Business Overview

Shaily Engineering Plastics is a precision plastic engineering company founded in 1987 by Mahendra (Mike) Sanghvi. The company started with two injection moulding machines in Halol, Gujarat. Today it operates seven manufacturing facilities in Gujarat with over 200 injection moulding machines and more than 2,000 employees.

Sanghvi studied chemical engineering at Wayne State University and completed an MBA from Toronto University. He worked in the North American plastics industry through the 1970s before returning to India. This background shaped Shaily’s focus on precision manufacturing and global customer standards.

The company specializes in high and ultra-high performance polymers including PA6/66/12, PES, PPS, PBT, LCP, PC, and PEEK. Shaily is the only company licensed to process Torlon in India. These materials serve demanding applications where regular plastics fail.

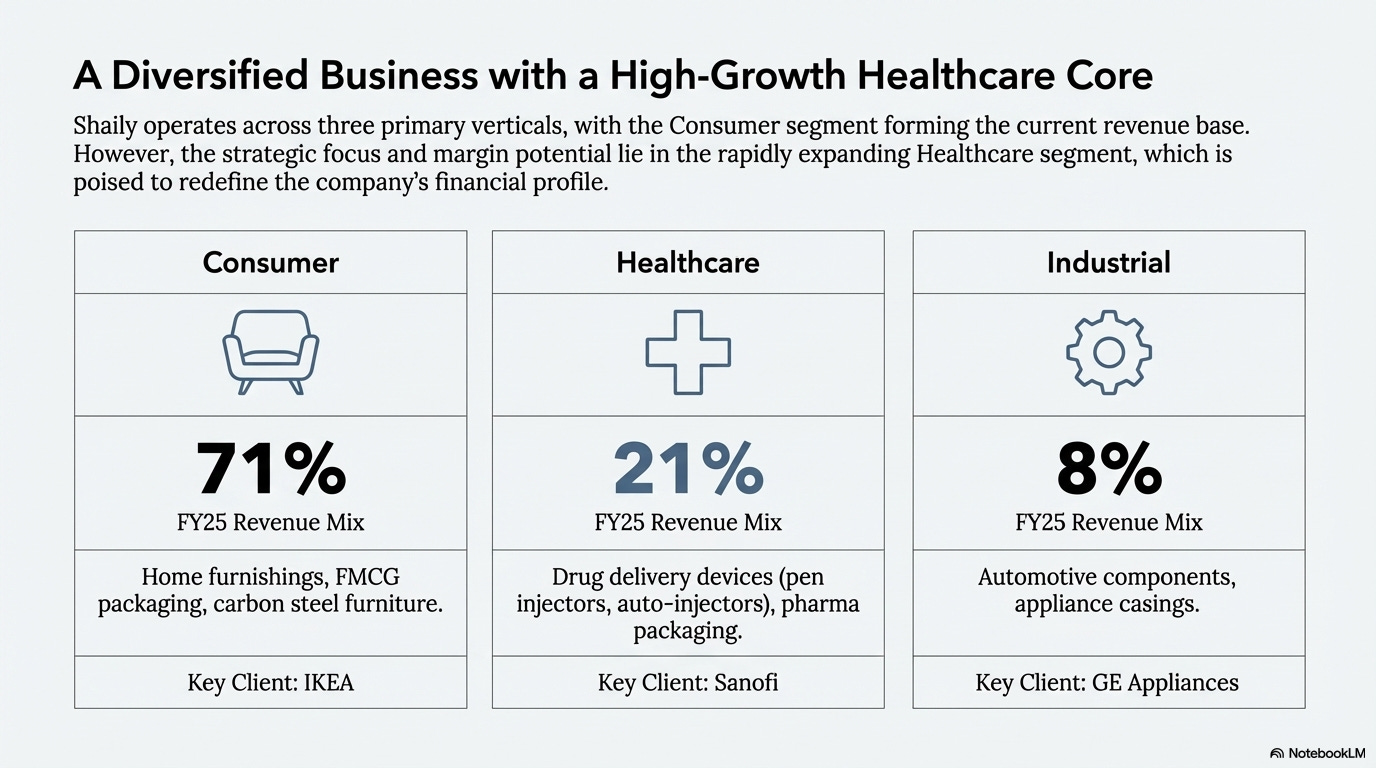

Exports account for 77% of revenue. Shaily serves customers across 35 countries. The business operates through three segments: Consumer (71% of FY25 revenue), Healthcare (21%), and Industrial (8%).

Segments Deep Dive

Consumer Segment

The consumer segment generated Rs 5,608 million in FY25. It covers home furnishings, FMCG packaging, LED lights, carbon steel furniture, and toys.

Key customers include IKEA, Gillette, P&G, Hindustan Unilever, Corvi, Lidl, and Lowes. The IKEA relationship demonstrates Shaily’s manufacturing capabilities. IKEA follows its IWAY standard, a comprehensive assessment framework with on-site audits. Shaily has maintained compliance with these standards while scaling operations.

Beyond injection moulding, Shaily built secondary capabilities: ultrasonic welding, vacuum metalising, high-speed rotary pad printing, polymer painting, screen painting, hot stamping, and hot filing. These capabilities transform it from a component supplier to a solutions provider. A customer buying plastic components can also get finishing, assembly, and packaging from the same facility.

The consumer segment faces tariff-related challenges. Global clients compete India against other emerging economies that currently have more favorable duty rates. Any India-US trade deal with reduced tariffs would benefit this segment.

Healthcare Segment

The healthcare segment generated Rs 1,647 million in FY25 and represents Shaily’s primary growth opportunity. Products include platform devices, drug delivery devices, and pharma packaging.

Shaily entered pharma in 2007 when Wockhardt launched a reusable pen for insulin delivery. The company partnered with IDC UK to develop a pen and gained Sanofi as a customer after success with Wockhardt. This base expanded to include Dr. Reddy’s, Sun Pharma, Aurobindo Pharma, Alembic, Zydus, Alvogen, Cadila, Aspen, and others.

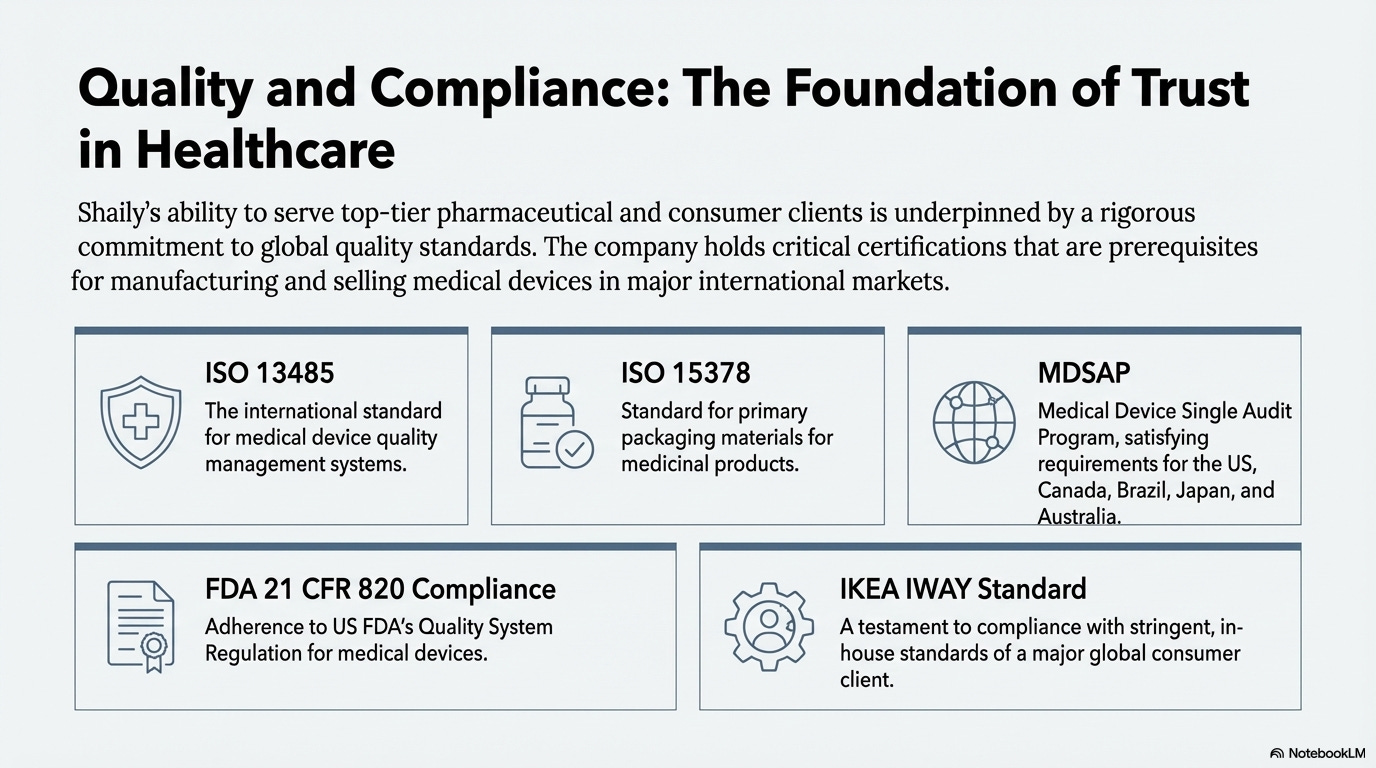

The segment holds key certifications. ISO 13485 covers quality management for medical device design and manufacturing. ISO 15378 addresses quality for primary packaging of medicinal products. MDSAP certification allows evaluation against quality requirements of Australia, Brazil, Canada, Japan, and the US through a single audit. The company also complies with FDA 21 CFR 820 Quality System Regulation and cGMP standards required for US market access.

In FY24, Shaily sold 11-12 million pens, primarily for insulin. The company has developed a platform of pens for GLP-1 drug delivery, which drives the growth outlook.

Industrial Segment

The industrial segment generated Rs 614 million in FY25. Products include automotive components, appliance casings, and high-performance engineering components.

Key customers are GE Appliances, Garrett Advancing Motion, MABE, Phoenix Mechano, Amvian, and Schaeffler. The segment carries IATF 16949 certification, a mandatory requirement for automotive industry suppliers.

The core strategy is metal-to-plastic conversion. High-performance polymers can replace metal components with lower weight and cost while maintaining strength and heat resistance. This positions Shaily for automotive lightweighting trends.

The GLP-1 Opportunity

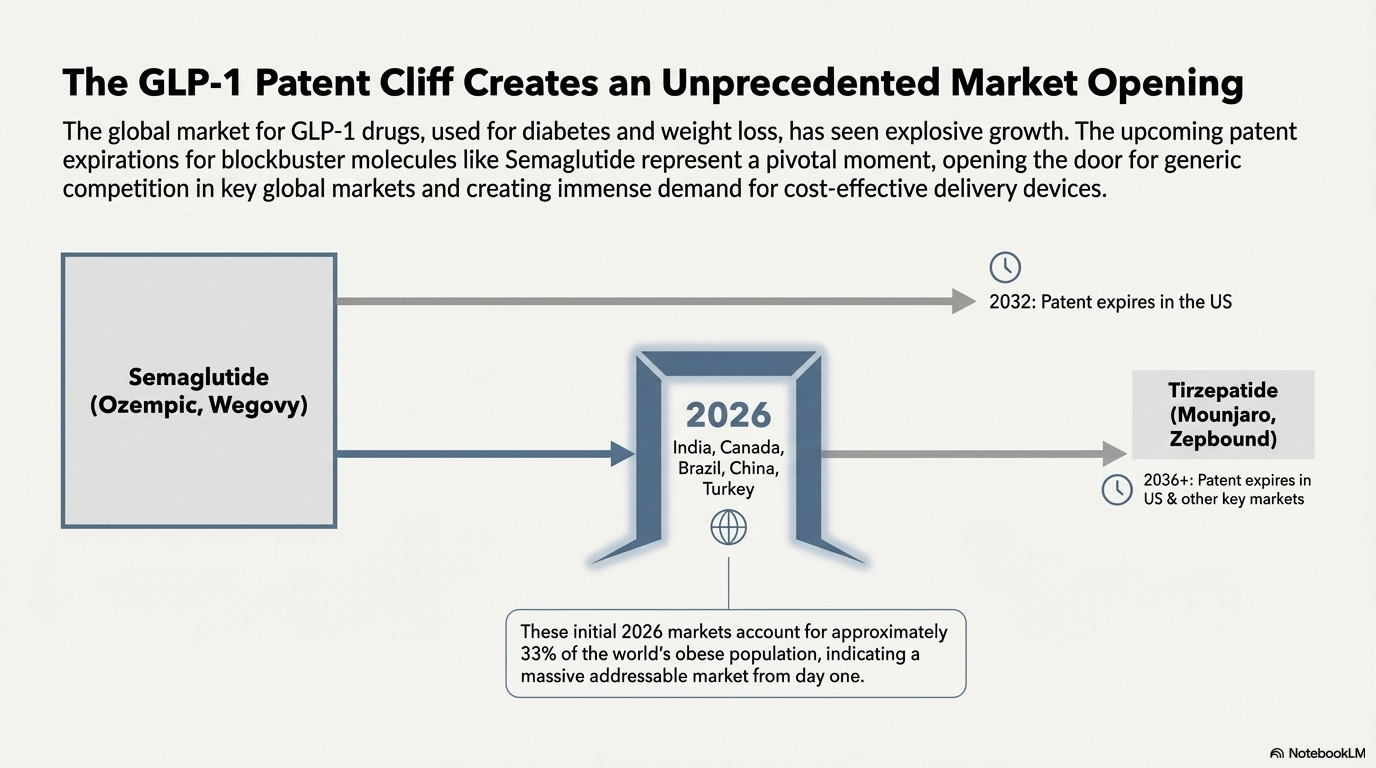

GLP-1 drugs treat diabetes and enable weight loss. The drug class gained momentum after Novo Nordisk’s semaglutide showed 15-20% body weight loss in clinical trials. FDA approved Wegovy (semaglutide) for weight loss in 2021. Eli Lilly’s tirzepatide followed with even stronger efficacy.

In 2024, semaglutide generated US$54 billion in sales from 56 million doses. Tirzepatide generated US$32 billion from 32 million doses. These two molecules drive GLP-1 penetration in the US.

The semaglutide patent expires in 2026 in India, Canada, Brazil, China, and Turkey. These countries account for about 33% of the world’s obese population. Generic manufacturers are preparing to launch at patent expiry.

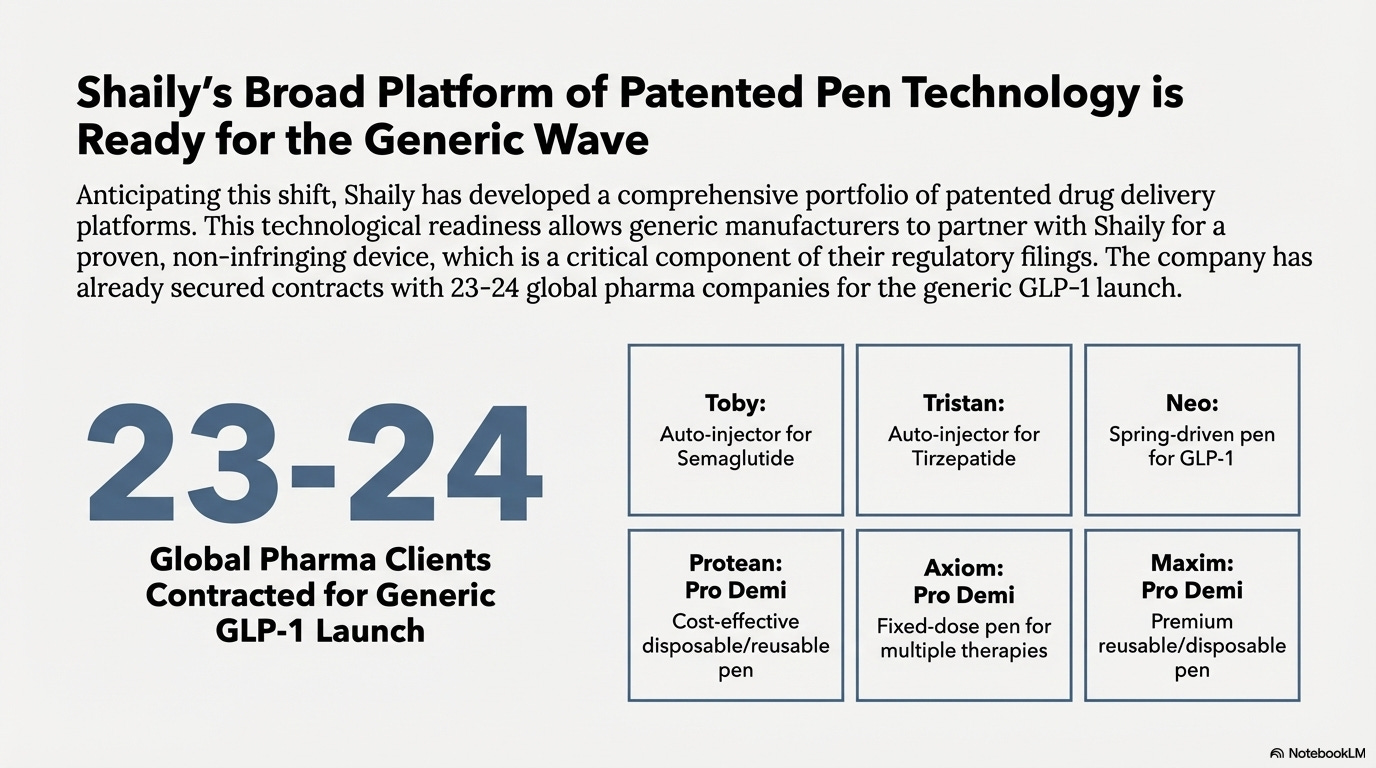

Shaily developed pen platforms for GLP-1 delivery:

Shaily Toby Auto-Injector: A two-step auto-injector for semaglutide delivery.

Shaily Tristan Auto-Injector: A three-step auto-injector with automatic needle insertion for dulaglutide and tirzepatide.

ShailyPen Neo: A spring-driven pen injector in variable and fixed dose formats for GLP-1.

ShailyPen Axiom: Handles multiple therapies including human growth hormone, follicle stimulating hormone, parathyroid hormone, and GLP-1.

ShailyPen Protean: A versatile 0-60 IU insulin pen adaptable for alternate therapies including triple-dose and single-dose peptide delivery.

ShailyPen Maxim: A 0-80 IU insulin pen for single-dose administration.

Management indicates Shaily has tied up with 23-24 global pharma companies for generic GLP-1 launch. This represents 50-60% of companies that have filed in Canada for generic semaglutide approval.

Patent Expiry Timeline

Generic Filings by Market

Canada: Eight companies have filed for approval as of the latest data. Two more (Biocon and Emcure) plan to file by end of FY26. Dr. Reddy’s was among the early filers and received a non-compliance notice seeking additional information, which may delay its launch.

India: At least eight domestic pharmaceutical manufacturers are conducting trials or preparing first-wave launches. These include Dr. Reddy’s, Biocon, Sun Pharma, Emcure, Alkem, Torrent, Cipla, and Natco. Eli Lilly launched Mounjaro (tirzepatide) in India in March 2025. Novo Nordisk launched Wegovy in June 2025.

Brazil: At least four companies plan generic launches. Three are Indian (Dr. Reddy’s, Biocon via tie-up with Biomm S.A., Torrent) and one is local (Hypera).

Addressable Market

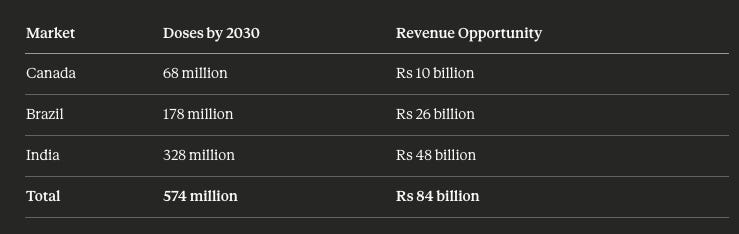

The three key markets for Shaily represent substantial opportunity by 2030:

The calculations assume GLP-1 penetration reaches 25% in Canada and 15% in India and Brazil by 2030. Lower penetration in India and Brazil reflects affordability constraints and urban population concentration.

Injectable vs Oral

One debate is whether oral GLP-1 will reduce demand for injectables. The injectable form shows better efficacy. Semaglutide enters the bloodstream directly when injected, producing higher and more consistent drug levels. Only about 1% of oral semaglutide reaches the bloodstream due to stomach absorption limitations.

At the 14mg approved dose, oral semaglutide produces modest weight loss of about 5 pounds versus 15% body weight loss with injectable Wegovy at 2.4mg. A 50mg oral dose under regulatory review achieved 15.1% weight loss matching the injectable, but this requires higher drug quantities per dose.

Survey data shows 59% of GLP-1 users take injectable semaglutide (45% Ozempic, 14% Wegovy). Only 2% use Rybelsus, the oral version. Users show minimal hesitation about injections. 87% prefer single-use or multi-use pens versus vials and syringes.

Single-Use vs Multi-Use Pens

Both semaglutide drugs (Ozempic, Wegovy) and both tirzepatide drugs (Mounjaro, Zepbound) use single-use pens. Zepbound offers a vial and syringe option, but convenience favors single-use pens. Multi-use pens cost less but require complex dose management.

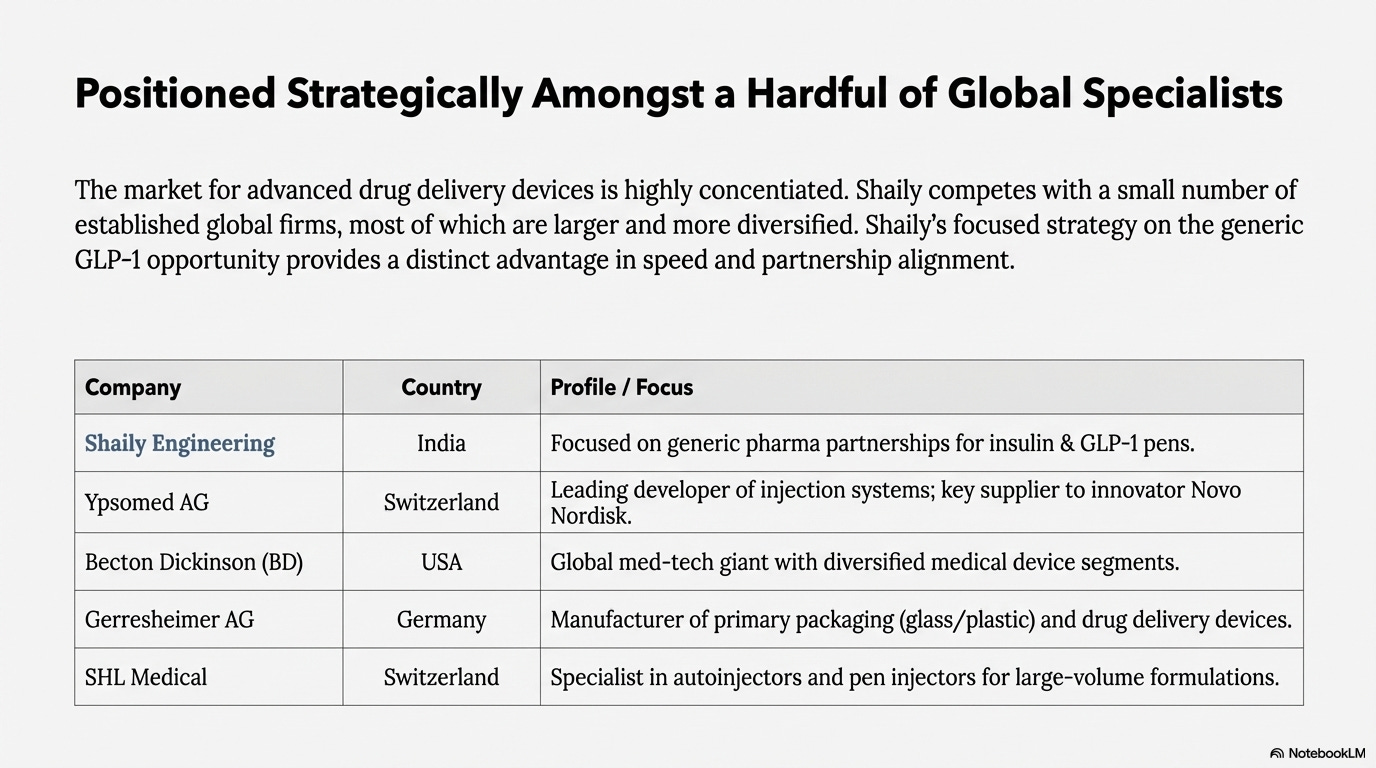

Competitive Landscape

Shaily competes with few global firms in healthcare devices:

Ypsomed AG (Switzerland): The leading developer and manufacturer of injection systems for self-administered medication. Revenue of US$630 million from delivery systems in FY25. Capacity around 350 million units annually with a target of 1 billion by 2031. Supplies Novo Nordisk for GLP-1. Opening a North America facility in 2027.

Becton Dickinson (US): Global medical technology company with US$4.4 billion medical segment revenue in CY24. Manufactures devices, instrument systems, and reagents.

Gerresheimer (Germany): Primary packaging and drug delivery devices with US$1.3 billion revenue from plastics and devices in CY24. Manufacturing in Europe, Americas, and Asia.

SHL Medical (Switzerland): Private company with indicated revenue around US$2.1 billion. Designs and manufactures autoinjectors, pen injectors, and specialty delivery systems for large-volume and high-viscosity formulations.

Ypsomed and Becton Dickinson work with innovators (Novo Nordisk, Eli Lilly), leaving limited capacity for generic manufacturers. Shaily positions as the primary option for generics in markets going off-patent in 2026.

Barriers to Entry

Three factors limit competition in GLP-1 pen manufacturing:

High switching costs: Drug filings mention the pen vendor. Pharma companies cannot switch vendors without refiling with regulatory authorities. Once a generic manufacturer commits to Shaily for a filing, that relationship locks in.

Limited capacity: Few companies globally manufacture GLP-1 pens. Long gestation periods for regulatory approvals apply to pen manufacturers too. Building capability to manufacture without infringing patents requires substantial investment and time.

India’s generic manufacturing base: Many domestic generic manufacturers launching semaglutide globally are Indian companies. Shaily has existing relationships with these customers from insulin pen supply.

Certifications as Moat

Shaily’s certifications create barriers competitors must clear:

ISO 13485: Quality management for medical device design and manufacture. Mandatory for manufacturers and suppliers selling internationally.

ISO 15378: Quality management for primary packaging of medicinal products. Required for materials in direct contact with medication.

MDSAP: Single audit program accepted by Australia, Brazil, Canada, Japan, and US. Involves documentation review, on-site audits, and annual compliance checks.

FDA 21 CFR 820: Comprehensive US regulations for medical device manufacturers. FDA inspects facilities for compliance. Mandatory for US market access.

IATF 16949: Automotive quality management standard. Prerequisite for business with major automotive manufacturers.

Beyond certifications, long-term relationships with demanding customers validate capabilities. IKEA’s supplier standards involve comprehensive assessments across 10 principles for responsible procurement. Consistent compliance while scaling shows operational discipline.

Company Evolution

1987-1994: Setup initial facility at Halol. Won first contract for precision gear components for a Japanese watch manufacturer. Built reputation for precision manufacturing to global standards.

1994-2007: Became the only licensed Torlon processor in India. Specialized in high-performance polymers. Built post-molding capabilities moving from component supplier to solutions provider. Onboarded IKEA, Gillette, P&G, GE Appliances, and Schaeffler.

2007-2015: Pivot to pharmaceutical through Wockhardt insulin pen. Partnered with IDC UK for pen development. Added Sanofi as customer. Built capacity for pharmaceutical bottles with necessary certifications.

2015-2021: Greater focus on pen device manufacturing. Executed projects including Vicks container redesign for leak-proof performance in extreme conditions, tamper-evident cap for Pepsi Aquafina, and low-voltage switchgears for ABB. Opened sheet metal furniture facility in 2019.

2021-Present: Aligned focus on GLP-1 pen development. Expanded offerings to gain wallet share from existing customers. Tied up with 23-24 pharma companies for generic GLP-1 launch.

Future Optionalities

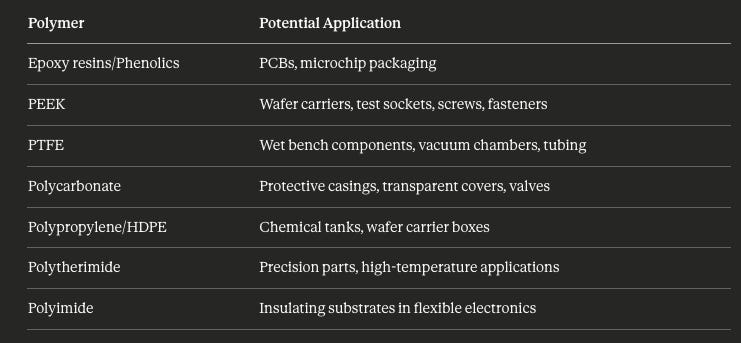

Semiconductor and Consumer Electronics

Management has highlighted exploration of semiconductor and consumer electronics opportunities. Details remain unclear, but Shaily’s polymer expertise maps to potential applications:

India’s semiconductor capex is underway with fab announcements from Tata, Micron, and others. Shaily’s existing capabilities in precision plastic components position it for this value chain if customer relationships develop.

Expanding Therapy Coverage

Beyond insulin and GLP-1, Shaily manufactures devices for parathyroid hormone treatment and migraine medications. The pen platform can adapt to multiple therapies as global peers demonstrate. Ypsomed covers diabetes, fertility, growth disorders, obesity, osteoporosis, Parkinson’s, multiple sclerosis, oncology, and more.

Growth Triggers

Generic GLP-1 launch in 2026: Patent expiry in Canada (January 2026) and India/Brazil (March 2026) triggers generic launches. With 23-24 pharma customers committed, Shaily captures first-wave volume.

Market expansion as generics reduce cost: Current semaglutide costs limit adoption. Generic launches at a fraction of innovator pricing expand the addressable market significantly. Survey data shows 30% of past GLP-1 users stopped due to expense. Lower prices convert these users back.

Capacity utilization improvement: Consumer and industrial segments have unutilized capacity. New customer wins improve absorption. Q2 FY26 saw five new projects signed with three home furnishing customers.

Tariff normalization: Any India-US trade deal reducing tariffs versus competing manufacturing countries benefits the consumer segment. India currently faces unfavorable rates compared to some emerging economies.

Therapy expansion: Success in GLP-1 opens doors to other injectable therapies where pen delivery applies. Platform approach allows adaptation without starting from scratch.

Risks

Competition in GLP-1 pens: Additional global capacity could emerge. Ypsomed plans 1 billion pens by 2031. New entrants could pressure pricing and share.

Slower generic semaglutide adoption: If efficacy concerns, side effects, or regulatory delays slow uptake, volume projections miss. Oral alternatives gaining ground could reduce injectable demand.

Launch delays: Regulatory processes can extend beyond expected timelines. Dr. Reddy’s non-compliance notice in Canada illustrates this risk. Delays push volume ramp into future periods.

Customer concentration: With 50-60% share of Canada filings, outcomes depend on those customers executing successfully. A major customer facing issues would impact Shaily.

Forex exposure: 77% of revenue comes from exports. Currency movements affect realized value.

Consumer segment recovery uncertain: Tariff relief depends on trade deal negotiations outside company control. Without favorable policy changes, the segment faces continued headwinds.

Further Reading

Explore more deep dives on Finance Pulse: