Skipper Ltd. is India’s largest manufacturer of transmission line towers, with an installed capacity of 375,000 metric tonnes per annum as of Q2 FY26. The company ranks among the top 10 globally in transmission and distribution structures. Founded by Sajan Kumar Bansal over 40 years ago, Skipper operates as a fully integrated T&D player. It handles everything in-house: structure rolling, galvanizing (375,000 MTPA capacity), tower load testing, and transmission line EPC.

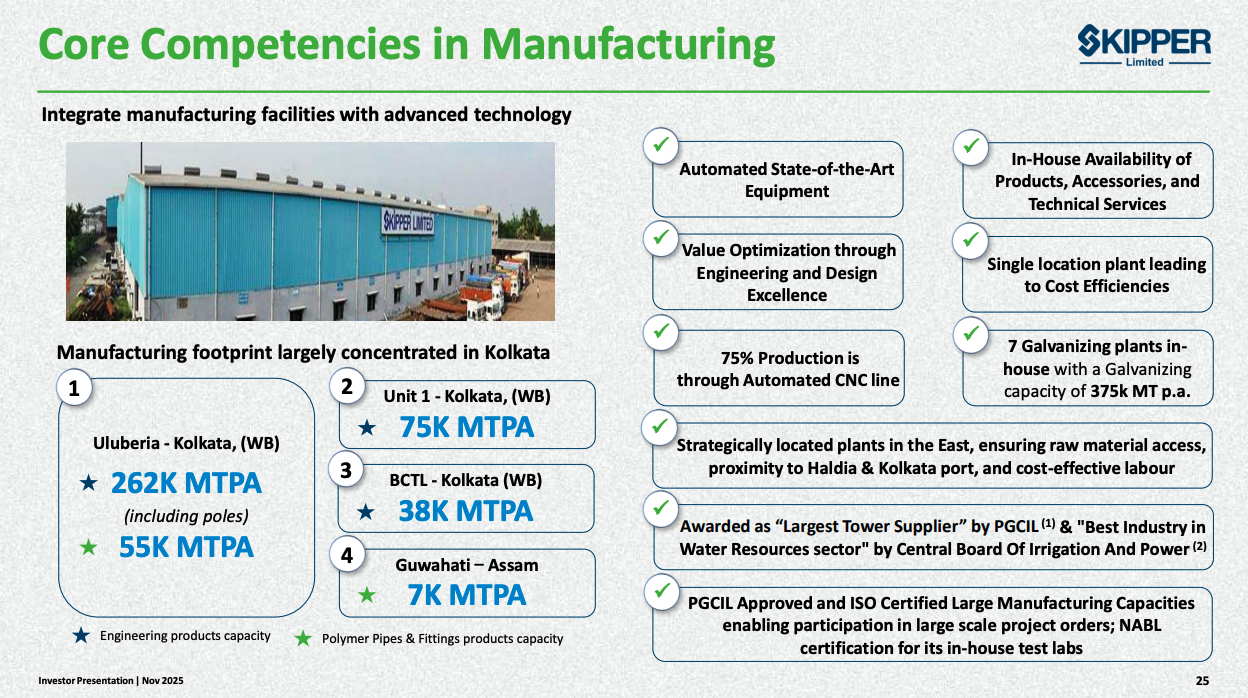

Manufacturing Facilities

Skipper’s manufacturing footprint concentrates in Kolkata, West Bengal. All engineering capacity sits within three facilities in the city, providing scale advantages and proximity to Kolkata port for exports.

| Location | Engineering Products (MTPA) | PVC Pipes & Fittings (MTPA) | Galvanizing (MTPA) |

|---|---|---|---|

| Uluberia, Kolkata (WB) | 262,000 | 55,000 | - |

| Unit 1, Kolkata (WB) | 75,000 | - | - |

| BCTL, Kolkata (WB) | 38,000 | - | - |

| Guwahati, Assam | - | 7,000 | - |

| Total Capacity | 375,000 | 62,000 | 375,000 |

The Uluberia facility handles the bulk of production at 262,000 MTPA for engineering products. Unit 1 in Kolkata added 75,000 MTPA in FY25. The BCTL unit contributes another 38,000 MTPA. Galvanizing capacity of 375,000 MTPA matches engineering capacity, allowing full in-house processing.

For polymers, Uluberia houses 55,000 MTPA capacity while Guwahati adds 7,000 MTPA, giving total polymer capacity of 62,000 MTPA.

Capacity expansion plan: Skipper plans to double engineering capacity from 300,000 MTPA in FY25 to 600,000 MTPA by FY29. The company already added 75,000 MTPA in FY25, taking total capacity to 375,000 MTPA. Another 75,000 MTPA expansion should complete by FY26 end. Total capex for this expansion: Rs 8bn spread over four years (Rs 2bn annually).

Each 75,000 MTPA capacity block costs Rs 200-250 Cr and generates roughly Rs 1,000 Cr in annual revenue. At 10% EBITDA margin, that’s a 2-3 year EBITDA payback. At 3.6% PAT margin, PAT payback stretches to 6-7 years. The company finances capacity expansion with a 60% debt / 40% equity mix.

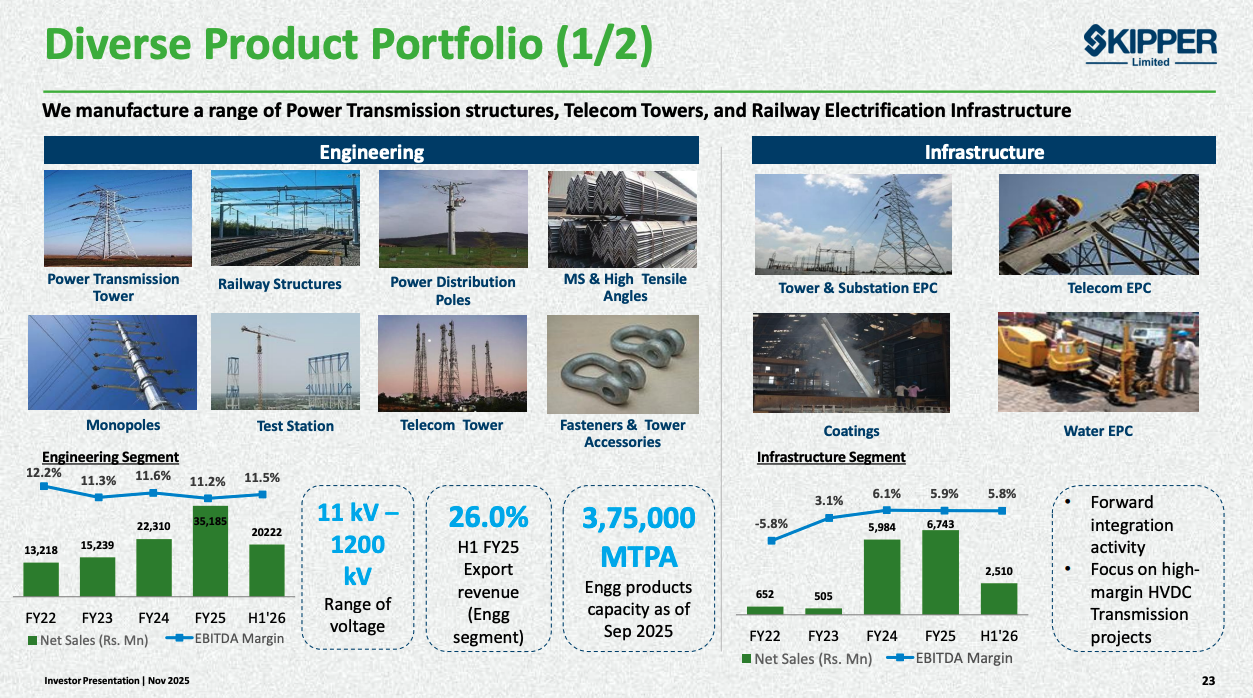

Product Portfolio

| Segment | Key Products | End Industries | Key Clients |

|---|---|---|---|

| Engineering Products | Power transmission towers (up to 800 kV HVDC, including 765 kV monopoles), monopoles, power distribution poles, telecom towers, railway electrification structures, MS/high-tensile angles, fasteners, tower accessories, solar mounting structures, high mast/swaged poles | Power T&D, telecom infrastructure, railways, solar | PGCIL, state electricity boards, exports to 65+ countries (US, South America, Africa, Middle East) |

| Infrastructure EPC | Tower EPC (high-voltage transmission lines up to 800 kV HVDC, live line work, retrofitting), telecom EPC (ground-based towers), water EPC, substation EPC, coatings | Power T&D, telecom, railways, water infrastructure | PGCIL, BSNL, state electricity boards, state utilities |

| Polymer Products | Pipes: UPVC, CPVC, HDPE (agriculture, borewell, SWR), fittings, storage tanks (Marina brand), bath accessories (NSF/ANSI 14 certified) | Rural agriculture, urban plumbing & sanitation, borewells | B2C: 35,000+ retail units (focus on eastern and central India) |

The engineering segment spans voltage ranges from 66 kV to 800 kV HVDC. The 220 kV and above segment matters most because this is where the National Electricity Plan expects the largest capacity additions.

Engineering Products: Deep Dive

Skipper commands roughly 15% market share in India’s high-voltage transmission tower segment (220 kV and above). The company sources 90% of raw materials in-house, which delivers structural cost advantages. This backward integration shows up in margins. Skipper’s EBITDA margin of 9.8% in FY25 sits higher than EPC-heavy peers like KEC (6.9%) and Kalpataru (8.2%).

PGCIL (Power Grid Corporation of India) is the primary customer for domestic orders. For exports, Skipper sells to utilities and EPCs across 65 countries. The Middle East, Africa, and North America are key markets. Exports contributed 20% of engineering revenue in Q2 FY26, with Africa alone accounting for 18% of export order mix.

Infrastructure EPC: Deep Dive

The infrastructure segment grew 13% in FY25 to Rs 6.7bn, driven by execution of a large BSNL order for telecom towers. Skipper’s EPC work spans transmission line construction (up to 800 kV HVDC), live line work, retrofitting, and substation projects.

Key clients include PGCIL, BSNL, state electricity boards, and state utilities. The company expanded its EPC capabilities in FY25 and won large T&D EPC orders. This segment carries lower margins than products but provides a route into larger integrated contracts.

Polymer Products: Deep Dive

The polymer business serves as Skipper’s retail play. The company holds 1-2% share of India’s Rs 400-450bn plastic pipes market and claims to be the largest PVC pipes manufacturer in eastern India. Revenue split within polymers: plumbing (65%), agricultural (25%), bath fittings and tanks (10%). Geographic presence concentrates in eastern and central India, with limited reach in north, south, and west.

Distribution reach has grown from 5,000 retail touchpoints in FY20 to 35,000 in FY25. Management targets 60,000 touchpoints by FY27. The company works through 330 distributors.

The polymer segment saw revenue fall 5% in FY25 to Rs 4.3bn. Volume grew 3% to 33,176 TPA, but weaker PVC prices cut realization by 14%. Margin in this segment stood at just 4.3% in FY25, well below the industry average of 15-20%. Scale should improve this over time.

New products include chrome-plated bath ware and water tanks. Geographic expansion into south and west remains a priority.

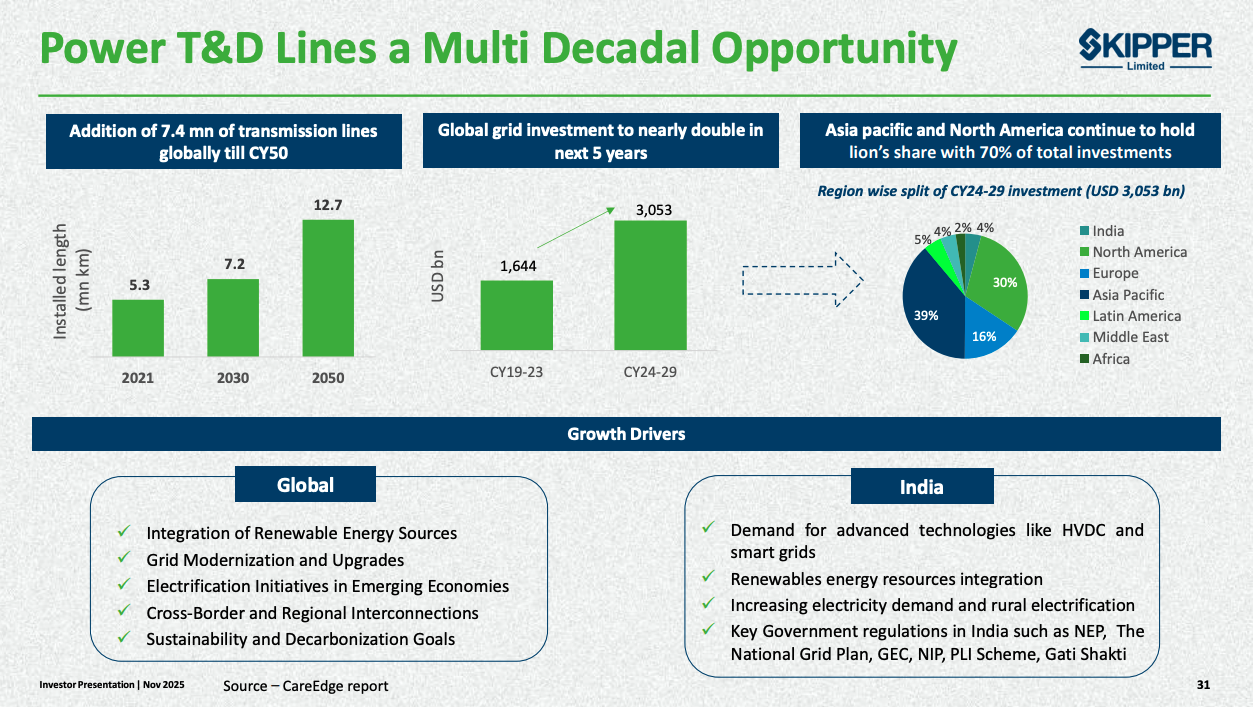

Industry Context: India’s T&D Capex Cycle

The National Electricity Plan (NEP) lays out Rs 9.15 trillion of transmission capex over FY23-32. The driver: India needs to raise inter-regional transmission capacity from 119 GW to 168 GW, adding 49 GW over this period. This translates to roughly 200,000 circuit kilometers of transmission lines and 1,270 GVA of transformation capacity by FY32.

Transmission line additions during FY22-27: 123,577 ckm, including 35,005 ckm at 765 kV, 38,245 ckm at 400 kV, and 46,027 ckm at 220 kV. Substation capacity additions during FY22-27: 711 GVA, with 319,500 MVA at 765 kV, 268,135 MVA at 400 kV, and 123,305 MVA at 220 kV.

The shift toward higher voltage matters for Skipper. Higher voltage towers use more steel per kilometer, which expands the addressable market for structure manufacturers. The share of 765 kV in transmission line additions is set to rise from 22% during FY17-22 to 28% during FY22-27. For substations, 765 kV share jumps from 26% to 45%.

Target addressable market calculation: Assuming Rs 5 trillion of the Rs 9.15 trillion capex remains to be spent over FY26-32, and 50% goes to transmission line infrastructure, Skipper’s TAM works out to Rs 2.5 trillion over seven years. At a 15% hit rate, this implies annual domestic order inflow potential of Rs 63bn.

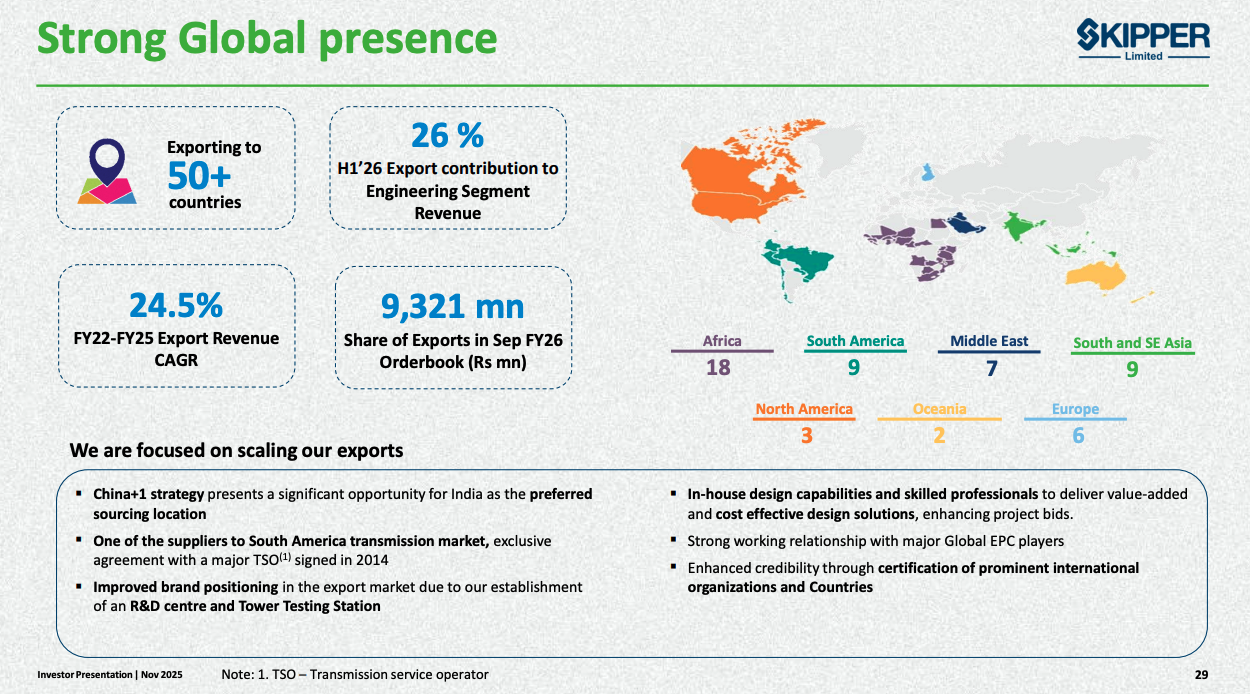

Export Markets: The Growth Lever

Skipper exports to over 65 countries. In H1 FY26, exports contributed 21% of total revenue (26% of engineering revenue). Management targets a 50-50 domestic-export order mix over the next 3-4 years, split equally between developed markets (North America, Europe, Australia) and developing markets (Middle East, Africa, Latin America).

Regional breakdown of exports:

- Africa: 18%

- South America: 9%

- Middle East: 7%

- South/Southeast Asia: 9%

- Europe: 6%

- North America: 3%

- Oceania: 2%

Why exports matter:

First, margin. Export orders carry 100-200 basis points higher margin than domestic business. Second, working capital. Export terms run similar to domestic, so no working capital penalty. Third, growth runway. The global T&D market is projected to expand at 5.0-5.5% CAGR over 2024-29 to USD 377-418bn.

Key export market drivers:

European Union: Nearly 40% of Europe’s distribution networks are over 40 years old. The European Commission targets EUR 584bn of electricity grid investment by 2030. Cross-border transmission capacity should double by 2030.

Middle East: UAE, Oman, Saudi Arabia, Bahrain, and Kuwait have net-zero targets between 2050 and 2060. The UAE alone has an AED 160bn T&D market (Rs 35bn opportunity). Skipper recently got board approval to set up a UAE subsidiary and passed audits by Saudi Electricity.

Latin America: The region grew renewable capacity by 51% over 2015-2022 and targets 80% renewable contribution in power generation by 2030.

Africa: The African Continental Power Systems Masterplan projects electricity consumption rising from 878 TWh in 2021 to 2,368 TWh by 2040, requiring USD 1.32 trillion of investment.

The company recently received board approval to set up three foreign marketing subsidiaries: one each in the US, UAE, and Brazil.

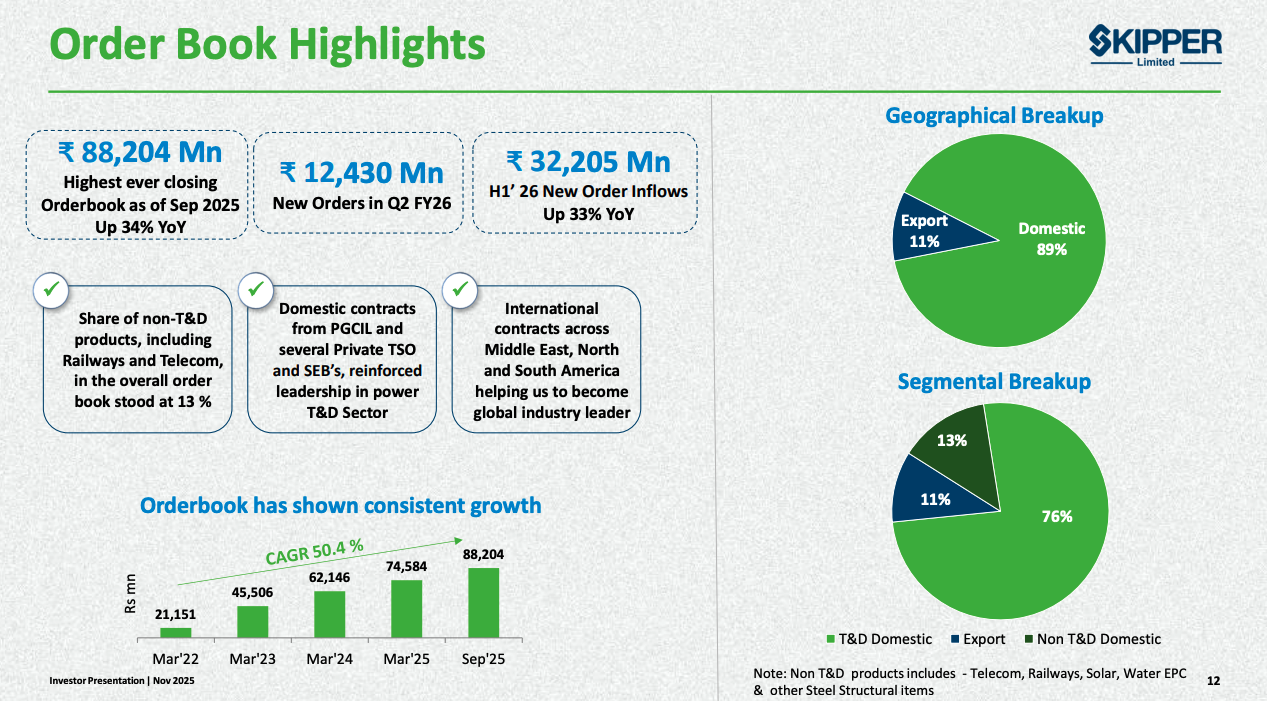

Order Book Position

Total order book stood at Rs 88bn at Q2 FY26 end, equal to 1.9x FY25 revenue. Order inflow grew at 26% CAGR over FY19-25. In FY25 alone, T&D order inflow hit Rs 39.2bn, up sharply from Rs 10.8bn in FY23.

Bidding pipeline -

- FY20: Rs 38.2bn total (Rs 13.1bn domestic, Rs 25.1bn international)

- FY25: Rs 167.3bn total (Rs 59bn domestic, Rs 108.3bn international)

- Q2 FY26: Rs 300bn total (Rs 250bn domestic, Rs 50bn international)

Recent order wins include:

- Three 765 kV transmission line contracts from PGCIL in Rajasthan and Andhra Pradesh

- Rs 2,570 Cr order from BSNL (2022) to supply and erect telecom towers in rural areas, to be executed over five years

- Rs 25 Cr tower testing and design order from Saudi Electric Company, the Middle East’s largest utility

- First substation EPC contract worth Rs 45 Cr, marking entry into the substation segment

Competitive Position

The domestic transmission line industry (both EPC and products) is dominated by Skipper, KEC, Kalpataru, L&T, and Techno Electric. Skipper’s product-heavy revenue mix and in-house manufacturing give it higher margins than EPC-focused peers.

Peer comparison (FY25):

- Skipper: 9.8% EBITDA margin, 3.2% PAT margin

- KEC: 6.9% EBITDA margin, 2.6% PAT margin

- Kalpataru: 8.2% EBITDA margin, 2.6% PAT margin

- Techno Electric: 13.7% EBITDA margin, 17.8% PAT margin (but much smaller scale)

- Transrail Lighting: 12.7% EBITDA margin, 6.2% PAT margin

Skipper’s capacity of 375,000 MTPA makes it the largest in India and among the top 10 globally.

Why Transmission Towers Are Hard to Replicate

Building high-voltage transmission towers is not a commodity business. Each transmission line requires custom design based on terrain, wind load, voltage, and span requirements. Towers for 400 kV and above face stringent engineering criteria where price alone does not win contracts. Credibility, capability, and capacity matter.

PGCIL empanelment takes time. The approval process is tedious, and not many players can meet the specifications for high-voltage towers. Project timelines of 2-3 years further raise the bar. Chinese players, despite lower costs, lack commitment for long-duration assignments. This limits competitive threat from imports.

Skipper has built additional credibility through its in-house R&D centre and tower testing station, which improves positioning in both domestic and export markets. The company recently obtained LCA and EPD certifications for towers and pole products, required for exports to Europe and the US.

Growth Triggers

- Domestic T&D capex of Rs 9.15 trillion over FY23-32 creates a multi-year demand runway. With 15% market share and expanding capacity, Skipper stands to capture significant share of this spend.

- Capacity doubling to 600,000 MTPA by FY29 allows the company to service both rising domestic demand and accelerate export growth. The Rs 8bn capex should complete by FY28.

- Export market penetration in developed geographies. Successful qualification with US and Canadian utilities could open large order pools. The company recently set up subsidiaries in the US, UAE, and Brazil.

- Higher share of 765 kV in transmission additions. The shift to higher voltage towers increases steel content per project, expanding Skipper’s addressable market.

- Operating leverage from capacity utilization. Capacity utilization hit 85.5% in FY25. Revenue growth of 20% annually through FY28 should drive margin expansion.

- Polymer business scale-up. Doubling retail touchpoints from 35,000 to 60,000 by FY27 and expanding into south and west India could drive volume growth. Margins should improve from the current 4.3% as scale builds.

- Working capital efficiency gains. Net working capital days fell from 79 in FY24 to 66 in FY25. Sustaining this efficiency supports cash generation.

Risks

- Concentration in T&D sector. Demand depends heavily on government capex plans. Policy changes or execution delays in the National Electricity Plan could slow order flow.

- PGCIL customer concentration. PGCIL is the primary domestic customer. Any shift in PGCIL’s procurement approach or payment delays could impact Skipper.

- Raw material price exposure. Nearly 50% of the order book sits on fixed-price contracts. Steel and zinc price spikes could compress margins. The company does not have full pass-through arrangements.

- Working capital intensity. The business remains working capital intensive despite recent improvements. Net working capital of 66 days ties up capital that could otherwise fund growth or reduce debt.

- Export execution risk. Setting up new subsidiaries in the US, UAE, and Brazil involves execution challenges. Qualification timelines with new utilities and EPCs remain uncertain.

- Geopolitical risk. Exports to Africa, Middle East, and Latin America carry political and payment risks. Project execution timelines and freight costs can be affected by regional instability.

- Competition in polymer business. The plastic pipes market is fragmented with strong regional players. Building brand and distribution in new geographies requires sustained investment.

- Tender-based business model. Competitive bidding can intensify during demand slowdowns, pressuring margins.

- Capex-dependent growth model. The business cannot grow without adding capacity. Margins are unlikely to expand significantly. Post FY28, after reaching 600,000 MTPA, the path to the next leg of growth remains unclear.

Further Reading

Explore more deep dives on Finance Pulse: