are buying motorcycles with larger engines. A 350cc motorcycle uses more sophisticated and valuable components than a 100cc commuter. Higher displacement means higher content per vehicle.

Tax relief in recent budgets has increased disposable income. Rural demand is improving. Two-wheeler exports are recovering. All these factors support volume growth in Sansera’s largest segment.

3. Aerospace and Semiconductor Businesses Offer High Margins

The ADS segment commands higher margins than auto components. Aerospace and semiconductor customers pay premium prices for precision manufacturing. These industries have longer qualification cycles but stickier relationships once established. Sansera’s Rs 3.7 bn ADS order book provides revenue visibility. The Airbus supply win demonstrates credibility with global aerospace players. The semiconductor equipment order from a global leader validates capabilities in precision machining.

4. Global Footprint Captures Supply Chain Shifts

Sansera derives 32% of revenue from exports to 27 countries. The order book has 62% exposure to international markets. This positions the company to benefit from China Plus One and Europe Plus One strategies. Global OEMs are seeking alternative sourcing locations. Indian suppliers with proven track records are winning new business. Sansera’s presence in Europe through its Sweden subsidiary provides a local foothold.

The company targets 35% to 40% export revenue over three to five years. North America is a particular focus, with growing RFQs from global customers.

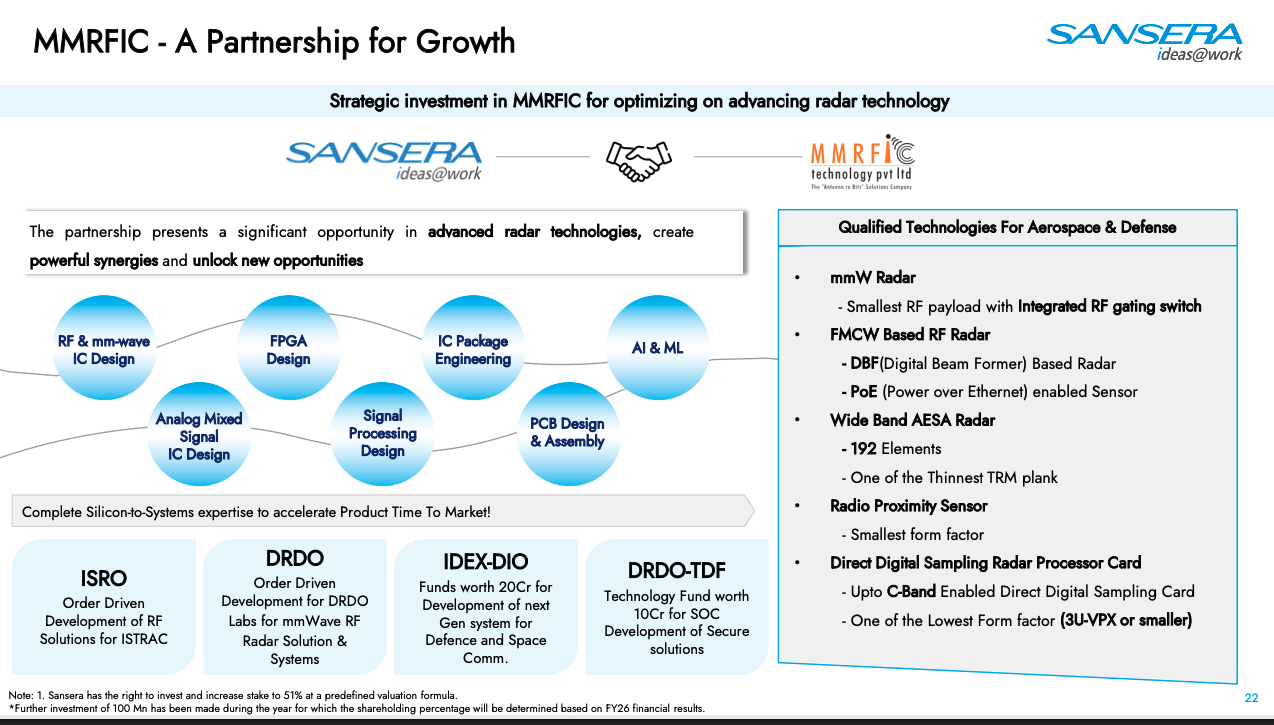

5. Strategic Investment in MMRFIC Opens New Markets

Sansera owns approximately 30% of MMRFIC Technology, a company specializing in advanced radars and millimeter-wave sensors. This investment provides exposure to defence, aerospace, telecom (5G), and automotive (autonomous driving) applications.

MMRFIC reported Rs 200 mn revenue in FY25 with 40% EBITDA margins. These margins are expected to increase with scale. The partnership gives Sansera access to advanced technologies and a strong R&D team. MMRFIC has received orders and grants from ISRO, DRDO, and the iDEX program. This validates the technology and provides a path to larger defence contracts.

Manufacturing Footprint and Capacity

Sansera operates 17 integrated manufacturing facilities. Ten facilities cluster in Bengaluru and Bidadi. Two are in Tumkur. One each in Chakan (Pune), Mehsana, Manesar, and Pantnagar. One facility operates in Sweden. The production lines are fungible. Capacity can shift between auto and non-auto products. This flexibility allows the company to respond to changing demand across segments.

The company signed an MoU with the Government of Karnataka and invested Rs 10 bn toward acquiring 55 acres of land. Construction is planned to start in FY27.

The Pantnagar facility spreads across more than 6 acres with built-up infrastructure. It will produce domestic two-wheeler components starting Q2FY26. The location serves low-cost manufacturing needs for mass production and legacy components. For the ADS business, gross block will reach approximately Rs 3.0 bn. The target is Rs 6.0 to 6.5 bn revenue, implying asset turns of around 2x.

Sweden Operations

Sansera acquired Mape Sweden AB in 2017 and renamed it Sansera Sweden AB. This acquisition provided entry into heavy commercial vehicles in Europe. The Swedish subsidiary manufactures precision-forged and machined components including connecting rods for diesel engines. Applications span buses, trucks, boats, generators, and compressors.

A new factory in Trollhättan consolidates operations into a modern facility. The subsidiary exports to 15+ countries and serves as a platform for European customer relationships. Management expects EBITDA margins to stabilize between 10% and 12% going forward. The European market faces its own challenges, limiting long-term growth rates to 15-20%. But the subsidiary plays a crucial role in Sansera’s international strategy.

MMRFIC Investment

Sansera committed Rs 200 mn in March 2023 to acquire approximately 21% of MMRFIC Technology. An additional Rs 100 mn investment during FY25 increased ownership to approximately 30%. The company has the option to increase its stake to 51% based on a predefined valuation formula. MMRFIC specializes in research, design, and manufacturing of sub-systems for next-generation radars and millimeter-wave sensors. Applications include defence, aerospace, telecom (5G networks), and automotive (autonomous driving subsystems).

The company has qualified technologies including millimeter-wave radar with the smallest RF payload and integrated RF gating switch, FMCW-based RF radar with digital beam forming and power over ethernet capability, wide-band AESA radar with 192 elements and one of the thinnest transmit-receive module planks, radio proximity sensors in the smallest form factor, and direct digital sampling radar processor cards up to C-band with one of the lowest form factors.

Government orders and grants come from ISRO for RF solutions development, DRDO for millimeter-wave RF radar solutions and systems, iDEX-DIO with Rs 20 crore for next-generation systems for defence and space communication, and DRDO-TDF with Rs 10 crore for secure solutions development. In June 2024, MMRFIC opened a new 14,000 square foot R&D facility in Bengaluru. The facility integrates semiconductor packaging, precision PCB assembly, and product testing. The US$ 4 mn investment enhances product development capabilities.

SWOT Analysis

Strengths

- Sansera has cultivated relationships with major automakers over 20 years or more. Bajaj, Honda, Yamaha, and Maruti Suzuki provide repeat business built on trust and proven performance.

- The company leads in ICE component manufacturing in India. Connecting rods, rocker arms, and gear shifter forks for two-wheelers and four-wheelers are core products with strong market positions.

- Vertical integration from design to forging to machining controls the full value chain. This improves quality, delivery reliability, and cost competitiveness versus competitors who outsource parts of the process.

Weaknesses

- The top 5 customers account for approximately 46% of revenue. Customer concentration has declined from 59% in FY21, but dependence on a handful of OEMs remains a risk.

- With 74% of revenue from ICE components, rapid EV adoption could erode the core business faster than diversification can replace it. The transition requires flawless execution.

- Expansion into aerospace, EVs, and defence demands heavy upfront investment in specialized infrastructure and precision tooling. Capital intensity is high, and payback periods are long.

Opportunities

- New orders are shifting toward non-ICE segments. About 50% of new orders come from xEV, tech-agnostic, and non-auto verticals. The order book mix is already more diversified than the revenue mix.

- The Sweden subsidiary provides a platform for European expansion. The MMRFIC investment opens doors to advanced technology markets. Exports to 27 countries can grow as global supply chains restructure.

- The ADS segment has a Rs 3.7 bn order book and direct supply wins from Airbus. Revenue should double in FY26. A Rs 1.2 bn investment in machining capacity will support this growth.

Threats

- The automotive sector is inherently cyclical. Slowdowns in overseas markets from trade tensions and tariff uncertainties can impact both volumes and margins.

- Continued shift from ICE to EVs could reduce demand for traditional components faster than expected. Policy changes favoring EVs could accelerate this transition.

- Non-automotive businesses involve longer development cycles. Customer validation and approvals take time before mass production begins. Delays in scaling up could impact returns on investment.

Growth Triggers

- ADS segment revenue doubling in FY26 from Rs 1.3 bn, driven by strong order book and Airbus supply wins

- Semiconductor equipment orders scaling from US$ 17 mn initial value to US$ 30 mn over three years

- xEV component revenue growth of 30% annually, supported by new American OEM orders and aluminium forging capacity expansion

- Two-wheeler premiumization increasing content per vehicle as consumers shift to higher displacement motorcycles

- Sweden subsidiary margin improvement to 10-12% EBITDA levels following customer price support and capacity expansion

- Export revenue expansion from 32% to 35-40% of total revenue as China Plus One and Europe Plus One strategies play out

- Pantnagar facility commissioning in Q2FY26 for domestic two-wheeler component production at lower costs

- Karnataka greenfield construction starting FY27 on 55 acres of land acquired with Rs 10 bn investment

Key Risks

- EV disruption risk if electrification accelerates faster than expected, reducing demand for ICE components that constitute 74% of current revenue

- Customer concentration risk with top 5 customers at 46% of revenue, exposing the company to OEM-specific volume swings

- Automotive cyclicality risk from slowdowns in domestic or export markets affecting volume growth across segments

- Execution risk in new segments given longer gestation periods in aerospace, defence, and semiconductor requiring customer validation before volume production

- Currency and geopolitical risk with 32% export exposure to markets facing tariff uncertainties and demand slowdowns

- Raw material fluctuation risk from steel and aluminium price volatility, though pass-through arrangements with lag provide partial protection.

Further Reading

Explore more deep dives on Finance Pulse: